Happy Sunday. This should be an exciting edition as we’ve enhanced our approach! You are receiving this if you’ve downloaded our app or subscribed via Substack.

We are currently beating the S&P 500 by 93% on our 2023 picks, with a 70% win-rate per pick against their S&P 500 benchmarks.

YouTube livestream tomorrow 9/18 at 11 AM EST

Speaking of Video… Our socials are gaining traction! YouTube shorts are close to 50K views in the last few weeks. If you like the newsletter and app you should check them out on YouTube, Instagram and/or TikTok as they provide a different as well as supplemental perspective!

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Our process takes a step forward. Outline:

Market Update

QQQ and SPY Net Options Sentiment and Portfolio Allocation

Signal Returns Analysis

How we can use historical by signal to determine our approach

Portfolio Macro Strategy

How we are approaching the number of longs/shorts and sectors

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Allocation Notes

The market was extremely volatile this week. How we added upside, while limiting our risk.

Market Update

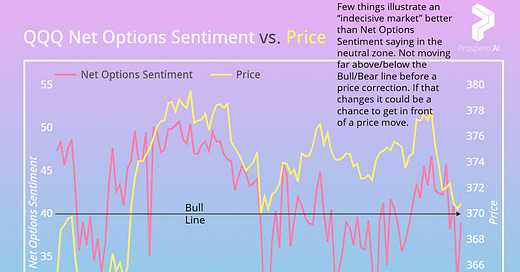

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish. < 15 = Bearish.

QQQ returned .48% this week vs .48% for SPY. The down week is not surprising, as we saw both QQQ and SPY Net Options Sentiment slip out of the Bull zones.

This is another important week to keep an eye on our trading letter for more frequent in-week updates. We need to keep an eye out for QQQ breaking clearly into the Bull or Bear zone. Or, if SPY shows ongoing strength, we will look to go long on non-tech value stocks, and/or short non-AI tech. We think the levels are providing good perspective here and we will leave them in the same place.

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish < 15 = Bearish.

