Prospero had a hell of a week last week. A pure embodiment of the lesson that we always preach, the market is never done teaching you lessons. Despite Net Options Sentiment on SPY and QQQ sending clear warnings of a big drop to come. (This number generally drops THAT quickly only when demand for puts from institutions spikes, aka they are worried about something) So we saw that, flagged it in front of the big drop by a full day and moved our portfolio almost 2 to 1 short to long (11 to 6). You’d think that would go well? It did not! We took a hit on the day because the big losers were what we’ve been making money on all year - large cap growth. On the flip side we tend to pick shorts with low options sentiment in price downtrends and at least this past Friday the market especially rewarded stocks that got beat up previously. So would we do anything differently? AI / large cap growth has shown strength over the last year, even when rate expectations change for the worse and bond yields rise AI has pressed on. Betting against that trend changing in a big way as it did Friday, would not be aligned with a process that worked for us. We didn’t have solid data showing us our process should change, but we certainly do now. That is why we will do this entire letter differently.

Like many of you I'm sure, we are licking our wounds but we are still producing stellar returns on the year, beating the S&P 500 by 116% with a win rate of 63% against that benchmark.

We knew the day would come. We’ve been riding the Bull for an incredible year, and anyone that didn’t think there’d be a correction, either is new to the market, or simply delusional. Market corrections ALWAYS come. As a matter of fact, they’re healthy. Times of consolidation allows for stocks whose fundamentals are good, but whose valuations have become overextended, to come back to a healthy place.

The bad news, IT’S BEEN A ROUGH WEEK!

The good news, WE SAW THIS COMING.

Here are some direct quotes from our previous letters or social posts from last week.

SUNDAY: “Prospero’s QQQ Net Options Sentiment has been on a slow and steady decline for a few weeks now. In the past, every time that’s happened, Tech and Communications did not perform well”

Wednesday Trading Letter:

THURSDAY (the day before everything took a nosedive): “SPY and QQQ Net Options are plummeting. How could you not be concerned looking at these graphs?”

There were many others, but you get the point. It’s important to note, that the WHOLE HEART BEHIND PROSPERO is to help the everyday retail investor succeed. If you’re an active trader and investor, it’s important to keep up with our communication. It makes all the difference in the world.

Let me give you one personal example…

I (Matt) have been actively day trading for the last couple of years. One of the primary reasons I’ve been trading was to help supplement my income for my daughter's wedding in May. Over a year ago, I made it a personal goal to get my daughter’s wedding fund account to $25,000. With the help of Prospero, a couple of months ago, I hit the mark. It was about that same time that our Options Sentiment Numbers began declining. So, I started being VERY conservative with my trading. I only traded a few shares at a time, based on George’s high conviction picks. I simply couldn’t afford to lose any of that money. Last week, when our SPY Net Options Sentiment numbers tanked, I withdrew my entire portfolio into cash. On Friday, that move paid off!!!! Needless to say, I’m thankful for Prospero. It saved my daughter's wedding and probably my marriage. 🙂

For those of you that may have had a harder week, don’t despair. We’re in this together, and we’re going to help you make it through this really difficult market!

For newer readers linking our short intro + learning videos.

Regular livestream times this week! Tomorrow 4/22 at 11 AM EST and Wednesday 4/24 at 3 PM EST. Simulcast from our X/Twitter page.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

WHAT GOES UP, MUST COME DOWN. Outline:

Market/Macro Update with Special Cap / Value Analysis

QQQ Net Options Sentiment and Value and Growth returns by Market Cap

Skipping Sector Analysis

Sectors have been too volatile and we aren’t seeing great data on them so no reason to highlight them specifically this week

New Portfolio Strategy

How we are completely changing our approach to handle the new market

Longs

Adds, Holds and Drops

Shorts

Adds, Holds and Drops

Portfolio Summary

Last week’s Net Options Sentiment levels from the 4/14 letter:

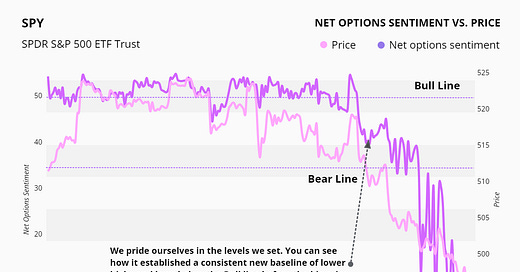

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 50 = Bullish. < 35 = Bearish.

