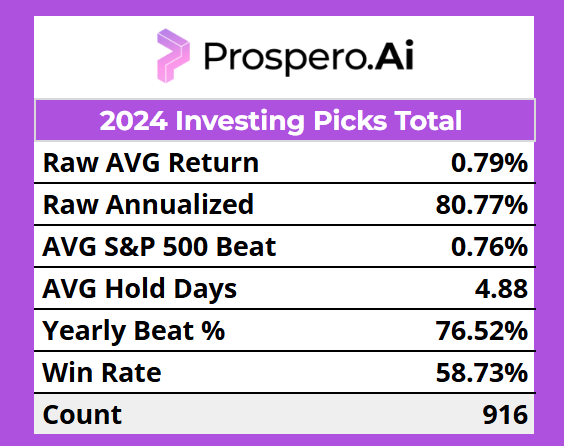

After beating “the market” (S&P 500) by ~50% in 2022 and 2023, 2024 was our best year yet. We beat the S&P 500 by 77% and won vs SPY Benchmarks - at a 59% rate. Hopefully we will do even better in 2025. We are off to another hot start beating SPY by 127% and an astounding win rate vs SPY benchmarks - 70%!

What makes 2024 even more special is the range in which our confidence has increased. We've made 916 picks in 2024 vs 151 in 2023. The fact that we can improve our win rate, while picking so many stocks is a testament to the growth of our Technology and process!

Below are the four main areas that we want to highlight about our excellent year:

Timing Chips Stocks (such as SMCI, AVGO and NVDA).

Seizing opportunities in Crypto / Blockchain for event driven wins.

Using Prospero’s signals and some good old fashion value analysis for a HUGE ASTS (AST SpaceMobile Inc) wins.

Playing stellar “defense” with our shorts.

Applovin - which came on so strong in our signals we couldn’t ignore it.

Disclaimer: Any signals presented are for illustrative purposes only and are not intended to portray recommendations to purchase or sell and security. Past performance is not necessarily indicative of future results. The results presented here relate solely to signals generated by our models and systems and are not actual trading results. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. The performance of accounts using actual trading will likely differ from the results presented here due to various factors including slippage, commissions and other costs. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown here.

How we beat the S&P500 by 77% in 2024

Timing Chips Stocks

We made 139 Tech investments this year and QQQ Net Options Sentiment gave us some conviction to load our portfolio heavy on Tech at the right times for big gains.

For example, our signals showed us when to ride SMCI up and it was those same signals that revealed when it was about to head in a different direction. When the signals changed, we knew it was time to get out and switch primarily to AVGO and NVDA. Bottom line is that Chips stocks were our bread and butter in 2024, but things changed quickly. So far in 2025, we're guiding to stay away from Chip stocks completely. And we were making that call before the DeepSeek moment! For some it might be difficult to ignore a category of stocks that has worked so well for them; but we always relish these opportunities. Why? Because the biggest opportunities often come from areas that were most overlooked previously.

Bitcoin Event Driven

We pride ourselves on being signal driven. Because of that, we don’t typically like bets on Cryptocurrency, Blockchain securities or any derivatives of their businesses. This is primarily because our metrics are driven by algorithms that only analyze stock options markets. The crypto space doesn't provide that information and is not even in the same neighborhood of organization and transparency.

But at a time, when the market was incredibly volatile, our signals showed Bitcoin proxies like (COIN and CLSK) were showing real strength. Additionally, they were at the top of our screeners for both Large and Small Cap stocks respectively. We added both COIN and CLSK to our portfolio. After seeing that Trump was speaking at a major Bitcoin conference, we gained further conviction because we knew he’d say something the crowd wanted to hear. It ended up being a fantastic decision.

As the year went on, COIN continued to be one of the clear favorites in our signals and we had a few more great runs before the year ended. The signals led the way for us, which allows us to be open to any strategy, even if it's outside our comfort zone.

ASTS (AST SpaceMobile Inc)

This is a stock we got to know well over the course of the year as we began engaging with more Smaller Cap stocks. Our ability to read this stock was a big part of our year's success. It was responsible for 4 of our top 10 picks, averaging 55% return per win! We took our first position because we saw Net Options Sentiment start to move up dramatically, with Downside Breakout moving down. We also knew qualitatively that the main concern around this stock was the de-risking of their technology and their potentially missing its satellite launch date. So when those two issues resolved and the signals began showing strength, we pushed our chips to the middle of the table.