Sector / Signal Update

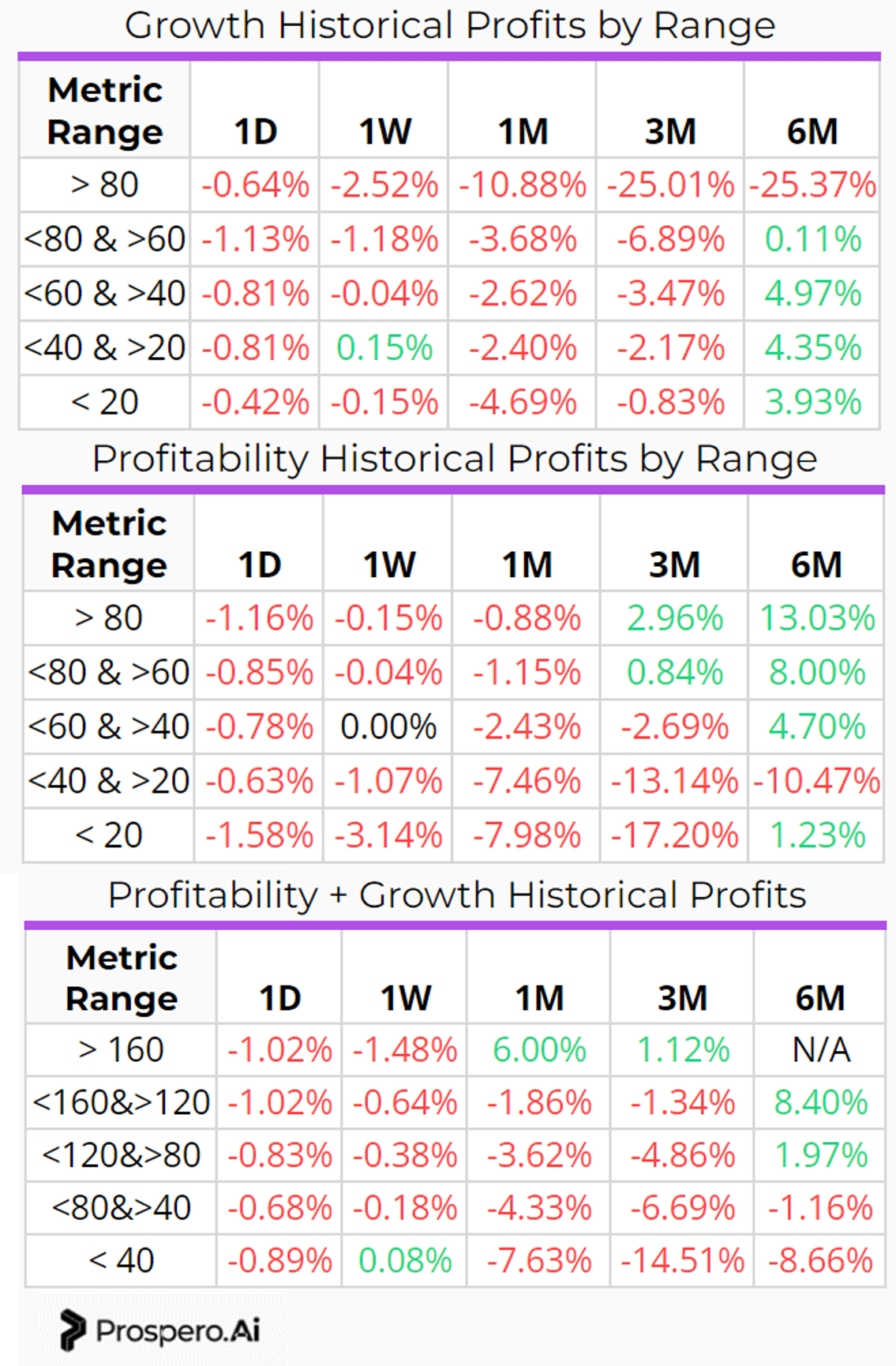

We’re going next-level with this section! Instead of just selecting the screener of the week, based on feel, we will make that part more data-driven as well.