QQQ returned -5.39% this week vs -3.07% for SPY.

Market/Macro Update:

Can’t say that we didn’t see the macro issues coming! Beyond the specific warnings the values fell well below our pre-established Bear levels.

There’s a lot of debate out there regarding what’s causing the market to have such a tough correction. Some say, it’s simply time for a correction. We’ve gone on quite a run lately and we’re due. Others say it’s because of the Geo-political unrest in the middle east. Still others say it’s the “A.I. Bubble” finally busting. Here’s what we know. #1 and #2 are absolutely part of the problem. #3 is still up for debate. We addressed that subject briefly in last week’s letter. NOBODY REALLY KNOWS FOR SURE, if A.I. is a bubble or not. At the end of the day, hedge fund managers are human beings that can’t tell the future. For example, SMCI just dropped by 25% on Friday. OUCH! But their Net Options Sentiment numbers didn’t drop dramatically. What does that teach us? Even the many institutions long SMCI options were/are not sure where the bottom is. But here is what we DO KNOW. Hedge fund managers are hedging QQQ and SPY. They’re buying options that allow them to hedge the downturn of the market. That’s what’s causing the decline in our QQQ and SPY Net Options Sentiment. When you throw all that together in the blender, the Fear and Greed Index turns to fear. The VIX goes above 17 for the first time in a long time…and the market corrects.

There is one particular piece of information that has us deeply concerned. See the graph below (Via: @Gameoftrades_)

The Yield Curve has been inverted for over 500 days now. There have only been 3 TIMES IN HISTORY THIS HAS OCCURRED.

1. 1929

2. 1974

3. 2008

If you don’t know the significance of those years, Google it. But I’ll give you a hint. All 3 of those years saw a greater than 50% stock market decline. YIKES!

Now, before you panic, it’s important to remember a couple of things. First, just because something happened in the past doesn’t mean it will happen again. Two, we have Tech earnings fast approaching. If the “Magnificent 7” shows strong earnings, this could all turn around in a hurry. But, if they don’t. It could get ugly. Please be paying attention to our communications, as well as the Net Option Sentiment Numbers.

Cap/Value Analysis

Here’s the main takeaway: Look at Large Cap Growth for last week. Not good. That sector dropped by a whopping 5.53%. BUT, look at Large and Mid Cap Value. They actually grew on Friday, and their drop for the week was minimal compared to Large and Small Cap Growth. That teaches us that traders were looking for stocks that have been beat up in the past few months, hoping they wouldn’t take more of a beating. This will help direct our picks in the days to come.

See the above graph: The slow and steady decline of our numbers turned into a fast and rapid free fall. But it’s important to note that we set our levels to help warn us of moves just like this. When SPY dropped below our 40 Bull Zone (which it’s stayed comfortably above all year) that sounded our alarms and we let you know. Those rapidly falling numbers demonstrated that hedge funds were hedging aggressively against the market.

ONE MORE THING WE NEED TO PAY ATTENTION TO DURING THE COMING WEEK. Last week we saw QQQ Net Options Sentiment dip to 0 and SPY dipped into the low single digits. It’s important to note, that historically even just SPY at 0 for extended periods is a bad sign. So, needless to say, we need to pay close attention to our SPY and QQQ numbers over the next couple of weeks.

For SPY and QQQ Net Options Sentiment > 25 = Bullish < 10 = Bearish.

