I’ll explain the title in a second, but first of all let me say: THE MARKET FINALLY PICKED A DIRECTION! We had a strong week where the Dow Jones, S&P 500 and the Nasdaq all surged to record closes. The good news, Prospero signals were all over it. We saw a strong uptick in SPY and QQQ Net Options Sentiment before the price action followed. The bad news, those same numbers began to decline slightly toward the end of the week. The question on everyone’s mind is: “where do we go from here?” The answer to that question has everything to do with a binary event that happens on Wednesday May 22nd after the market closes. That would be Nvidia's earnings.

Before I explain, let me define the word “Binary”. A Binary event refers to an outcome with two possible states. Right or wrong. Success or failure. Yes or no. The essence of a binary event, is that it simplifies scenarios to only two possible outcomes, excluding any middle ground. Computers are built on binary code. O’s and 1’s. It’s straightforward. It’s black and white.

Bottom line: We think Nvidia’s earnings will be a binary event for the market. On Wednesday it is all about NVIDIA’s forward guidance, especially revenue. They need to do what's called “Guiding up” or at least not guiding down. In other words, their expectations of future growth need to be bigger than what analysts expect. Why are we zeroing in on this? Because even if the current quarter’s earnings / profit miss, good guidance could overshadow this. But the reverse we do not think would be true, good earnings pulling the stock / market up with lowered guidance.

In the past, Nvidia crushed top and bottom line expectations (revenue was up 231%), but their CEO, Jensen Huang shared some concerns about forward guidance, because of slowing demand from China. The stock started tanking and finished down after one of the best quarters we’ve ever seen.

Why is this so important? Because much of what has been carrying the market is AI and if people are ordering more chips and NVDA is forecasting more from their cloud division it means AI demand is still accelerating faster than the people most “in the know” can even forecast. If it is the opposite and it looks like it has plateaued well then the primary driver of this Bull market is all of a sudden a big unknown.

On Wednesday after the market closes, we think Nvidia’s earnings WILL DETERMINE THE DIRECTION OF THE MARKET. With the rest of the letter, we’re going to tell you how we will play this week, and how you can be prepared for it. Now a word from our CEO.

A WORD FROM OUR CEO

Linking my appearence on Fox 5 DC discussing social / retail investing.

We did a special on how to use Prospero signals to understand memestocks and we are currently running a 25% off special to make it easier to read the whole letter.

We had a strong tech run up in the middle of the week but settled close to where we ended last week beating the S&P 500 by 86% annualized and a win rate of 63% against that benchmark this year.

For newer readers linking our short intro + learning videos.

Regular livestream times this week! Tomorrow 5/20 at 11 AM EST and Wednesday 5/22 at 3 PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

A BINARY EVENT

Market/Macro Update w/ Special Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Last week’s Net Options Sentiment levels from the 5/12 letter:

SPY and QQQ Net Options Sentiment > 35 = Bullish < 25 = Bearish.

MARKET/MACRO UPDATE

In last Sunday’s letter we asked the question: “Does the Market Have Gamophobia?”. Gamophobia is the “fear of commitment”. Well, last week the market finally committed and all three indexes reached all time highs. The fear and greed indexes moved out “fear” levels and we’re actually beginning to see signs of market “euphoria”. But despite this last week, we need to remain ESPECIALLY careful as we move into this week. Here’s why:

3 reasons why a market correction could be HARSH (if Nvidia reports bad earnings)

Hedge funds are likely already hedging.

As we talked about at the beginning of the letter, as Nvidia goes, so goes the market. Hedge funds know this. On Friday afternoon, we began to see a decline in the market. After some amazing numbers all week, we watched as QQQ and SPY Net Options Sentiment numbers dip going into the weekend. That likely happened because hedge funds are beginning to hedge against bad earnings from Nvidia. That could intensify on Monday as soon as the market opens.

Small Cap Stock earnings are showing concerning signs.

While we’ve seen the Small Cap Sector finally begin to show signs of life, the underlying fundamentals are deeply concerning. Currently, 41% of Russell 2000 stocks had negative earnings. Those numbers haven't been that bad since the 2008 financial crisis.

Credit card defaults just reached RECORD levels.

