Happy holidays! As a special offer for Finimize that we wanted to extend to our readers here, we are offering 50% this investing letter and 50% off the trading letter until the end of 2023!

We shared our 1 year results 12/19/23. It was early because Finimize shared them. Welcome to all our new readers! You can always feel free to respond/comment or email george@prospero.ai with questions.

We are currently beating the S&P 500 by 48% on our 2023 picks, with a 60% win-rate per pick against S&P 500 benchmarks.

We’re taking the week off live streams but will keep making short-form content on TikTok and YouTube.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Cautiously Bullish, Outline:

Market/Macro Update

QQQ and SPY Net Options Sentiment

Sector Update / Portfolio Strategy

Now the Sector analysis will be roped into our allocation!

Longs

Adds —> Keeps —> No Drops

Shorts

Adds —> Keeps —> No Drops

Portfolio Summary

Market Update

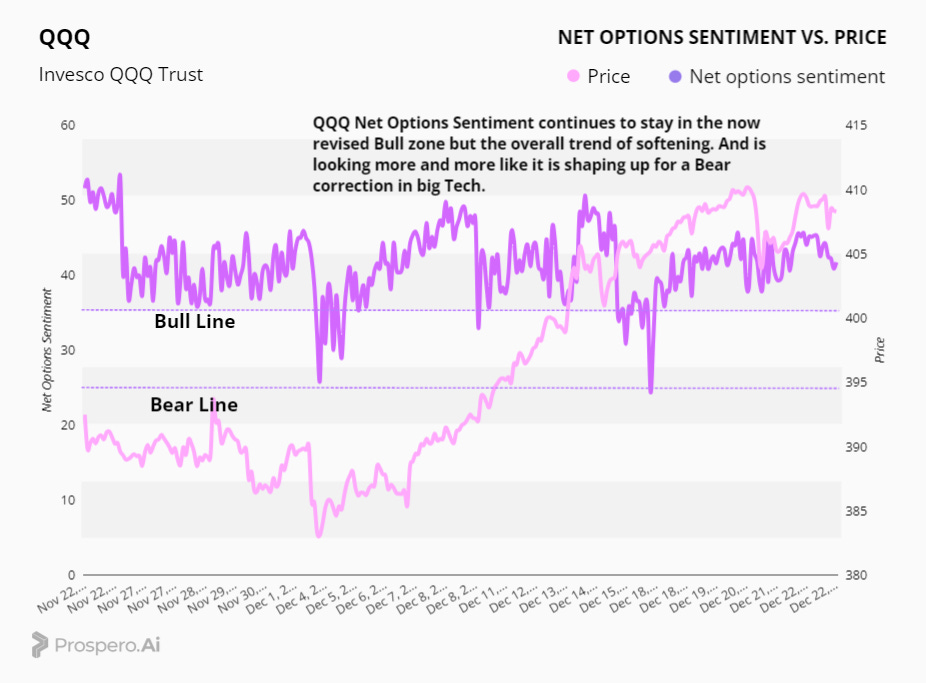

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish. < 15 = Bearish.

QQQ returned .75% this week vs .92% for SPY; and another week of looking smart on IWM, as it was up 2.25%. The first ever ETF we made a newsletter pick is now up 8% on SPY since 11/19/23.

This luke warm/positive performance is expected with Net Options Sentiment indicators (SPY and QQQ) remaining in Bull zones. However, the softening trend we are seeing in QQQ Net Options Sentiment has us concerned that a stronger correction in opposition of the extended Santa rally could be on the way.

There are two potential scenarios playing out here:

QQQ is slightly underperforming SPY and significantly, IWM. This could mean that this is the correction we are already seeing for big tech.

This is the start of a much larger big tech correction. (But we remain Bullish on diversified AI companies, more on this later)

It’s often hard to spot the difference between two competing theses like these. Regardless, we will watch for QQQ Net Options Sentiment to dip below 35 as a sign we are in scenario #2.

We’re lowering the Bull level on QQQ to reflect softening in the index.

For Tech: QQQ Net Options Sentiment > 35 = Bullish < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish < 15 = Bearish.

Sector Analysis / Portfolio Macro Strategy

Utilities keep getting hammered. If you must go Bear, that may be the best Sector to target. But considering it’s so beaten down, there's danger in it reversing the other way.

Another thing to watch out for, is the poor 1 day performance of Consumer Discretionary. That could be a clear signal that the Santa Rally is ready to end.

