Happy Sunday! Tech was the worst performing Sector on 01/26 so that will put it even more in our focus. Our newsletter picks are 135% above the S&P 500 on an annualized basis and 70% win rate vs their S&P 500 benchmarks.

Welcome newcomers, some of you may be here from FiSavvy’s success journey with Prospero in the 18 months since he first got access to our beta. To help on your journey, we now have our short intro (with lots of video links)

Normal stream times. YouTube stream links: 1st tomorrow 1/29 at a special time, 1 PM EST and 2nd Wednesday 1/31 at 3 PM EST. Simulcast from our X/Twitter page.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Tech fears gain steam? Outline:

Market/Macro Update

QQQ and SPY Net Options Sentiment

Sector Update / Portfolio Strategy

Now the Sector analysis will be roped into our allocation!

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market Update

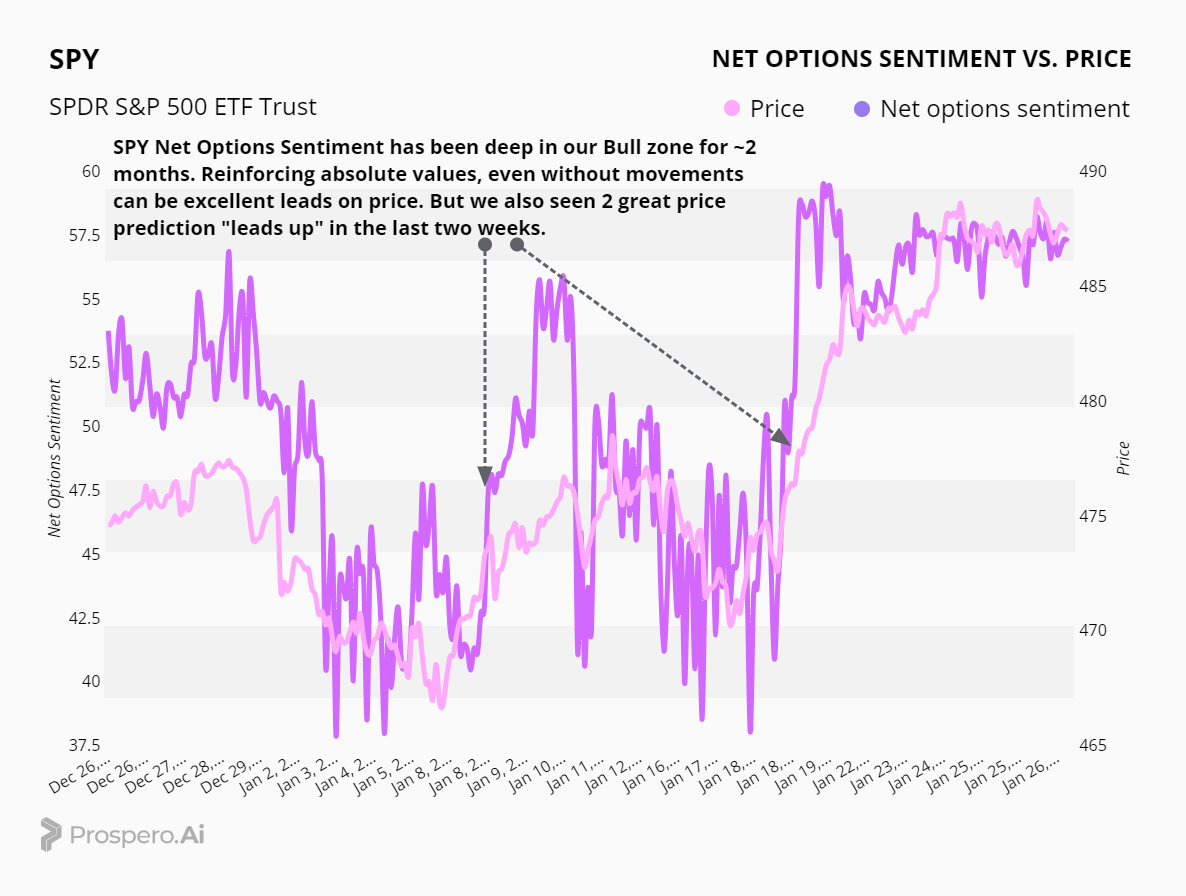

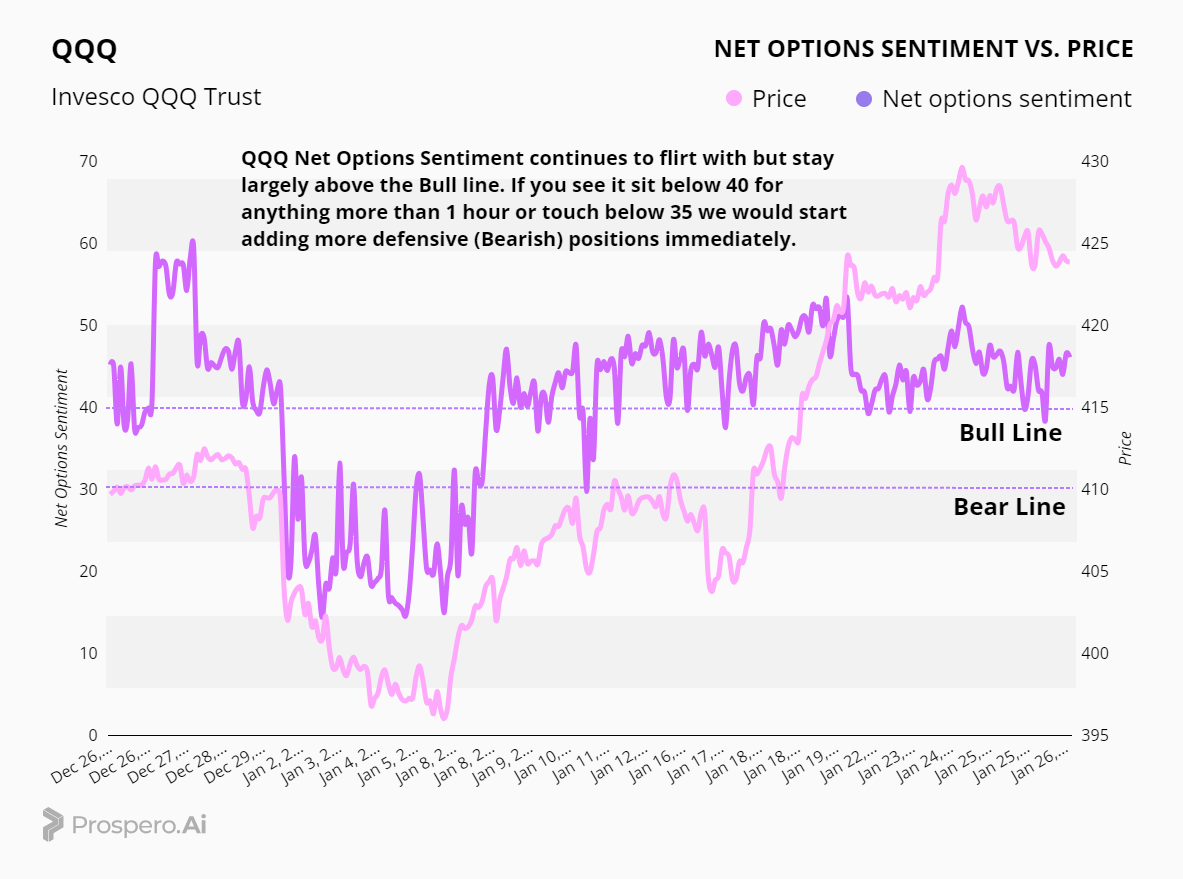

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

QQQ returned .62% this week vs 1.03% for SPY. Last week we asked the question “how long can tech stay hot?” and it was a pertinent question, especially as the week ended badly for the Tech Sector.

For those that got our paid add on 1/25 skip this part as it is largely the same section:

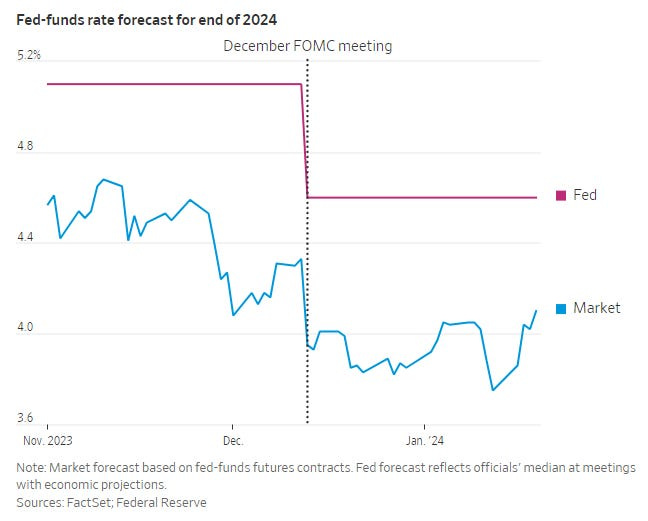

This WSJ article makes a lot of the same points that we often do: Stocks Are at Record Highs, but Things Will Only Get Harder From Here. We often talk about the “cap” on the market until we reach the 2% inflation target, but Fed Chair Powell might choose to delay rate cuts if the market is too strong. And boy, is it looking strong! So the picture below especially resonates with us.

