Happy new year! We continue to see a big influx of readers as we start the year! A quick reminder — we shared our 1 year results 12/19/23 and beat the market by close to 50% for the 2nd year in a row!

We’re back to normal times on our live streams, so follow us on Twitter and YouTube to watch. Direct YouTube stream links: 1st tomorrow 1/8 at 11 AM EST and 2nd Wednesday 1/10 at 3 PM EST. We will also do a deep dive on our new app and features with @WOLF_financial, on Twitter spaces Tuesday at 1 PM EST.

Our apologies for the missed letters last week. We’ve been debating a change in format. Our letters will continue in the same format, but will just tell you what our active portfolio holdings are each Sunday. Unlike last year, where we set our picks on Sunday and only changed a few times during the week, this year we expect to send pick changes to our paying users at a higher frequency. We extended 50% off to give everyone a last opportunity to access them at a big discount.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Bears Strike Back, Outline:

Market/Macro Update

QQQ and SPY Net Options Sentiment

Sector Update / Portfolio Strategy

Now the Sector analysis will be roped into our allocation!

Longs

Adds —> Keeps —> No Drops

Shorts

Adds —> Keeps —> No Drops

Portfolio Summary

Market Update

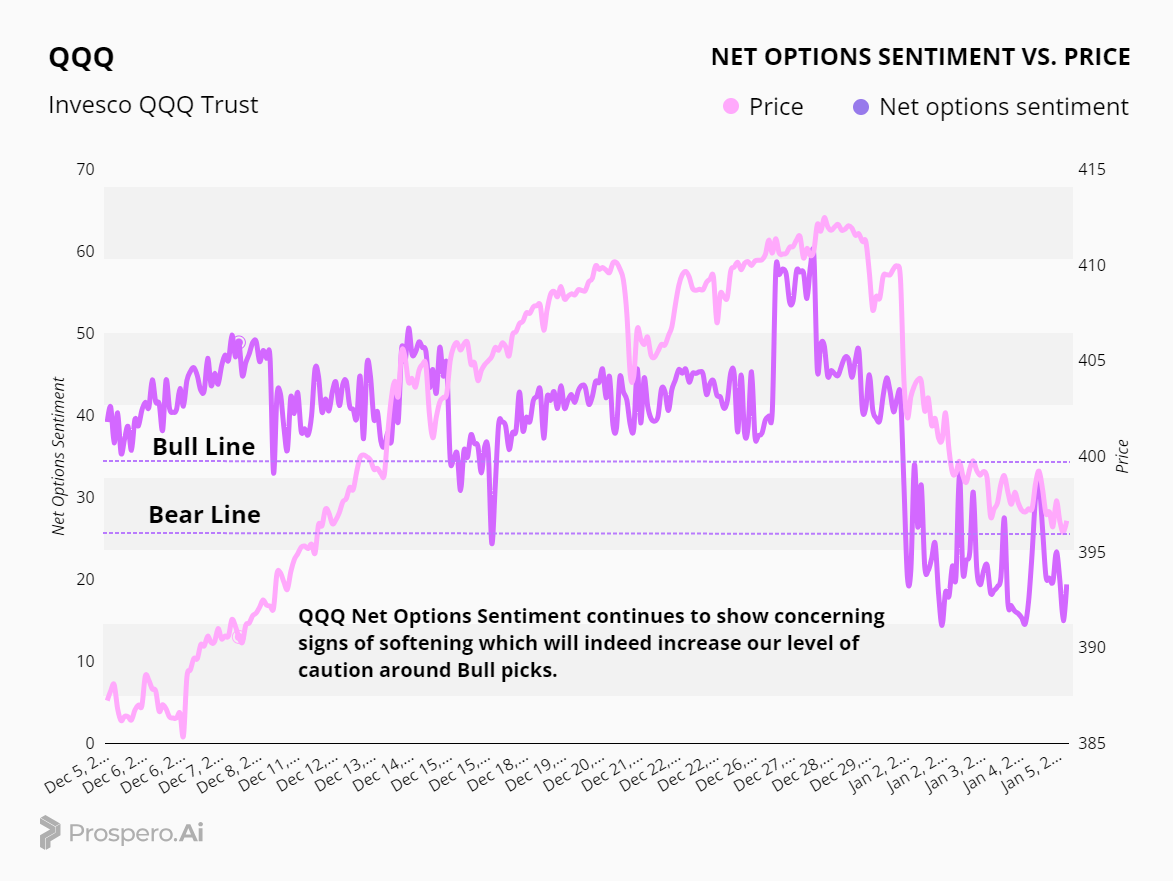

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish. < 15 = Bearish.

QQQ returned -3.12% this week vs -1.55% for SPY. IWM lost some momentum at 3.72%, although we’re still up close to 5% on SPY, since we made IWM the first ETF we ever chose as a newsletter pick.

This was a hard week for tech and that was especially reflected in our Net Options Sentiment. We saw QQQ dive down in advance of price this week, which is a great example of how our signals can give advance warnings of bearish market movements.

The still quite Bullish levels for SPY Net Options Sentiment have us leaning Bullish but we will adjust our levels to account for more sensitivity around a Bear move by moving our Bull / Bear levels up for SPY.

For Tech: QQQ Net Options Sentiment > 35 = Bullish < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 35 = Bullish < 25 = Bearish.

Sector Analysis / Portfolio Macro Strategy

The biggest takeaway here is that we don’t like Consumer Discretionary, and will target that Sector for the foreseeable future. We have more short term concerns over tech, so we’ll target that on the Bear side (despite our overall Bullish slant).

We’re going 5 Longs and 4 Shorts + IWM Long. IWM as an index is a different risk profile than an individual stock, and therefore should be viewed differently.

As a new wrinkle, we will start weighing our higher conviction picks more heavily. For example, META will join the portfolio on a 2X weight for the first time!

Long / Bull Adds - Link to Below Picture

Since META is both a hold and an add, we could have marked it orange or green, but we chose to mark it green because we think it’s set up is that much better than any other stock.

The rest of the picks reflect a strategy to spread ourselves out across several Sectors, as well as avoiding the ones we don’t like (Tech and Consumer Discretionary). As a quick reminder, we’re concerned about a consumer credit crunch impacting spending; so BKNG, a travel company, could start to get hit despite showing strong technicals. As we saw, that Sector started to face some serious headwinds last week.

Long / Bull Keeps

META is a keep, and returned -.57% vs -1.55% for the SPY. No big mystery here, it’s perched on the top of our Bull Screener again, as it was for most of a very successful 2023.

Short / Bear Adds - Link to Below Picture

LEG is added despite the “Buy” Oscillator, primarily because we’re targeting that Sector. We’ve decided that we don’t want to be involved with China, so that rules out the obvious pick in HUYA. As we begin the new year, the US market is hard enough to read, without having to deal with the transparency and control issues of the China market to boot.

NL is a nice add because the Industrials Sector did have a tough week; which is also why we skipped over a similar profile higher on the list in MGEE. Not only did Utilities do better, but as the worst performing Sector of 2023, we’re concerned it might correct sharply the other way, as many hard-hit Sectors did to close out the year.

Short / Bear Keeps

EURN is a keep, and returned .06% vs -1.55% for the SPY. EURN had a decent week but its ongoing, very low Net Options Sentiment, makes it a clear standout Bear on the above list.

Portfolio Allocation

6 Longs: IWM, 2X META, CI, TDG, TDW

4 Shorts: EURN, LEG, VSH, NL

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.