Today in our newsletter, we’re going to unpack the earnings of Google, Meta and Tesla, and discuss how a company’s approach to A.I. can drive sentiment; but so can good old fashioned Wall Street politics. We’ll discuss this more in-depth in our Market Update. But now a word from our CEO George Kailas…

A WORD FROM OUR CEO

The markets finally started to behave more as we expected this week and we are beating the S&P 500 by 99% with a win rate of 63% against that benchmark this year.

For newer readers linking our short intro + learning videos.

Regular livestream times this week! Tomorrow 4/29 at 11 AM EST and Wednesday 5/1 at 3 PM EST. Simulcast from our X/Twitter page.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

WHAT GOES UP, MUST COME DOWN. Outline:

Market/Macro Update with Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Last week’s Net Options Sentiment levels from the 4/21 letter:

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 20= Bearish.

For Non-Tech: SPY Net Options Sentiment > 50 = Bullish < 35 = Bearish.

MARKET/MACRO UPDATE

In this section, we want to focus on 3 of our favorite long-term stocks and unpack how their earnings and consequent price action was impacted by two very important factors: A.I and their CEOs. We titled this letter “A Tale of 3 Earnings”, because if you were writing a novel that depicted how GOOGL, META & TSLA’s quarterly earnings played out…it would be in the fiction section of the bookstore.

One company had HORRIBLE numbers (TSLA). Their price skyrocketed.

One company had AMAZING numbers (META). Their price tanked.

One company had GREAT numbers (GOOGL). Their price went to all-time high’s.

The difference in these companies' price action had everything to do with the companies approach to A.I, combined with Wall (and main) Street’s view of their CEO. As investors, understanding how this all played out, can be an important tool in our belt in approaching the market in the coming days and weeks.

Last week began with a fairly ominous backdrop, of the Fed hinting that a cut in rates may not happen. But then Tesla reported its earnings, and despite its poor numbers, the stock took off to the upside. The next day, Meta gave its quarterly report, with impressive beats in revenue and profit, but for factors we’ll explain, they dropped a whopping 15% in aftermarket trading. Then, on Thursday after the close, Google reported earnings, scoring an incredible quarterly beat across the board. The market finished the week strong, with its first green week in almost 2 months. Let’s take a little bit deeper dive into each company and the public’s perception of their CEO.

TSLA: Why did TSLA produce such bad numbers but the stock took off on a 27%+ run? Well, it’s important to note that TSLA has been on the decline over the last year. Even through the heart of the bull market. Why? Declining margins and their CEO Elon Musk. Love him or hate him, he’s a lightning rod. He says what he thinks, even if it’s political and like it or not, that can effect a companies stock price. Bottom line, it was due for a turnaround. BUT, the primary thing that caused the stock to jump is they discussed plans for a lower priced model of their car. Making it accessible to more people. Wall Street has grown a bit frustrated with him (evidenced by the stock performance) but they’ve been asking for this from TSLA. Even the same person willing to say fuck you to his advertisers can be swayed by the sentiment of Wall Street.

META: Meta had CRAZY good numbers but their stock tanked. There were two primary reasons. Their forward looking guidance (what they bet their future revenue will be) was “in-line” with expectations. The market loves when companies raise guidance. On top of that, META, upped their AI capital expenditure budget. That spooked the heck out of the market. BUT…wait a minute!!! The capital expenditures are being spent on research and development for A.I. That’s a good thing right? We believe it has everything to do with Wall Street’s view of Zuckerberg and his history of a Cap-Ex raise for the “Metaverse”. In early 2022 (right before the Bear Market commenced in earnest) Zuck announced that he was spending a huge amount of money on what he foresaw as the future. The Metaverse. He even changed the name of the company from Facebook to Meta. It bombed. Turns out, nobody wants to hang out in an alternative universe made of people that look like they were created on a bad video game platform for 3rd graders. So when Zuck announced that he was spending money on R and D for AI…it hit a little too close to for Wall Street RE: his Metaverse days. The crazy thing, is that when it’s all said and done, Meta’s AI expenditures (Llama) may end up putting a sizable dent in Open A.I’s (Chat GPT) business. META has been spending money wisely lately so we aren’t aren’t bailing anytime soon but will make sure there isn’t a longer correction first. It was on a torrid run up for 1+ years.

GOOGL: Finally Google. Their CEO is named Sundar Pichai. Serious question for everybody. How many of you knew the name of the CEO of Google? I’d bet not too many. He’s not flashy, or famous. But he IS efficient and really good at running a profitable company. Google has created one of the most efficient A.I models in existence, but not only that, THEY HAVE MONETIZED IT. In other words, they are actually making money off of A.I and it’s only the beginning. That’s why Google is performing well. People believe their CEO is a no-nonsense, get er done, type of guy that is producing real world results. But this is the interesting part, how can the market get excited about Google in AI and penalize META? Well it is all about who is in charge clearly!