Check out the chart below (via @GameofTrades) We just experienced the highest level of credit card default since they’ve been tracking it. Even during the 2008 financial crisis, credit card defaults weren’t nearly as high as they are today. Don’t listen to the politicians, look at the numbers. Consumers are struggling.

We could keep going. But you get the picture. We might continue an upward trend, but you get the sense that unless the economy and inflation turn a major corner, this dance won’t last forever. It is why even in our Bullish weeks and last week was our most Bullish in a while (at one point 10 longs and 4 shorts) it is hard to feel like the ground is ever all that solid with inflation not quite tamed and an event like this in the picture.

CAP/VALUE ANALYSIS

See the chart above. I want you to look at two numbers. Look at Large Cap Growth for 1W (week). Then look at Large Cap Value for 1D (Friday). What do those two numbers tell us? That tells us that after a week of a Large Cap Growth rally, there was a move back into value. As we mentioned earlier, we believe that is the market hedging as we come into Nvidia’s earnings on Wednesday. Nobody knows for sure, but this trend could certainly continue on Monday until there is more clarity on Nvidia’s direction. We have seen this happen a lot, where a Large Cap Growth run will be followed quickly by a correction / volatility. And it cannot be stressed enough that the market continues to move in an overall Bullish direction. So we will continue with the strategy that has been working. Start the week closer to neutral and load more Bullish or Bearish if the signals dictate that.

NET OPTIONS SENTIMENT

See the chart below. We mentioned earlier that we finally broke out of the up and down market sentiment and had a nice upward trend. But look at the 16th. It starts a very obvious downtrend. This has us a little concerned moving into this week, that we could see more correction as folks hedge against a potentially negative earnings response.

See the chart above. SPY Net Options Sentient didn’t see quite the dip that QQQ did. You see a consolidation of the numbers for most of the week. It looks like it’s poised for a big move. But which way that will be, nobody knows other than perhaps Jensen Huang and his executive team. One thing we do know. There’s liable to be some fireworks after earnings on Wednesday. If you are loaded up on Tech / AI / Chips i’d strongly consider an SQQQ hedge at least on Wednesday.

I’m moving up our levels a bit to account for the more Bullish market.

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

SECTOR ANALYSIS

Nothing too crazy here to see. Interestingly, Energy had a breakout on Friday, but it’s been on a downtrend for awhile. We’ll see what happens with that during the coming week. For the week, you can see that Real Estate had a solid showing. This is likely in view of potential rate cuts that are on the way. And finally, you see that Technology had an amazing week, but fell off a cliff on Friday. That was likely profit taking and preparation for Nvidia earnings. This coming week should be fascinating to watch. So be smart. Be defensive. And let’s be ready to respond to what the market gives us!

PORTFOLIO STRATEGY

Due to the overall Bullish nature of the market we will continue to lean more Bullish than Bearish. But SPY Net Options Sentiment showing more strength will have us lean more away from Tech to start the week. Especialy because, as you will see below, our Tech holdings have had the technicals turn around. As we remain more Bullish than Bearish, 6 Bulls and 4 Bears this week.