We think the “market” needs to catch up to the reality that this Bull run, means Powell will be slower to bring about those highly anticipated rate cuts. How do we know that? Because at the very least, that is EXACTLY what the fed is saying. This means we will remain cautious.

You’ll notice it isn’t a bad idea to get our paid letter as we have been on top of this Bear event and especially its potential impact on the most volatile Sectors. Our trading letter goes out almost every day, and is a great way to track our most current market view. But for now, watch QQQ Net Options Sentiment. If it loses the 40 level, that is bad news. If it loses the 30 level, we will flip all our portfolios and take a more Bearish stance.

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 30= Bearish.

For Non-Tech: SPY Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Sector Analysis / Portfolio Macro Strategy

The only clear thing to us, is that Technology could get concerning pretty quickly. But to be fair, one day in the red is not nearly enough to get Bearish on Tech. But it does point to Communications as a stronger Sector to see upside, as it has performed almost as well as Tech over the last year. It’s also maintained more strength / downside protection vs. Tech over the last 1 day, 1 week and 1 month periods.

With so many Sectors doing relatively well, we do not see anything too exciting on the Bear side. Because of that, we will lean heavily on our overall Macro view to target Consumer Discretionary, with a slight change. We will go 2 short Consumer Discretionary, and 1 long, in case this thesis is wrong. Either way, we’re protected on both sides. This is the same strategy we’ll implement on Tech. Despite our concerns, at market open, we’ll be holding two tech stocks on the Bull side. We want to make sure we have a Bear pick too. Bear in mind (no pun intended), we may get out of one of our Tech picks really quickly (SMCI and/or FICO). If we do, it’s because we don’t like what we see.

6 Longs and 5 Shorts this week. We’re leaning on this methodology, because right now it makes the most sense. On weeks we don’t have strong conviction, (either Bullish or Bearish) we will open up neutral and give ourselves room to close positions that tilt us toward the direction we want to go. Additionally, going neutral gives us the most protection on both sides of the spectrum. We recommend you also consider that line of thinking; and continue that neutral stance for the foreseeable future.