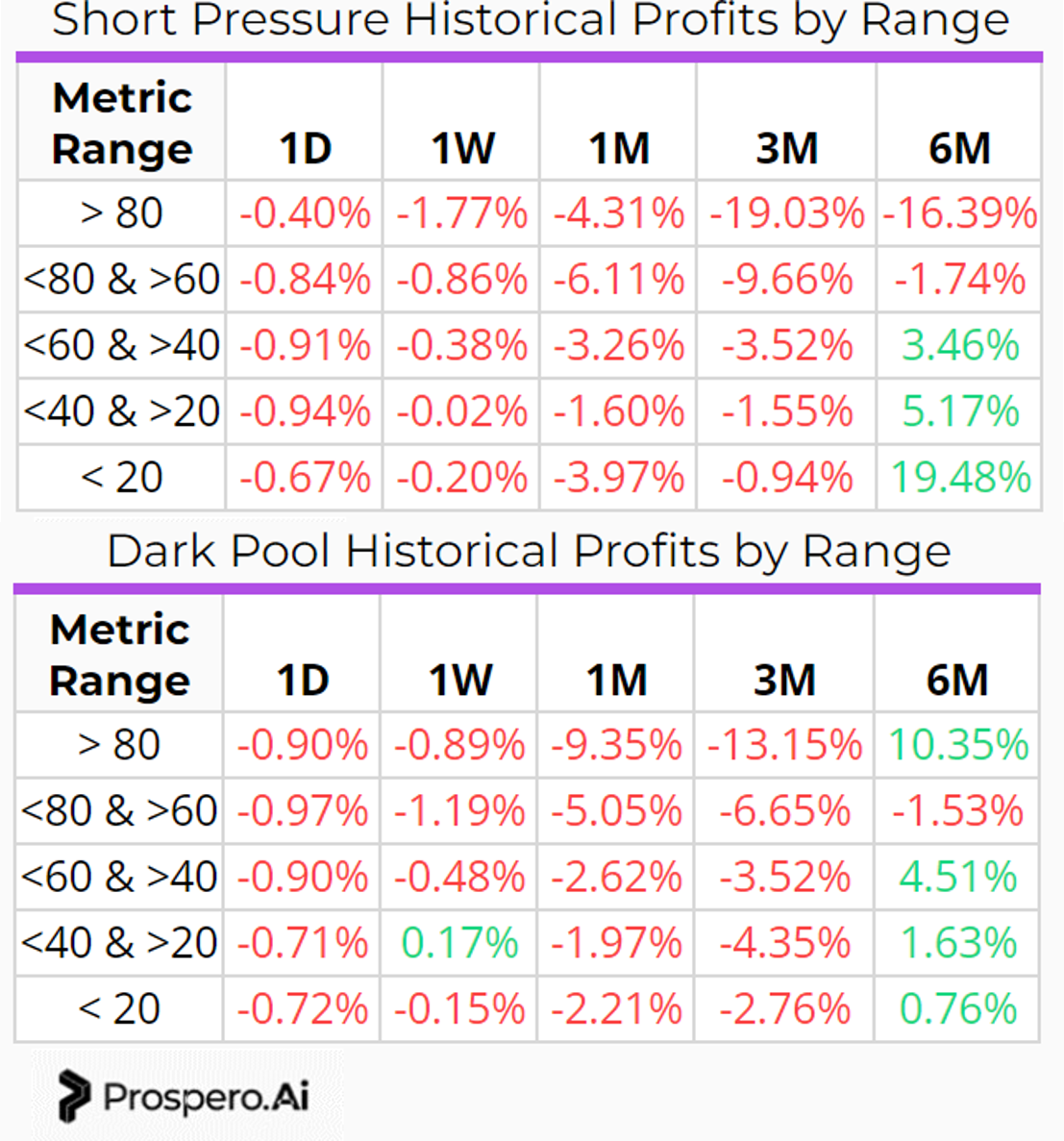

FYI table calculations work as follows: trailing metric average, then the performance. 1D = 9/14 metric and 9/14 close to 9/15 close return. 1W = AVG 9/5-9/8 and 9/8 close to 9/15 close. 3M = AVG 3/15-6/15 and 6/15 close to 9/15 close.

Interesting takeaways:

Our instincts last week, regarding high Short-Pressure being risky, looks accurate. On the 1M timeline we see > 80 performing better than <80 and >60.

Higher Dark Pool looks like an excellent short term metric for Bears, so we will incorporate this today.

There’s a fascinating divergence between Short Pressure and Dark Pool (the metrics most retail investors refer to as manipulation). There is a clear long-term performance improvement for lower Short Pressure, but Dark Pool numbers are anything but consistent there. My guess is that Dark Pools help institutions control a price in the short term, but eventually the “market” catches up.

Interesting takeaways:

Blown away by the Growth. Growth performs worse in non-Bull markets. But given that there were some Bull runs this year, we expected this to do better.

The further out, the clearer and more linearly Profitability + Growth achieves good returns. Even better than pure Profitability. This validates our emphasis.

Portfolio Macro Strategy

The market is looking highly indecisive, but it is leaning toward a bit of a Bearish trend. Due to our lessening conviction in either direction, we are trimming the total number of picks; but staying Bear-leaning with 3 Bull picks and 4 Bear picks.

Long / Bull Adds - Link to Below Picture

I’m excited by the organization of the results in the new system! MELI and SMCI would have been holds in the old system, but they turned out to be excellent drops vs. what we kept.

The reason we ended up keeping EQIX, and not higher ranking stocks with similar technicals ARGX and VRTX, was that in this uncertain market we just aren’t comfortable with Healthcare. But if you’re a trader willing to take on a bit more risk, go for it.

