Happy Sunday! You are receiving this if you downloaded our app or subscribed via Substack.

We continue to be on fire ~5 months into our 2023 picks. Out of 30 picks we have a 73% win rate vs. SPY by an average of 3.91% per pick. An average hold time of 18 days is a 122% return on an annualized basis. Link to calculation support. It is no wonder power user @FiSavvy reported 5X alpha vs. SPY for his picks supported by Prospero in 2023.

NO MONEY OR OTHER CONSIDERATION IS BEING SOLICITED, AND IF SENT IN RESPONSE, WILL NOT BE ACCEPTED. NO OFFER TO BUY THE SECURITIES CAN BE ACCEPTED AND NO PART OF THE PURCHASE PRICE CAN BE RECEIVED UNTIL THE OFFERING STATEMENT IS FILED AND ONLY THROUGH AN INTERMEDIARY’S PLATFORM. AN INDICATION OF INTEREST INVOLVES NO OBLIGATION OR COMMITMENT OF ANY KIND.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Bull run or Bull trap? Smart people and our key signals are sending mixed messages. We point to some important themes to watch. We resolved the last YouTube issue and will go live at this link to discuss at 11 AM EST tomorrow.

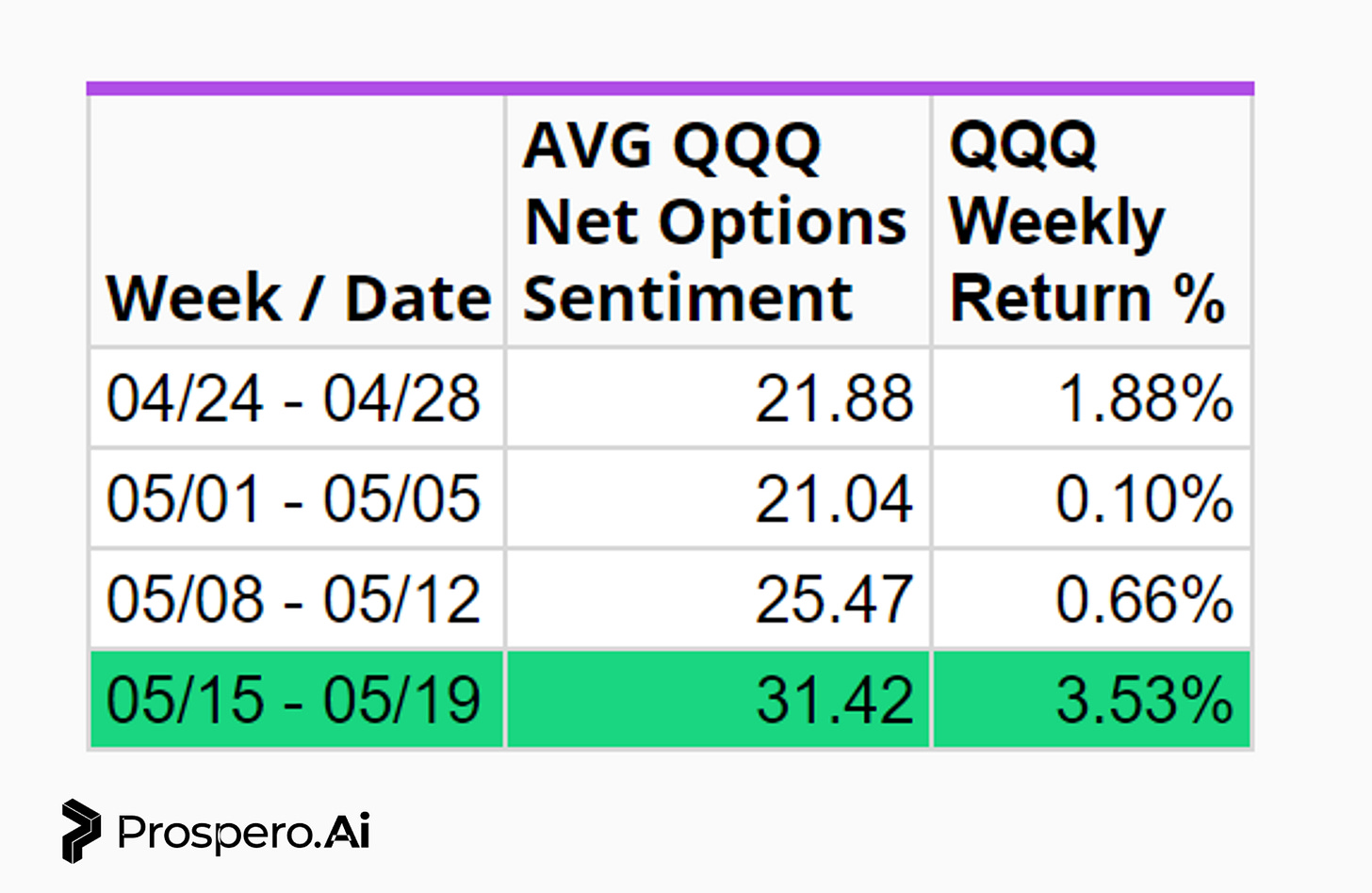

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

QQQ returned 3.53% this week vs. 1.71% for the SPY. QQQ Net Options Sentiment, especially this week, provided clear Bull signals, the 1st week in a long time, with an average in our Bull > 30 zone.

What should we make of a persistently low SPY Net Options Sentiment diverging from QQQ? Our 05/17 paid letter introduced a new theory “this could be the result of excessive hedging against debt ceiling talks going awry.” This is an easy explanation for the split, as a systemic risk would drive up demand for the most common market hedge (SPY Put options) driving down Net Options Sentiment values for SPY. After reviewing this weeks movement we will discuss the medium term Bull and Bear case in light of the divergence.