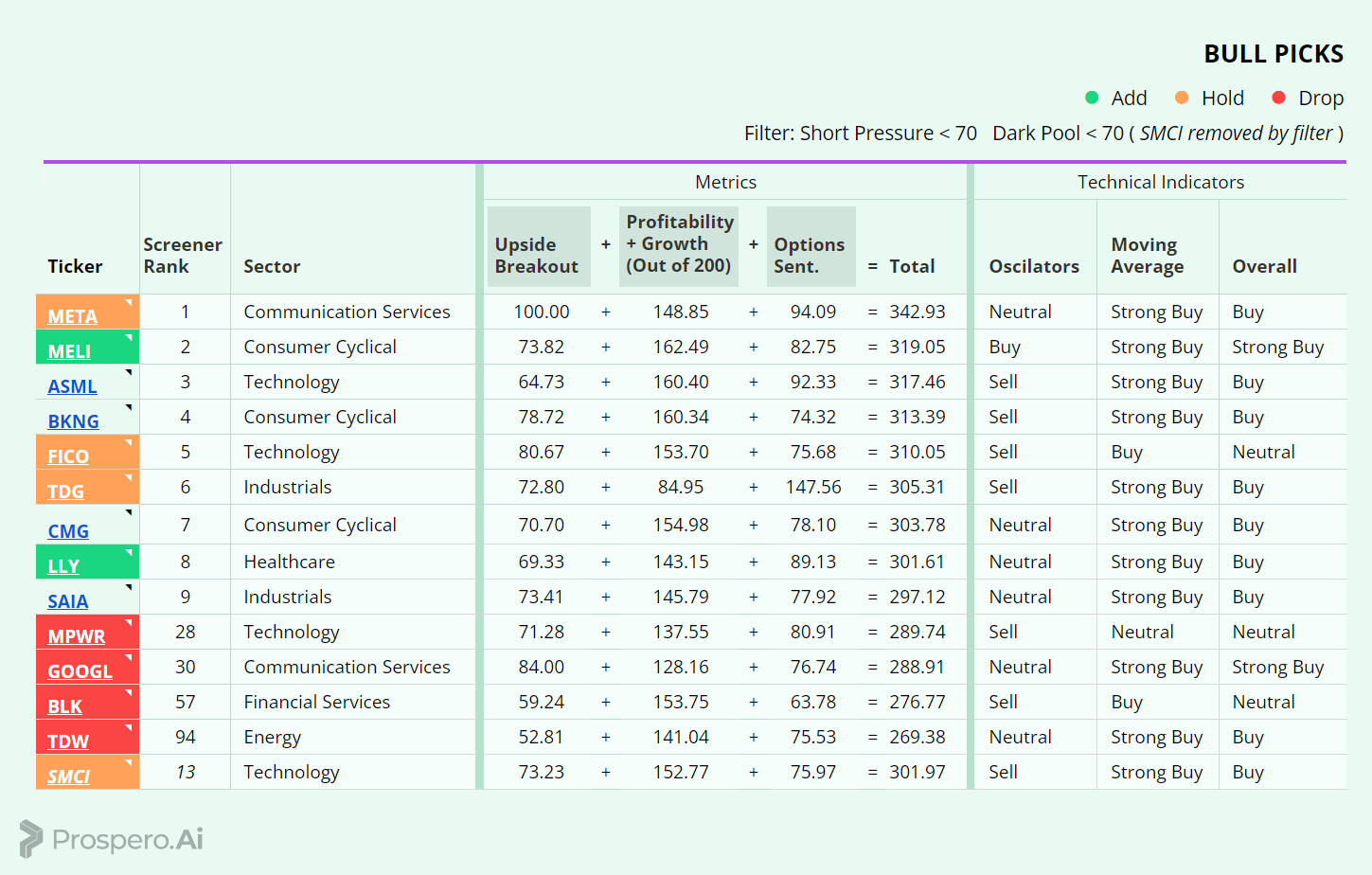

Long / Bull Adds - Link to Below Picture

We mentioned it above, but MELI is added to balance out our Consumer Discretionary Bear positions. You will see later in this letter.

When looking for diversification, LLY is always one of our favorites. Especially because its Ozempic competitor is looming large to the upside. We don’t want to miss the boat on a big run for this stock, and its Net Options Sentiment trend is up and looking nice.

Long / Bull Keeps

META is a keep, and returned 2.79% vs 1.03% for the SPY. META is again at the top of our Bull Screener, it continues to show it has more room to go up.

FICO is a keep, and returned -5.07% vs 1.03% SPY benchmark. FICO had some tougher guidance (which is very difficult to predict) but we’re still holding it because after a big post-earnings move, stocks can often “snap” in the other direction. To test this theory, we’re holding it for open, but may get rid of it shortly (and send an alert to paid subscribers) when we do.

TDG is a keep, and returned .96% vs 1.03% SPY benchmark. So far it has stayed strong in our screener technicals. Tomorrow, if it starts to go the other way, it could also be a quick drop candidate.

SMCI is a keep, and returned 8.69% vs 1.03% SPY over the same period. SMCI did get filtered out, and we labored over dropping it, but there is too much to lose in potential momentum going into earnings tomorrow to drop it. We will likely drop it right before earnings to avoid a large amount of risk. But that is likely to be something we internally debate for the entire day tomorrow.

Long / Bull Drops

GOOGL is a drop because it doesn’t wow us in the Screener. Covered 1/15-1/26, and it finished 6.69% and a Win, Beating the SPY benchmark by 4.44%.

TDW is a drop because it doesn’t wow us in the Screener. Covered 1/7-1/26, and it finished 6.22% and a Win, Beating the SPY benchmark by 2.06%.

Short / Bear Adds - Link to Below Picture

Despite its strong technicals, XRX was picked as a bear. We believe those strong technicals are a result of it riding high after an earnings beat, but could rapidly correct downward in a scenario where tech is not doing well.

MED was a much easier target. It was the highest stock in the Screener with good technicals for a Bear.

Short / Bear Keeps

MGEE is a keep, and returned -4.40% vs 1.03% SPY benchmark. Not many Bears look good in the Screener and Technicals, so it’s an obvious keep.

LEG is a keep, and returned 4.74% vs 1.03% SPY benchmark. This is in the same boat as MGEE, as not many Bears look good in the Screener and Technicals. So again, it’s an obvious keep.

GLPG is a keep, and returned 1.33% vs 1.03% SPY benchmark. A tougher call here, but we like this as a Bear to hold, as it has a 19 Profitability (13) + Growth (6)

Short / Bear Drops

PKBK is a drop, because it looks bad in the Screener and technicals. Covered 01/21/ - 01/26, and returned 3.14% and a Loss, losing to the SPY benchmark by 2.11%.

AMED is a drop, because it looks bad in the Screener and technicals. Covered 01/24 - 01/26, and returned .33% and a Loss, losing to the SPY benchmark by .35%.

IPGP is a drop, because it looks very bad in the Screener. Covered 01/26 - 01/26, and returned -1.34% and a Win, Beating the SPY benchmark by 1.42%.

Portfolio Allocation

6 Longs: META, TDG, FICO, SMCI, MELI, LLY

5 Shorts: GLPG, LEG, MGEE, MED, XRX

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.