Happy Sunday! You are receiving this if you’ve downloaded our app or subscribed via Substack.

We are currently beating the S&P 500 by 84% on our 2023 picks, with a 67% win-rate per pick against their S&P 500 benchmarks.

Normal YouTube livestream tomorrow 9/25 at 11 AM EST but we have a special bonus AI livestream 09/28 at 11 AM where we will be joined by James Villarrubia Applied AI expert, CTO and currently a Presidential Innovation Fellow at NASA.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Bear momentum accelerating. Outline:

Market Update

QQQ and SPY Net Options Sentiment and Portfolio Allocation

Portfolio Macro Strategy

How we are approaching the number of longs/shorts and sectors

Shorts up first!

Adds —> Keeps —> Drops

Longs

Adds —> Keeps —> Drops

Portfolio Allocation Notes

The market was extremely volatile this week. How we added upside, while limiting our risk.

Market Update

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish. < 15 = Bearish.

QQQ returned -3.48% this week vs -2.92% for SPY. This is very much in line with our increasingly Bearish Net Options Sentiment readings for both indexes.

We’ve been saying how important it is to keep track of our metrics during the trading week. This proved especially true last week, as we gave a stern warning with our “advanced trading” tip a day before the Fed meeting. Those subscribed to our trading letter know that typically, this section is not used to make or emphasize market hedges; but this 9/19 warning reflected a highly concerning Bear pattern we had to warn those readers about.

“Advanced trading recommendation

Especially if you are long I’d consider going more market neutral in this environment and broadly hedge to the downside. I’d consider owning 20% of your portfolio in SQQQ through the FOMC meeting on Wednesday if you are long only and/or tech concentrated.”

Moving our levels a bit to better capture movement out of this Bear turn.

For Tech: QQQ Net Options Sentiment > 35 = Bullish < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish < 10 = Bearish.

Portfolio Macro Strategy

Things are looking pretty Bearish right now, so we will lean fairly heavy that way with 4 Bears and 1 Bull pick.

Our consumer credit Bear watch got another interesting data point on Twitter As a result, we are targeting consumer goods for our Bear picks.