It’s also important to note the lack of Real Estate stocks on the rest of this list. This means something is standing out to institutions in the options markets vs. the rest in the sector.

Bullish this week if:

EQIX Net Options Sentiment > 60

EQIX Net Social Sentiment > 40

QQQ Net Options Sentiment > 35

SPY Net Options Sentiment > 15

Long / Bull Keeps

Bull review - META (Meta Platforms Inc) Bullish this week if:

META Net Options Sentiment > 80

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 35

META returned .81% vs -.48% for SPY and is kept as a Bull because it is ranked 7 on the screener above.

Bull review - GOOG (Alphabet Inc) Bullish this week if:

GOOG Net Options Sentiment > 80

GOOG Net Social Sentiment > 50

QQQ Net Options Sentiment > 35

GOOG returned .80% vs -.48% for SPY and is kept as a Bull because it is ranked 1 on the screener above.

Long / Bull Drops

We are dropping BKNG as a Bull, because it was 19 on the screener. And technicals are no longer solid Bullish. Covered on 9/10-9/15 and finished +.54% and a Win, Beating the SPY benchmark by 1.03%.

We are dropping CYBR as a Bull, because it was 23 on the screener. Covered on 9/10-9/15 and finished +.99% and a Win, Beating the SPY benchmark by 1.47%.

We are dropping TSLA as a Bull, because it was 59 on the screener. And technicals are no longer solid Bullish. Covered on 8/27-9/15 and finished +15% and a Win, Beating the SPY benchmark by 14.23%.

Short / Bear Adds - Link to Below Picture

The nice thing about this new system is that the numbers can do the talking for themselves. Technicals were not lining up for all of the top-signal picks, so we had to go fairly far down to find the ones we liked. But ultimately we were happy. Downside Breakout is a little lower than we’d like to see, but we think it is made up for it with a higher Net Options Sentiment. We will watch this for sure.

Bearish this week if:

Above Stocks Net Options Sentiment < 50

Above Stocks Net Social Sentiment < 60

QQQ Net Options Sentiment < 30

SPY Net Options Sentiment < 15

Short / Bear Keeps

OTTR returned .99% vs -.48% for SPY and is kept as a Bear because it is ranked 3 on the screener above.

Short / Bear Drops

Dropping MED as a Bear. If we were more certain of a Bear market we’d keep it, but we don’t want to take any chances with technical indicators due to uncertainty. Covered 9/4-9/15, it finished -1.99% and a Win, Beating the SPY benchmark by 4.52%.

Dropping NAVI as a Bear because technicals look horrible for a short. Covered 9/10-9/15, it finished +4.99% and a Loss, Losing to the SPY benchmark by 5.47%.

Dropping FULT as a Bear because it is ranked 80 on the screener above. Technicals look good (and this is a choice we may regret), but the fact that we saw such solid historical results for shorts with higher Dark Pool ratings, we are making this move to test that strategy live. Covered 9/10-9/15, it finished +.77% and a Loss, Losing to the SPY benchmark by 1.26%.

Dropping EXPD as a Bear as it was both filtered out of the screener and would have finished 309 if it was included. Covered 9/4-9/15, it finished +2.49% and a Loss, Losing to the SPY benchmark by 4.23%.

Portfolio Allocation Notes

3 Longs: META, GOOG, EQIX

4 Shorts: OTTR, KBH, GO, ABM

Sometimes the metrics match our instincts, and as readers know, we like META and GOOG as value plays due to their excellent 2024 forward P/E ratios META (18) and GOOG 20.55. Given what we saw with Dark Pool, TSLA at 88.57 was scary enough for me to drop it. Especially with technicals moving.

We are trying something new with KBH, GO and ABM. They have lower Downside Breakout, but we liked the rest of the profile (especially for KBH and GO), they are in sectors we expect to fare poorly the rest of the year.

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.