Prospero.Ai is continuing its run of sensational performance! In 2022 and 2023 newsletter picks beat the S&P 500 by ~50%. In 2024, newsletter picks are beating the S&P 500 by 339% and have a win rate of 70% against that benchmark.

We explain below how earnings forecasts could be driving / sustain) this Bull run.

To help you get up to speed quicker we now have our short learning intro (with lots of video links)

Our livestreams are also great for that at our normal times this week: YouTube stream links: 1st tomorrow 2/12 at 11 AM EST and 2nd Wednesday 2/14 at 3 PM EST. Our CEO George Kailas is doing an AMA (ask me anything) livestream 2/13 at 2 PM EST Simulcast from our X/Twitter page.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

A new reason for optimism, Outline:

Market/Macro Update

QQQ and SPY Net Options Sentiment

Sector Update / Portfolio Strategy

Now the Sector analysis will be roped into our allocation!

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

From 2/4 letter:

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

QQQ returned 1.39% this week vs 1.87% for SPY.

As we look back at the beginning of this latest Bull charge, which began around January 19, our SPY Net Options Sentiment gave us an excellent lead for that run up. But as you look at the Net Options trend since that massive run up, you can tell it’s slowly but surely losing steam and trending lower. At the end of the day, this kind of setup is what makes investing so fun. There’s a case to be made that we could see the market continue to move toward higher highs. But at the same time, there’s a case to be made that trend will reverse at any moment. As of Thursday’s close, only 62% of large-cap stocks were above their 50 day MA. That’s down from 87% in December. That direction is concerning. But at the end of the day, nobody really knows what direction we’re heading, but Prospero’s tools can give us an edge we need, not to be caught off guard.

See the graph above. Our QQQ Net Options sentiment bottomed around the beginning of February, but quickly reversed and has begun a climb that’s not showing any obvious signs of stopping. With NVDA’s earnings coming up on Feb 21, we could see that trend continue. But as with SPY, there’s a case to be made for a reversal. We’ll continue to watch the numbers closely.

One new “Bull signal” we wanted to highlight from Stocks Are at Records, but Are They Expensive? These Models Have an Answer

Analysts are more optimistic about the profit picture for this year and project that earnings among the companies in the S&P 500 will rise roughly 11%. That could offer stocks more room to run.

This improved year for earnings with projections that continue to move up is an obvious reason for strength in the market. And an answer for how we keep climbing with a looming consumer credit crisis and spending crunch? Well, if companies are still projected to earn more, they are projecting themselves to cruise past that.

Follow along on our trading letter which offers our market view at a much higher frequency. The way we are nailing these directional moves, our model portfolio pays huge dividends. Now at 49%! above the S&P 500 on 738 picks since 06/04/23.

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 30= Bearish.

For Non-Tech: SPY Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Sector Analysis / Portfolio Macro Strategy

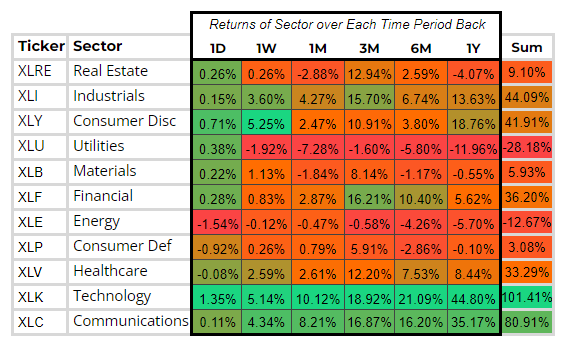

There are a couple of things that stand out to me on the sector analysis chart. First is the continuing strength of technology and communications. While the market breadth is beginning to expand outside of the “Magnificent 7”, their continued strength alone could mean there are more bullish days ahead. Until we know for sure what the market is doing, we are going to continue to be less aggressive in shorting sectors like consumer discretionary.