Final thought. Yes the market is volatile. Yes there are things effecting sentiment like interest rates and wars. But the reality is that these three companies are not going anywhere. They have a pile of cash, and they’re innovating in ways that is likely to completely change the world as we know it.

CAP/VALUE ANALYSIS

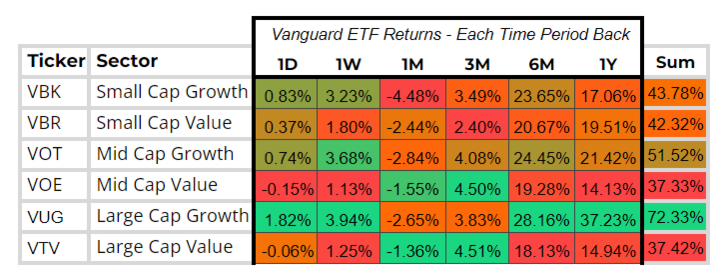

See the chart above. The good news is that Large and Mid Cap Growth had strong weeks. That’s a welcome sight after a multi-week drawback. The other good news is that Small Cap Growth had a strong week. If this is a sign of market breadth expanding into Small Cap, at the same time Large Cap Growth comes back into favor; this could lead to a longer rally upward. It’s important to continue to watch our QQQ and SPY Sentiment this coming week.

NET OPTIONS SENTIMENT

See the chart below. One really important thing to note is the volatility. See how we had radically swings, both up and down. We’ve never seen it like this, and that means NOBODY has a firm grasp on which way the market is heading. Keep in mind, those SPY Net Options Sentiment numbers are moved by Wall Street Hedge Funds. What does that tell you? Even they don’t know which way the market is going. For long term investors, just put your seat belt on and be patient. For more active traders, we need to be paying VERY close attention to how the sentiment changes. Our SPY and QQQ numbers have been excellent indicators of market direction.

What leaps off the page to me is the uptrend we see in QQQ numbers. Also see how our numbers went up, right before the market did. So those are excellent indicators of where the market is heading. This chart combined with the great numbers in Large Cap Growth might mean that good days may be ahead. But volatility remains. So be careful. And it is important to note it just cleared into the Bull zone, we want to make sure this holds tomorrow. We are cautiously bullish, with the key word being cautious. We will closely monitor this all week trading letter which we publish at a much higher frequency. (About once per day)

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 20= Bearish.

For Non-Tech: SPY Net Options Sentiment > 50 = Bullish < 35 = Bearish.

SECTOR ANALYSIS

Take a look at our Sector analysis chart. As you can see, Technology and Communications had a good week. That is encouraging and in line with our uptrend in QQQ Net Options Sentiment. But there’s one thing that stands out to me that I find very interesting. All the sectors were positive for the week. Even Real Estate was green for the week. Consumer Discretionary had a very strong week in comparison to it’s monthly numbers. This, combined with our Cap Analysis numbers and QQQ Sentiment, leaves us hopeful for brighter days. I’ll leave you with the reminder that The Fed speaks this week. If they come out overly Hawkish, or convey no rate cuts for 2034…things will likely turn south in a hurry. Be prepared.

PORTFOLIO STRATEGY

Happy to get back to more of our traditional style this week and we view it as pretty straightforward. We have to respect the Bull trend especially in light of the fact that all Sectors are positive over the last week. So we will lean slightly Bullish but stay hedged with 7 longs and 6 shorts.

Long / Bull Moves - Link to Below Picture

Long / Bull Moves - SRPT, GOOG, GE adds / AVGO, CEG, FANG, SMCI holds / META drop

Adds

SRPT, GOOG and GE were the best stocks in the Screener that had good technicals.

Holds

AVGO was an easy hold with good technicals and Screener performance. CEG was held for those reasons as well as diversification, it is far and away better than the other utilities stocks. FANG was a tough hold as Energy has been losing its good performance streak. We debated SMCI and we are not sure we will hold it through earnings (April 30th) but we thought given the ~90 Upside and Net Options Sentiment it was worth the risk to hold to start the week to gather more data.

Drops

META Not only was behind 2 other stocks in the Screener it was also filtered out on Short Pressure so no reason to hang onto it this week.

Short / Bear Moves - Link to Below Picture

Short / Bear Moves - NEU, NAVI, CRI, BEPC, CALM, DXC adds / no holds / NJR, X, CTLT, AXNX, GETY, SBGI, SKT, SAP, FORM drops

Adds

Easy explanation here. These were the highest ranking stocks in the Screener that also had good technical set ups for Bear picks.

No Holds

Drops

X, CTLT, AXNX, GETY, SBGI, SKT, SAP, and FORM were all dropped because they did not perform well in the Screener. NJR was not the top Utilities Bear and it also had a “Buy” signal from the oscillators so all easy drops.

Portfolio Allocation

7 Longs: SMCI, AVGO, CEG, FANG SRPT, GOOG, GE

6 Shorts: NEU, NAVI, CRI, BEPC, CALM, DXC

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.