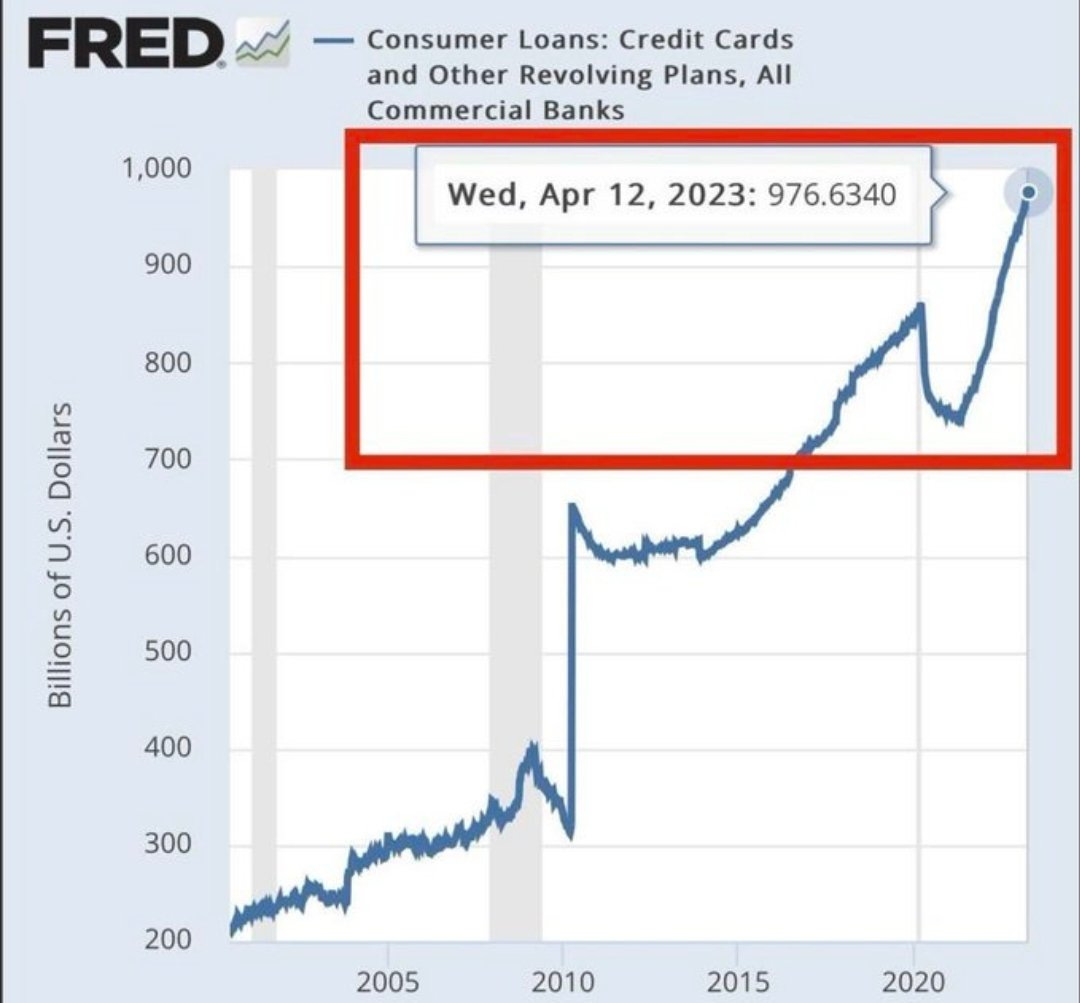

We take seriously divergence vs. agreement in the key Net Options Sentiment Indices (QQQ/SPY). But any good investor should match data to a cohesive macro story and there is a glaring ongoing concern:

It is hard not to imagine consequences stemming from this. Everything from less consumer spending to banks tightening credit to profit impacts for consumer finance entities, mortgages and the related Real Estate fields that depend on credit to drive expansion. While the recent uptick in SPY Net Options Sentiment adds to the story that low values were the result of debt ceiling hedges (and those worries decreasing) the above needs to temper enthusiasm. For additional data, we addressed on Twitter, both JPM and GS seem to be getting more Bearish on rate cuts this year, a looming Bear cloud.

Steve Cohen (perhaps the savviest investor out there) offers a counter:

…not to miss the "big wave" of artificial intelligence and to stop fixating on a recession.

Cohen also expressed optimism more broadly, noting profit margins should improve, which will allow the Federal Reserve to be less aggressive on rate hikes and boost markets.

"I'm making a prognostication — we're going up," he said, according to Bloomberg. "I'm actually pretty bullish."

Great minds think alike, we posted similar thoughts on Twitter before this article was published. We’ve talked about cost cutting to improve Profitability as a path towards recession without a Bear run. And are in strong agreement that AI is being aggressively priced into stocks, carrying the market. Especially the more AI/Tech heavy QQQ.

There is a reason the Prospero short and long term signals have liked AMZN and META and we’ve been recommending them. We expect them to be big beneficiaries of this “wave” while having the most well rounded businesses. IE GOOG has the best AI “brain” but OpenAI has a go to market head start, an existential threat to Google’s massive search business. AMZN and META have strong teams and data sets to benefit massively from cutting headcount and expanding features around this tech without similar existential threats to their core business.

For Tech this week: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech this week: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

In Review - Bull Potential - META (Meta Platforms Inc)

From 05/14 letter, Bullish if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