New Portfolio Management Strategy

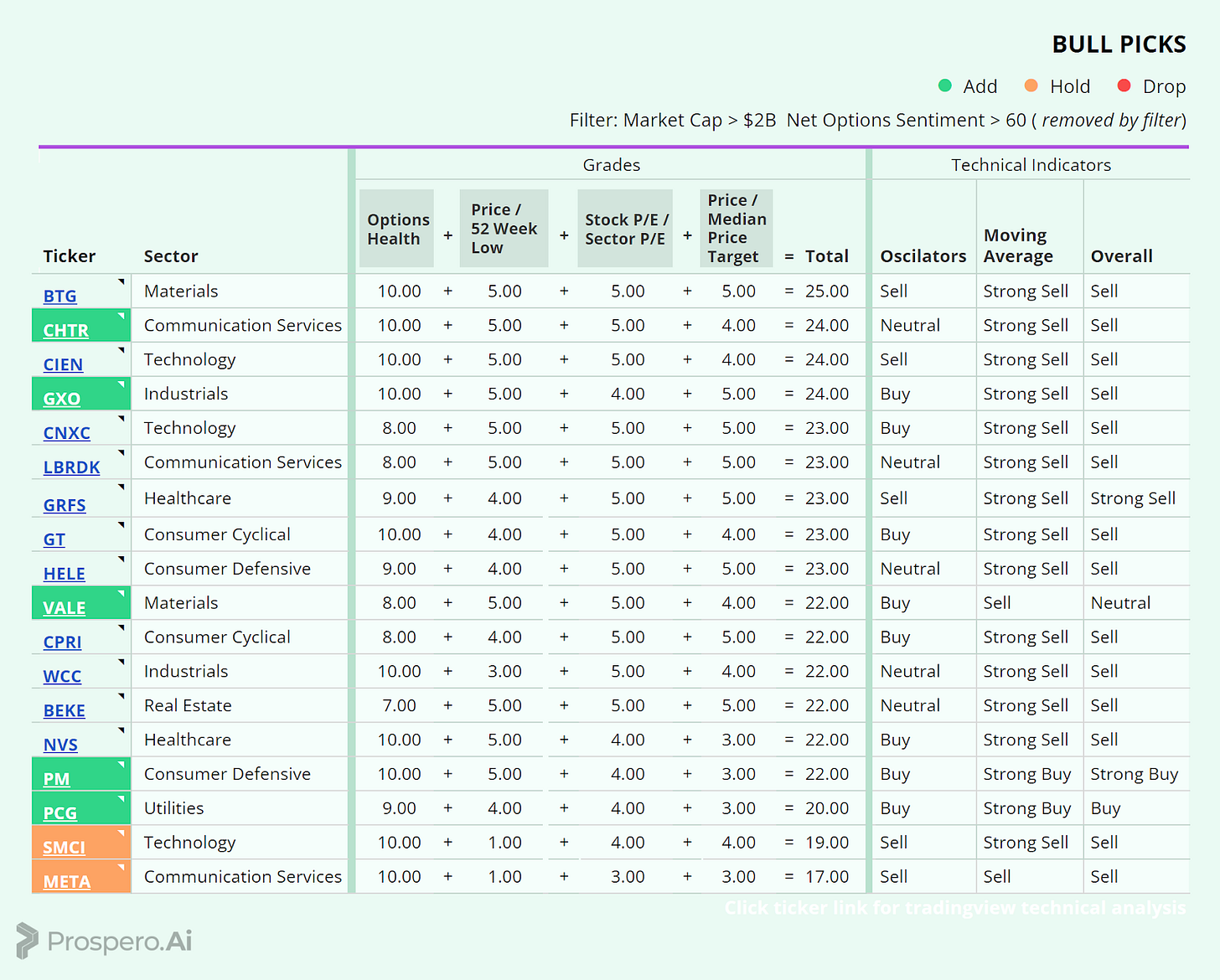

We showed you above how Value stocks were rewarded heavily but one of the things we always prioritize is Profitability, so how do we take this to the next level? Well we are looking for stocks that our metrics like AND they are undervalued. How do we decide what is undervalued? Well we are glad you asked. Here are the custom metrics we put together with traditional value metrics + our signals.

*A note on these grades, since these numbers are in different scales we “bucket” the values with a grade between 1-10 for our signals (to prioritize them more) and 1-5 for the rest.

Options Health - Graded 1-10*

Options Health provides an assessment of how the stock is performing in the market. This adds our Upside signal subtracts Downside and adds 2X Net Options Sentiment. These are our most options heavy metrics and since Upside and Downside are long term and Net Options Sentiment short term we are balancing long-term and short-term signaling this way.