Long / Bull Moves - Link to Below Picture

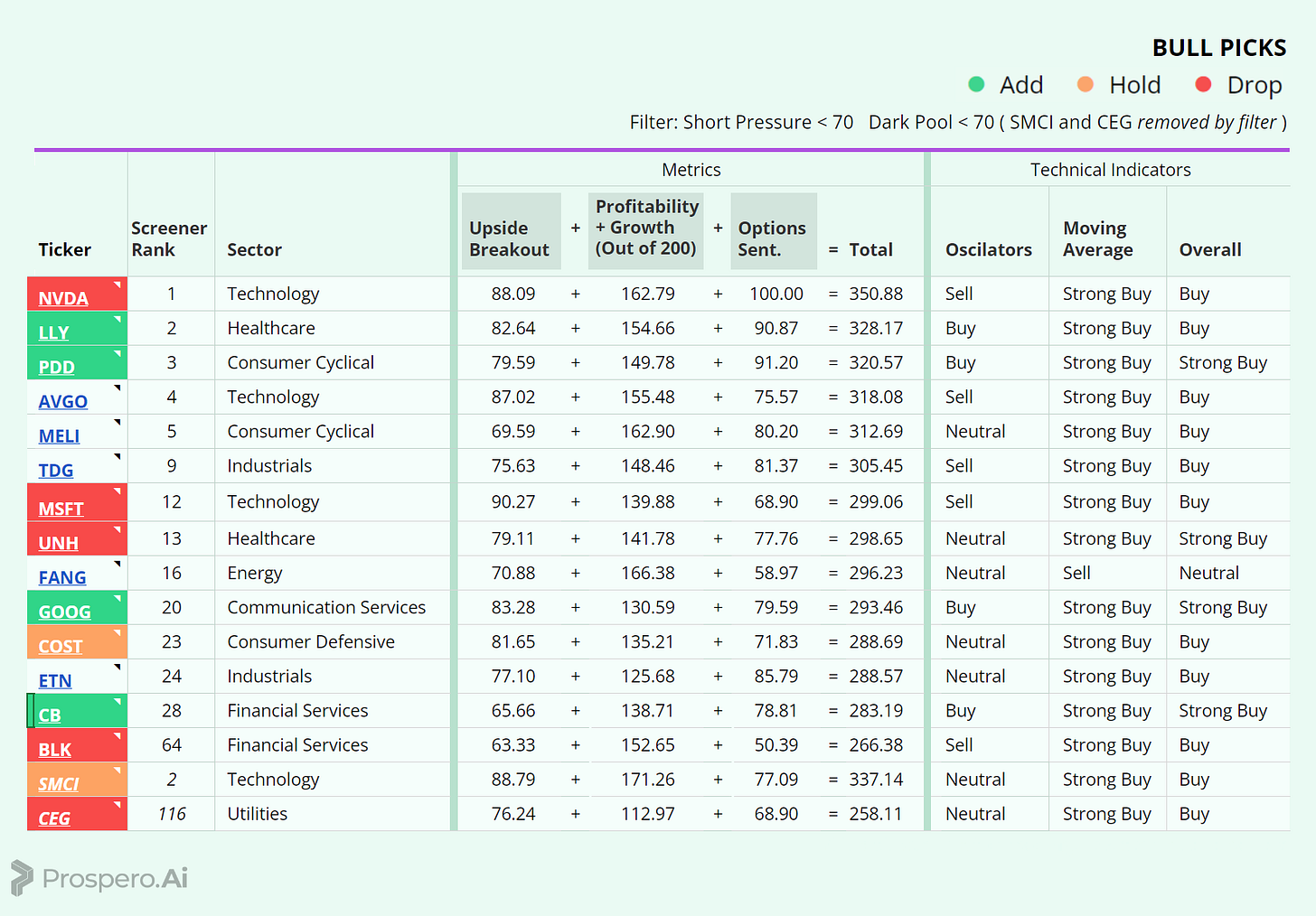

Long / Bull Moves - LLY, PDD, CB, GOOG adds / SMCI, COST holds / UNH, MSFT, NVDA, BLK, CEG drops

Adds

Did not want to overthink this one. We wanted to go with the best stocks in the Screener in diverse industreis with all “Buy” in the technicals. In a volatile market we felt that was the safest avenue.

Holds

SMCI we are holding 1/2 positions. Easy answer here was that it was the only one of our tech names that had a Neutral in the technical Oscilator. COST has been a strong and stable performer the last few weeks so it was an easy hold.

Drops

BLK an easy drop with CB looking better all around in Financials. Same for UNH in Healthcare vs LLY. MSFT was the 4th best tech stock and dropped because of the Buy Oscilator. CEG was previously performing well in our Screener so the drop is impossible to ignore. NVDA was