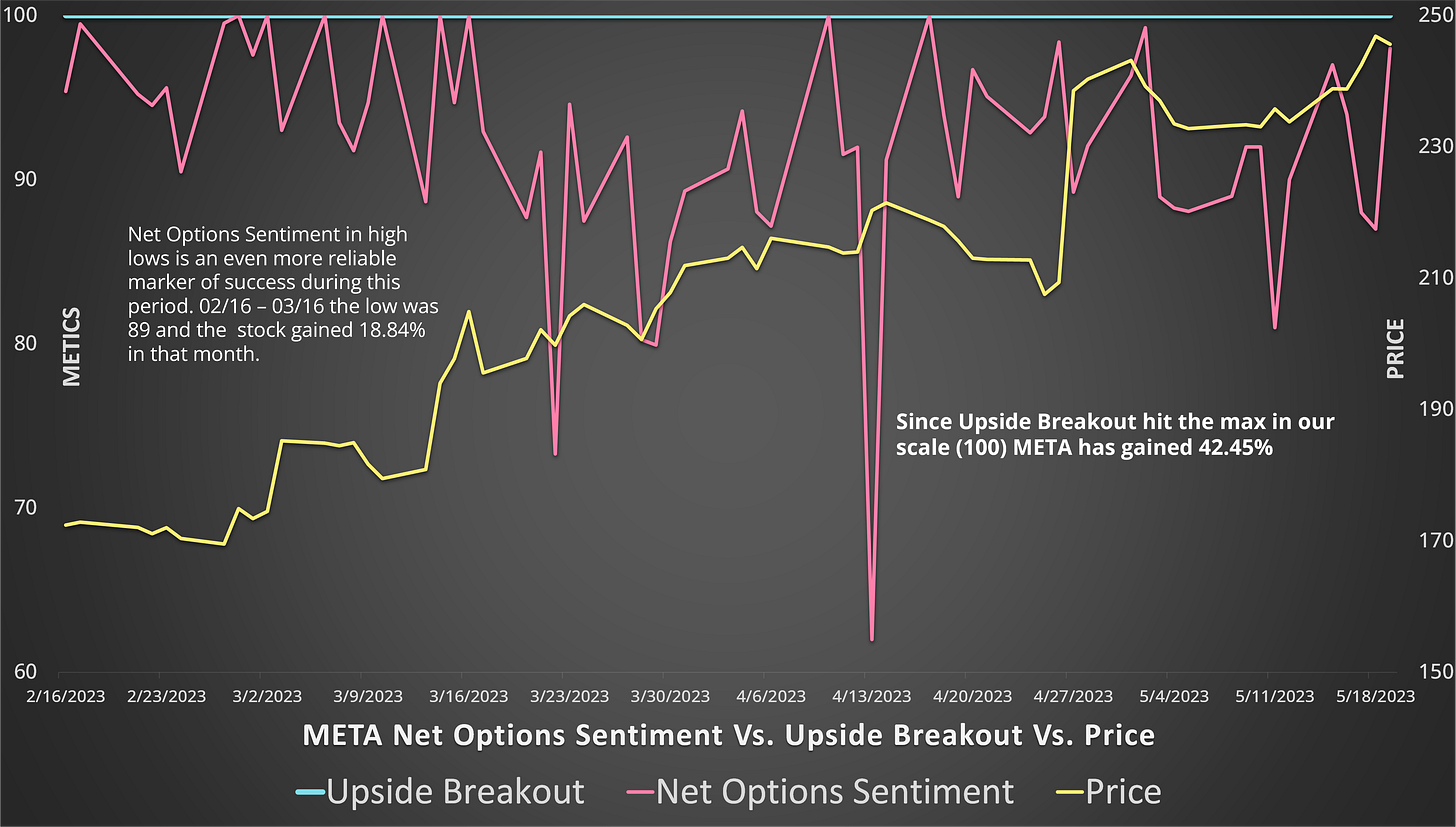

The trend of higher lows in Net Options Sentiment is potentially very exciting for META stock. We saw before the last big run up that it settled into lows of 84-86 and we did get back into the low 80’s for the first time in a month to end last week. If those lows keep climbing it could mean it is set up for another price run up.

META returned 5.06% this week vs. 1.71% for the SPY. The guidance we added was important as we can see in periods of higher lows for Net Options Sentiment, META has made the big runs. Since META grabbed the perfect 100 Upside Breakout rating on 02/16/23 it hasn’t surrendered that position and has gained 42.45%.

Nothing too complicated here. META continues to be our best stock because of extremely strong short and long term signals. Not to mention Short Pressure Rating is down to 53 from 77 last week. Short sellers closing positions is a good sign for longs.