Price / 52 Week Low - Graded 1-5*

Price / 52 Week Low is a comparison between the stock’s current close price and its lowest price in the last year. Where a price falls in comparison to its 52-week price low provides insight into what could be opportunistic value buys in a tough market.

Stock P/E / Sector P/E

Stock P/E / Sector P/E is a comparison between the company’s current Forward Price to Earnings Ratio (P/E ratio) and the P/E for the Sector SPDR. This tells us if there is value relative to the Sector the stock trades.

Price / Median Price Target

Price / Median Price Target is a comparison between the stock price close and the median analyst Price Target. This gives us a feel to the extent that analysts, on the whole, think the price of this stock has room to move up.

We did other things to manage risk, such as we are keeping a few of our favorites, META (1 of 2 positions) and SMCI that got hit hard because you are always at the risk of overcompensating, and we think that these stocks will be prime candidates to bounce back if the market reverses from the end of last week. But to hedge the risk there, we have 3 tech shorts in our portfolio…and the rest of our picks long and short, were made to optimize what we think the market could view as great value.

We wanted to enforce risk control, so beyond our move to target value stocks, we’re staying with 7 Bull and 11 Bear picks.

Long / Bull Moves - Link to Below Picture

*NOTE if these headers confuse you, scroll up to the New Portfolio Management section to see the strategy.

Long / Bull Moves - CHTR, GXO, VALE, PM, PCG adds / META (½) SMCI holds / META (½), FANG (all), LLY, GOOGL, VRT, MSTR drops

Adds

PM and PCG were added as the only stocks that looked good in this new screener and technicals. VALE, GXO and CHTR were all added because they were near the top of the Screener, and had positive price movement this past Friday. There were also some of the stronger technical stocks towards the top, especially when I zoomed into shorter than 1 day time horizons.

Holds

As highlighted above, we are pursuing an entirely new strategy for long / short, but we’re holding onto a few of our favorites in case last Friday was a short correction, causing SMCI and META to snap back up quickly.

Drops

It is pretty simple. The rest of our portfolio we dropped, because we’re concerned about a fundamental shift in the market towards value. So unless it’s META or SMCI, if we owned it last week, consider it dropped. Specifically: META (½), FANG (all), LLY, GOOGL, VRT, MSTR

Short / Bear Moves - Link to Below Picture

*NOTE if these headers confuse you, scroll up to the New Portfolio Management section to see the strategy.

Short / Bear Moves - AXNX, FSS, BX, MGY, FORM, CTLT, IT, SPXC, X, SKT adds / SAP hold / TEL, SOHU, GRMN, BXMT, WEC, SABR, G, PTCT, LPL drops

Adds

Other than MGY, which was added because it looked good in shorter term technicals, each and every one of the above was added because it looked strong for a Bear in our new Screener, or had good Bear technical setups to match. A lot of our traditional shorting methodologies didn’t do well this past Friday, so for this one, we changed up our playbook almost completely.

Holds

We had already started shifting our view to larger cap shorts on Friday, which is how we identified TEL and SAP. TEL didn’t make the cut, but SAP did. And we were happy to have at least one stock in the portfolio stay the same on the short side!

Drops

It is pretty simple. The rest of our portfolio we dropped, because we’re concerned about a fundamental shift in the market away from what has worked for us. So unless it is SAP if we owned it last week, consider it dropped. Specifically: TEL, SOHU, GRMN, BXMT, WEC, SABR, G, PTCT, LPL

Portfolio Allocation

7 Longs: META, SMCI, CHTR, GXO, VALE, PM, PCG

11 Shorts: SAP, AXNX, FSS, BX, MGY, FORM, CTLT, IT, SPXC, X, SKT

Paid Investing Letter Bonus - for the first time we are sharing the sheet built for the screener. We thought showing the whole list would be the best way to help our paid readers beyond the data above. To be clear, we find anything outside of our above recommendations highly risky after Friday and we are personally leaning on this Screener until we see a clear reason from the market to deviate.

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.