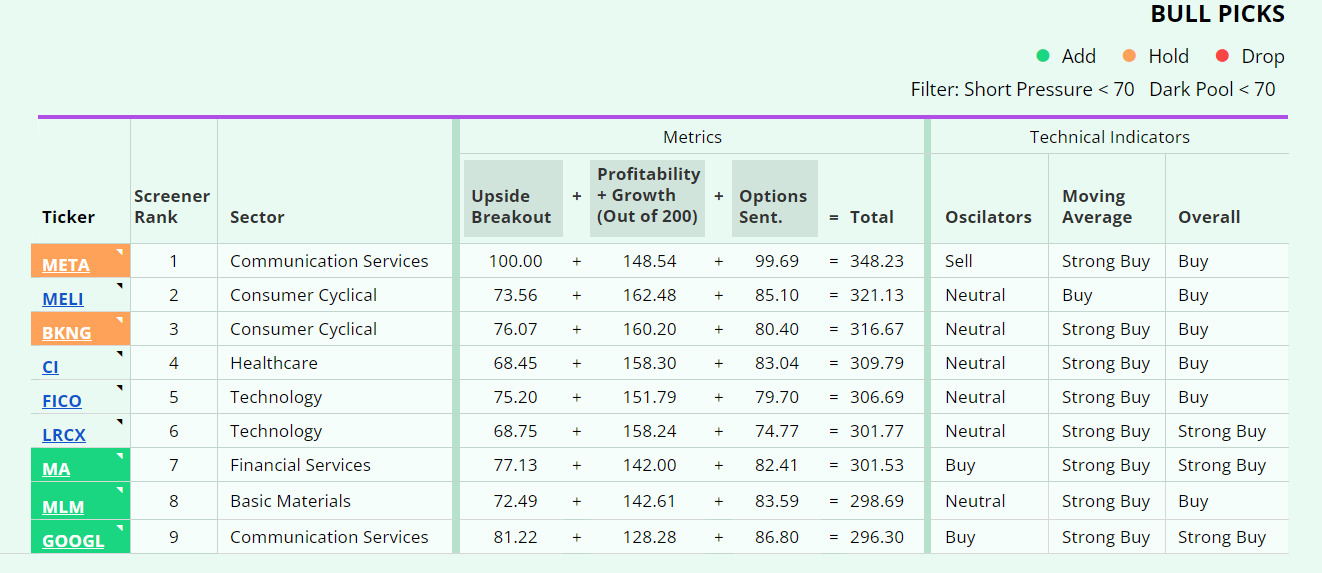

On the Bull side, our Materials call seems to be a good one. If we see any Materials companies near the top of our Screener, we will target them. However, at this point, nothing seems like a glaring Bull or Bear pick for any Sector. Because of that, we will make our choices, based heavily on the Screeners.

Going 5 Longs and 3 Shorts + IWM Long. IWM as an index, is a different risk profile than an individual stock and should be viewed differently

Long / Bull Adds - Link to Below Picture

Going to keep leaning on the Bull market, even though we are keeping some short/hedge positions in case it turns. We like the diversity of this portfolio and don’t mind the duel “communications” Sector picks because both also have broad AI exposure. And we do like AI still, heading into 2024. As long as it is more diversified like GOOGL or META vs. AI or PLTR (more concentrated) we like AI still. Too much real revenue being generated already to ignore the impact. The cloud companies are buying NVDA (an insane 206% beat this last Q) chips too much to ignore this trend. They see the incoming demand wave as well as anyone.

Long / Bull Keeps

META is a keep, and returned 5.51% vs .92% for the SPY. No big mysteries here, it is perched on the top of our Bull Screener again.

BKNG is a keep, and returned 1.63% vs .92% for the SPY. No big mysteries here either, 3rd in Screener with better technicals than 2.

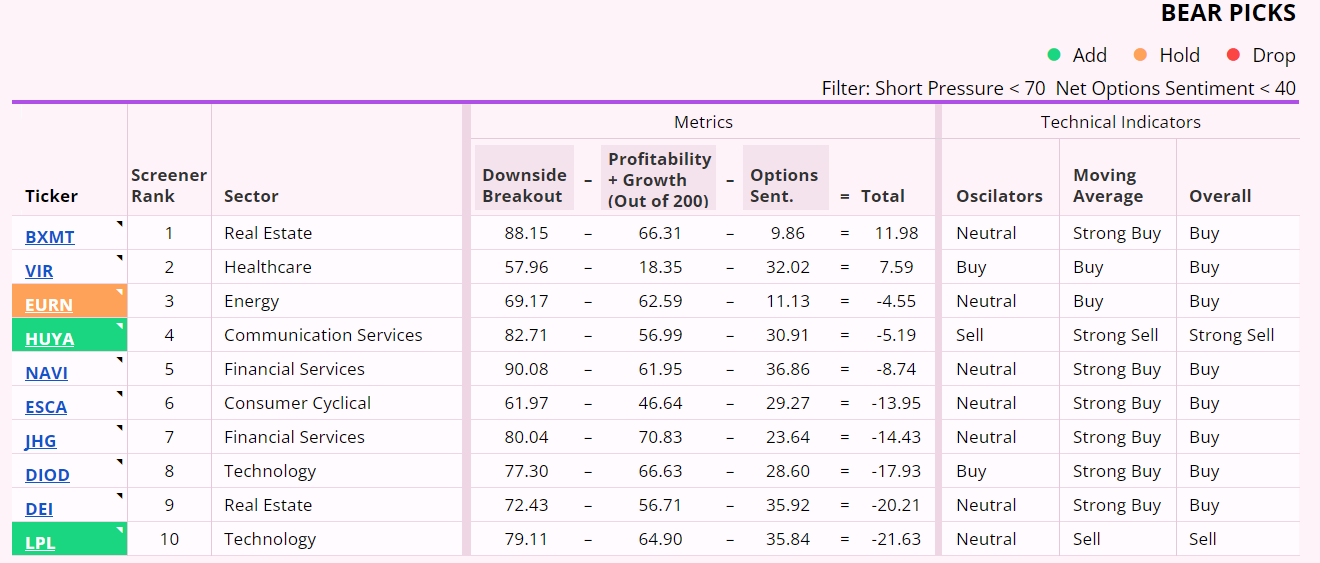

Short / Bear Adds - Link to Below Picture

We like HUYA to balance out our 2 communications businesses. LPL has burned us in the past but the softening in Tech made it a desirable target.

Short / Bear Keeps

EURN is a keep, and returned 1.03% vs .92% for the SPY. This was a really tough call. EURN looks bad in the signals but has gone a bad direction on the techicals. We may drop it early this week pending the movement.

Portfolio Allocation

6 Longs: IWM, META, BKNG, GOOGL, MLM

3 Shorts: EURN, HUYA, LPL

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.