Although market breadth is slightly expanding, we continue to see relative weakness in Utilities and Energy. BUT, we’re at an interesting point of inflection. We saw a one day positive return of .38% last week in utilities. Maybe that’s an anomaly, and maybe it’s a sign of a bullish divergence. Also, it’s important to note that when you look at the seasonality chart for oil, February is traditionally the seasonal low point for Natural Gas and oil seasonality typically begins an uptick into Spring. @Namzes. If oil/gas seasonality remains true to past trends we should see an upswing in that sector very soon.

As the market indices have all time highs, we are literally in uncharted territory. Now, more than ever, we have to remain diligent and pay attention to any bearish signals we see over the next few days. At the very least we are far over due for a garden variety 2-3% pullback. At worst, we could see a hard decline. So be nimble and keep your eyes peeled for a correction.

For reasons you will see more below we are going to lean slightly Bullish but still maintain the neutral caution we’ve been advocating for. 5 Bulls and 4 Bears.

Long / Bull Adds - Link to Below Picture

ETN is an add to keep our diversification with the TDG drop for the Industrials Sector but ETN is obviously looking stronger.

One more quick point. Why didn’t we add ASML over SMCI? SMCI still looks better from a P/E standpoint than ASML and we are deferring to the “value” tiebreaker as we’re worried that some of these hot AI names are getting too overvalued. We don’t think this is true for SMCI, which still has a .7% 2026 P/E

Long / Bull Keeps

META is a keep, and returned -1.45% vs 1.39% SPY benchmark. META is again at the top of our Bull Screener. META has been fixed at the top of our Upside rating since 02/16/23 when the stock was trading at only $170. Our signals thrived where other tools fail, because of our unique options pricing formulas, which accurately predicted META's trajectory, culminating in a substantial earnings report surge last week. Link to full case study on our new blog!

MELI is a keep, and returned -1.28% vs 1.39% SPY benchmark. Though it had a loss last week, we’re holding onto it because of its overall strength in our metrics, especially because of strong technicals and a higher Net Options sentiment.

SMCI is a keep, and returned 16.94% vs 1.39% SPY benchmark. It barely made our list as we saw a drop in Net Options Sentiment. We will continue to monitor it closely as a quick drop candidate in light of the high short pressure that caused it to get filtered out.

LLY is a keep, and returned 4.44% vs 1.39% SPY benchmark. We are dropping 1/2 positions though to reduce single stock based risk. This has long been a Healthcare favorite of ours and we love it as a diversification Bull.

Long / Bull Drops

TDG is a drop because of how far they dropped in the screener. Covered 1/07-2/09 and it finished 14.4% with a Win, Beating the SPY benchmark by 7.11%.

CACC is a drop because it doesn’t wow us in the Screener. Covered 2/5-2/9, and it finished -5.25% with a Loss. Losing to the SPY benchmark by -6.63%.

Short / Bear Adds - Link to Below Picture

ICLK is a tough add. We’ve been wanting to stay away from China, but it (by far) is the best short in terms of our signals. It is also Sector that we want to hedge META against (Communications) so that breaks the tie.

SWX was another tough call. As we mentioned above, we’re nervous that both Energy and Utilities could be due for a turnaround. We will watch how it goes tomorrow to see if there is more juice in these Sector downswings, or if it’s over. One thing that does add to our comfort (for both SWX and E) is that those companies are both in good downswings, which puts them worse than their Sector comps.

Short / Bear Keeps

NAVI is a keep and returns .094% vs 1.39% SPY benchmark. We’re keeping it because of its higher rank in the screener.

E is a keep and it returned -.26% vs 1.39% SPY Benchmark. We’re keeping it because of the weakness in the energy sector.

Short / Bear Drops

MGEE is a drop because it’s in utilities, which showed a one day bullish divergence last week. Covered 1/26-2/09 with a WIN by beating it’s SPY benchmark by 3.82%.

NL is a drop because it fell too far in our screener. Covered 2/05 - 2/09 with a LOSS. It lost to its SPY benchmark by -2.34%

X is a drop because it fell too far in our screener. Covered 2/05 - 2/09 with a LOSS. It lost to its SPY benchmark by 1.39%

Portfolio Allocation

5 Longs: META, SMCI, MELI, LLY, ETN

4 Shorts: NAVI, E, ICLK, SWX

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.