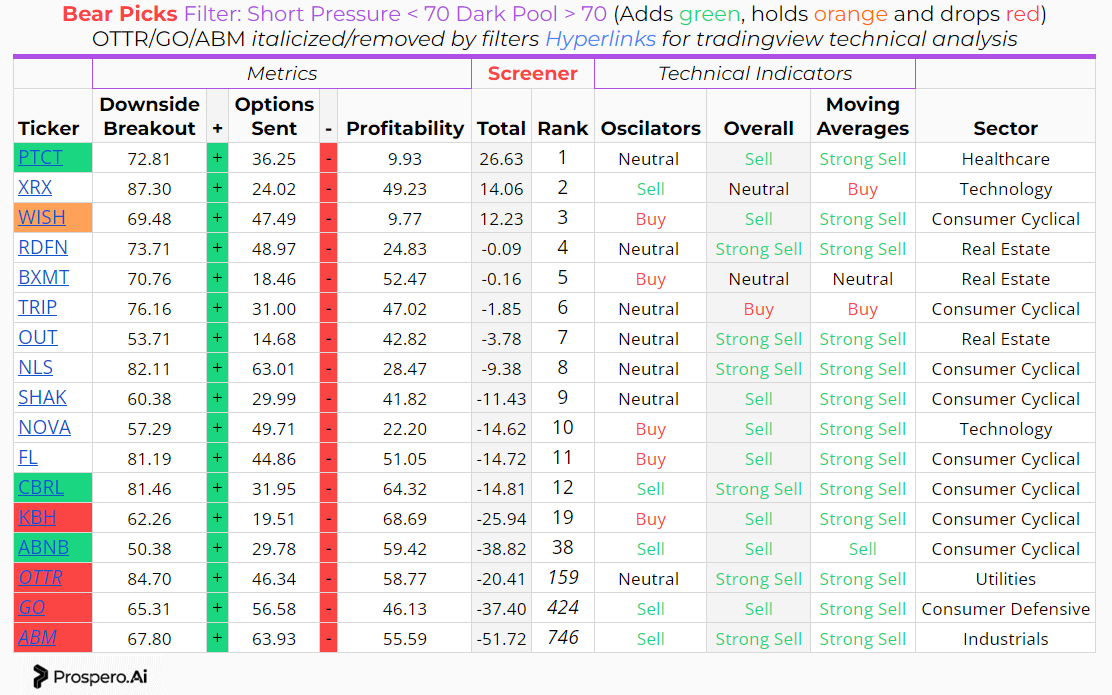

Short / Bear Adds - Link to Below Picture

We added WISH in our midweek letter 9/20 and although it flipped to a Buy on the "Oscilators” we are holding it because is has such low Profitability + Growth (20).

CBRL and ABNB were added, because both had technical oscillators and moving averages as “Sell”. They were in the target sector we wanted “Consumer Cyclical” and as our loyal readers know, we’ve been eyeing ABNB for a decline due to some concerning legislation passed in NYC. ABNB had a healthy 50+ Net Options Sentiment, but declined consistently over the course of last week, now below 30.

Bearish this week if:

Above Stocks Net Options Sentiment < 50

Above Stocks Net Social Sentiment < 60

QQQ Net Options Sentiment < 25

SPY Net Options Sentiment < 10

Short / Bear Keeps

WISH is a keep and returned--.94% vs -1.87% vs the SPY and since it was added 9/20.

Short / Bear Drops

Dropping KBH as a Bear, as it did not perform well in the filter. Covered 9/15-9/22, it finished -5.58% and a Win, Beating the SPY benchmark by 2.66%.

Dropping GO as a Bear, as it did not perform well in the filter. Covered 9/15-9/22, it finished -3.68% and a Win, Beating the SPY benchmark by .76%.

Dropping OTTR as a Bear, as it did not perform well in the filter. Covered 9/10-9/22, it finished +1.73% and a Loss, Losing to the SPY benchmark by 5.12%.

Dropping ABM as a Bear, as it did not perform well in the filter. Covered 9/15-9/22, it finished -1.87% and a Loss, Losing to the SPY benchmark by 1.05%.

Long / Bull Adds - Link to Below Picture

No adds this week! Not only are we Bearish overall, but as you can see there aren’t strong technicals for any of these top picks above. This makes it an easy decision for us to play it safe with just our strongest Bull pick, META.

Notice we are even hedging our longs by using these filters / looking for stocks with both lower Dark Pool Rating and Short Pressure Rating. As we saw last week, picking stocks with lower ratings in both these signals is a great way to add additional risk mitigation to your longs.

Long / Bull Keeps

Bull review - META (Meta Platforms Inc) Bullish this week if:

META Net Options Sentiment > 80

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 35

META returned -.41% vs -2.92% for SPY and is kept as a Bull because it is ranked 1 on the screener above.

Long / Bull Drops

We are dropping GOOG as a Bull, primarily because it was 21 on the screener and the technicals went south. Covered on 9/10-9/22 and finished -4.34% and a Loss, Losing to the SPY benchmark by .95%.

We are dropping EQIX as a Bull, because it was filtered out of the screener. It performed poorly overall, and its technicals went south. Covered on 9/15-9/22 and finished -5.71% and a Loss, Losing to the SPY benchmark by 2.79%.

Portfolio Allocation Notes

1 Long: META

4 Shorts: PTCT, WISH, CBRL and ABNB

We tried something new with KBH, GO and ABM. They had lower Downside Breakouts and they had uneven weeks. PTCT, WISH and CBRL are more traditional Bear picks for us this week and they’re in a sector we think will have a rough end to the year. We are a little nervous, that perhaps, PTCT and WISH have been hammered too much already on price. But we will keep a close eye on this issue and perhaps send a mid-week update.

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.