Bullish this week if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

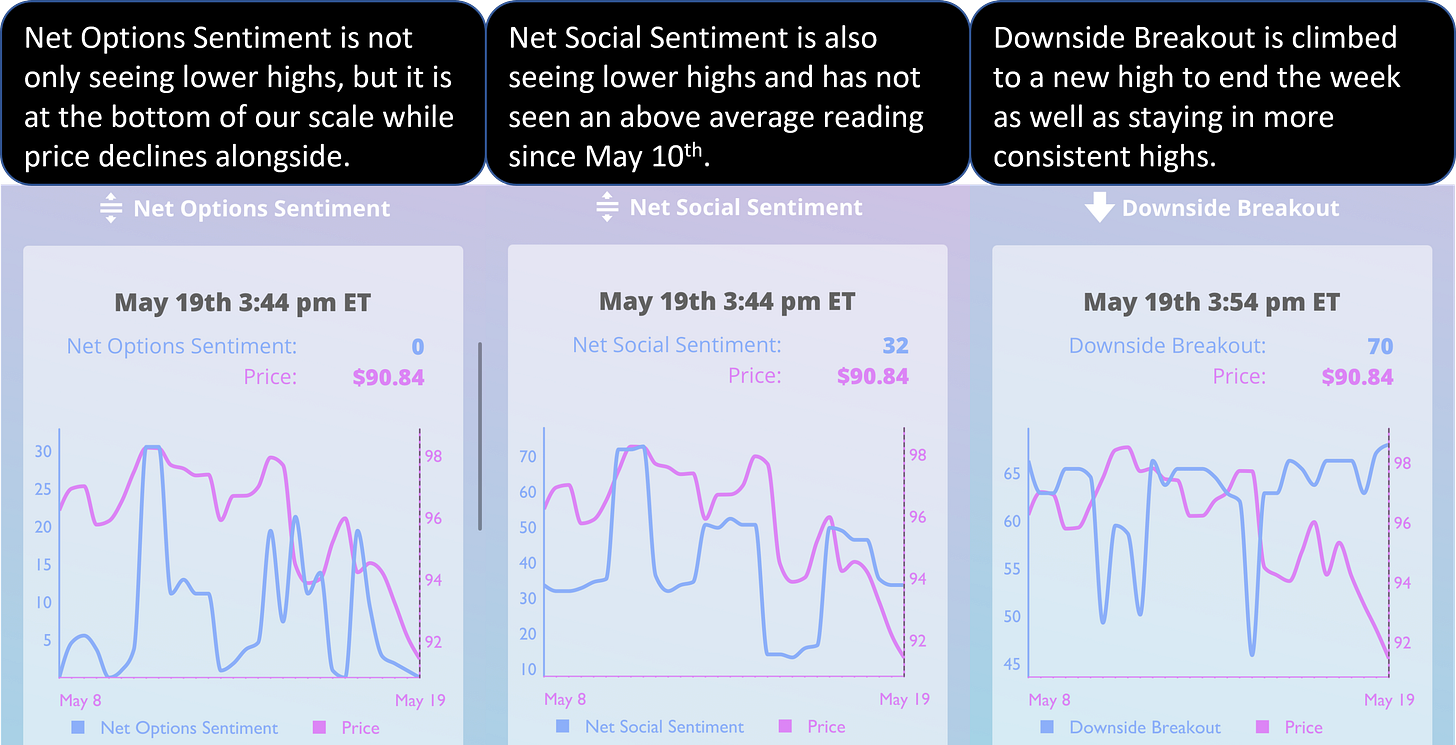

Bear Potential - DLR (Digital Realty Trust Inc)

We like when a stock is at the literal bottom (0) of Net Options Sentiment, even below SPY with all of the Put hedges we believe to be there. Other than good Net Institutional Flow all signals point Bearish.

Bearish this week if:

DLR Net Options Sentiment < 50

DLR Net Social Sentiment < 50

SPY Net Options Sentiment < 10

In Review - Bull Potential - AMZN (Amazon.com, Inc.)

From 05/14 letter, Bullish if:

AMZN Net Options Sentiment > 70

AMZN Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

AMZN returned 5.43% this week vs. 1.71% for the SPY. We have been touting AMZN and it is up 8.69% vs. 1.56% for SPY since we first recommended it 04/23. It is making our case well, when blue chips are offering returns like this, why chase riskier smaller caps?

Nothing has changed much here. Net Options Sentiment is in a positive trend of higher lows, which, unless the market turns, could mean an even bigger week for AMZN.

Bullish for this week if:

AMZN Net Options Sentiment > 70

AMZN Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Bear Potential - CHRW (CH Robinson Worldwide Inc)

This play is more about a plummeting Upside Breakout than anything. Where we continue to see lower lows. Net Options Sentiment of 33 makes it a bit more risky than some other Bears, but we like that it isn’t strong in any signal with the long term options markets clearly turning more Bearish on it as many stocks turn Bullish.

Bearish this week if:

CHRW Net Options Sentiment < 50

CHRW Net Social Sentiment < 50

SPY Net Options Sentiment < 10

Coverage Drops - 2 more wins!

SJW is dropped as a Bear because it is above our 50 Net Options Sentiment warning level. SJW closed out as a Win losing -2.06%, beating SPY by 3.77% 05/14/23 (1st and last covered) to end of week.

CACC is dropped as a Bear because it is above our 50 Net Options Sentiment warning level. CACC closed out as a Win gaining 1.23%, beating SPY by .48% 05/14/23 (1st and last covered) to end of week.

Impressive win rate