Short / Bear Moves - Link to Below Picture

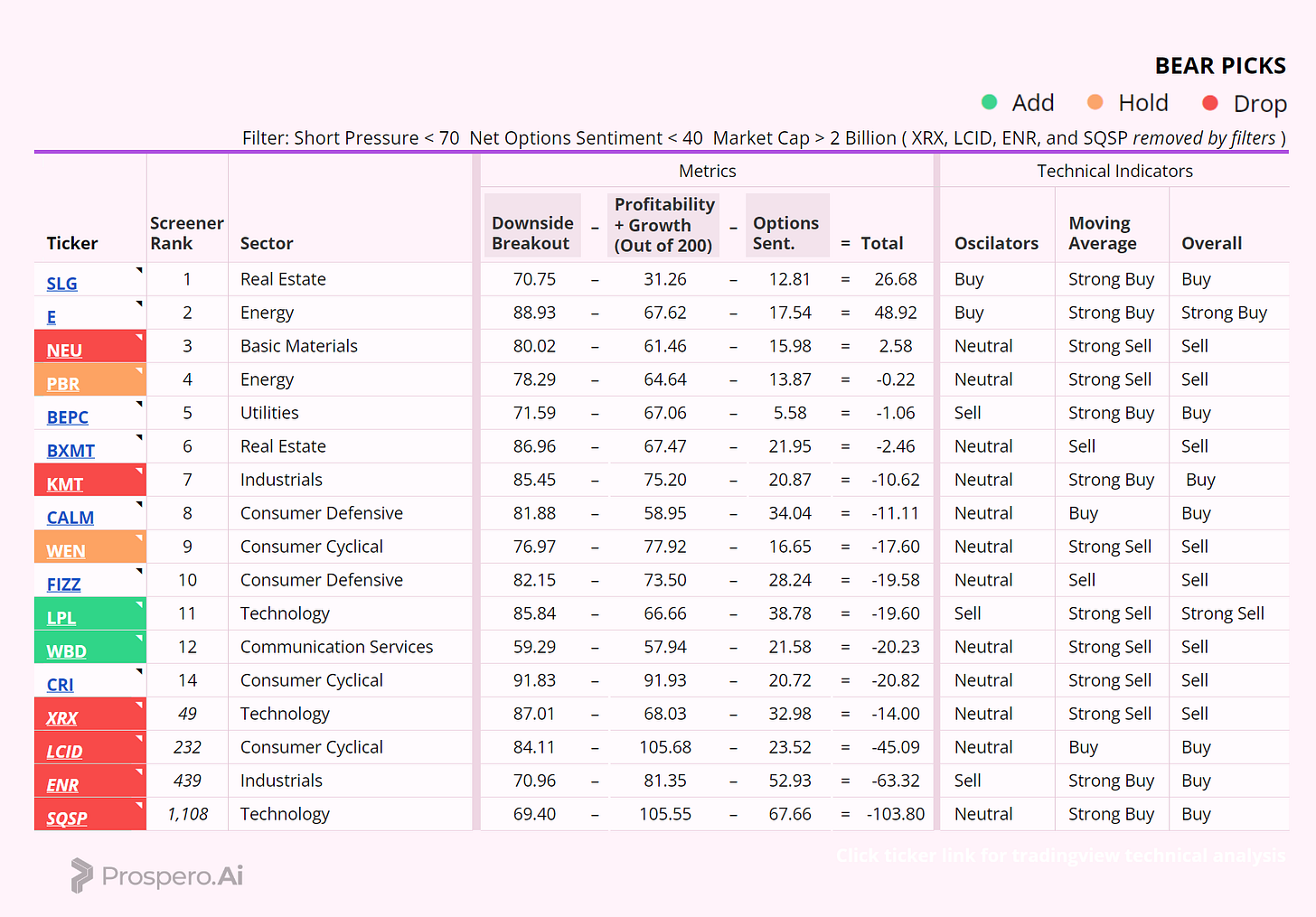

Short / Bear Moves - LPL, WBD adds / PBR, WEN hold / NEU, KMT, XRX, LCID, ENR, SQSP drops

Adds

LPL was the best pick overall combining technicals and Screener. WBD is a good add in the Communications Sector (which has not recovered as well as Tech) to counterbalance GOOG Sector wise, while GOOG still has th AI Upside as well.

Holds

WEN is the highest in the Screener with any Strong Sell technicals so an easy hold. PBR we liked because it had a bad day when the Energy Sector had a good one. Always a great sign for a Bear.

Drops

LCID, ENR, SQSP, and KMT are all easy drops because they do not have good technical setups. XRX would have been a hold if we were hanging onto more than 1 Tech stock. And NEU was a very tough drop but the good close to the week for Materials made it a tough cut because we wanted to stay 6 Bulls and 4 Bears. Had we been a little more Bearish overall it would have been a hold.

Portfolio Allocation

6 Longs: COST, SMCI, CB, LLY, PDD, GOOG

4 Shorts: WEN, LPL. PBR, WBD

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.