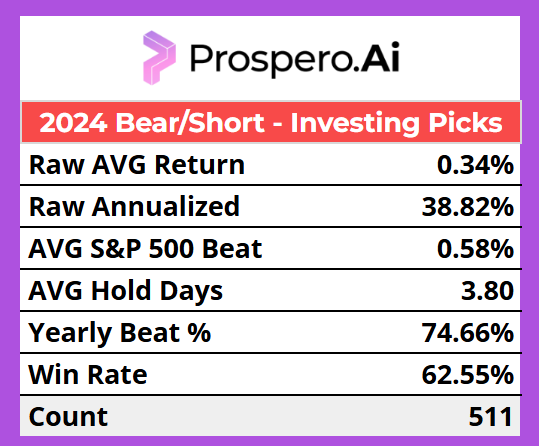

Playing Stellar Defense with Shorts

Even during a Bull Run, we've chosen more than 100 short vs long picks. Ultimately we've made those moves, because in this high volatility environment, we've taken a defensive posture. During those periods of volatility, the tech sector was our highest concentration of longs, but also our highest concentration of shorts. This kept us in a defensive position and it proved highly successful. In our short picks, 10 of 11 Sectors were winners; whereas only 6 of 11 of our longs Prospero's signals led us to make these decisions. This has proven our ability to have a strategy and stick to it. This strategy allowed us to go for bigger, riskier gains on longs as we protected them with stellar effectiveness on shorts.

Applovin

We dedicated a whole newsletter to our process for the discovery of this stock which ended up being our biggest gainer of the year at +100%! We found it when it began to show real strength in our Bull Screeners (for its Market Cap) in our most important metrics of Upside & Net Options Sentiment. These metrics are particularly important when dealing with Market Cap. When Mid and Small Cap stocks show bigger moves (Applovin only had a $37B Market Cap) it was impossible to ignore.

Bull / Long Picks

*See a chronological view of our Bull by letter picks at this link

We'd like to take a second and answer a question we often get from folks who receive our Investment Letter. They ask: "Why would hold times be so short for investing picks?" This stems from the reality that during the last several months, we've often changed in and out of picks more quickly than we did in the past. This is our strategy we utilized because of the heightened volatility of 2025. With the changing political and economic landscape, the market has been highly erratic. As a result, the strength and weaknesses of stocks can change rapidly, sometimes within a given day. So if we move in and out of a pick, we're simply picking the very best stocks at any given moment in time. We understand that this is not your traditional model for investing, and this is not the same strategy we would suggest for everyone. But more than hand picking stocks, we want our users to learn to use and interpret the signals for themselves. Watching our process will help them learn that skill. We want our picks to be a jumping off point any of our Bull picks and most of our Bears we’d also reccomend for long holds. So grab what makes sense to you and hold it for whatever fits your process. More in - How to use this letter?

One example was when we dropped a stock like AVGO about a month ago ago to pick up LRCX. It wasn't because we think AVGO is a bad investment, it had actually been on a tear and we ultimately believed that AVGO was a better longer term investment. But we made the call to show our process for making our high conviction picks during a highly volatile market using signals like Net Options Sentiment. LRCX looked like the better tech pick, and was performing better in our Bull Screener. We are certainly not suggesting people follow every move we make; but part of the reason we do so well is we are adamant about having the best stock in a Sector at any given time.

Sector Analysis

The biggest difference this year is our aggressive approach to Tech investments. While only investing in 9 picks all of last year at a loss, we have more than 10Xed that in picks this year. Our returns in this Sector are one of the primary drivers for excellent portfolio performance.

It is also worth noting that while not investing in Utilities at all last year, that has been our second best performing Sector this year. This really highlights the flexibility of our system. Making that point further, Consumer Cyclical was both our best performing Sector and our most frequently picked Sector in 2023; but It is was 6th in our number of picks this year. What was our bread and butter with Bull picks (like TSLA) last year not only has had a major shift but has become a big Bear target this year!

Cap Analysis

2024 was a much bigger year for us with cap diversification. Interesting to see that even though it was a small sample size, Mid Cap has been our best category each of the last two years.

One thing we thought a ton about in 2025 vs 2024 was our timing with Small Caps. More than once in 2024, we seemed to get into them right as they were peaking, instead of actually being on the way up. This year we have been much more serious about entering Small / Mid Caps even with only a few days of good performance.

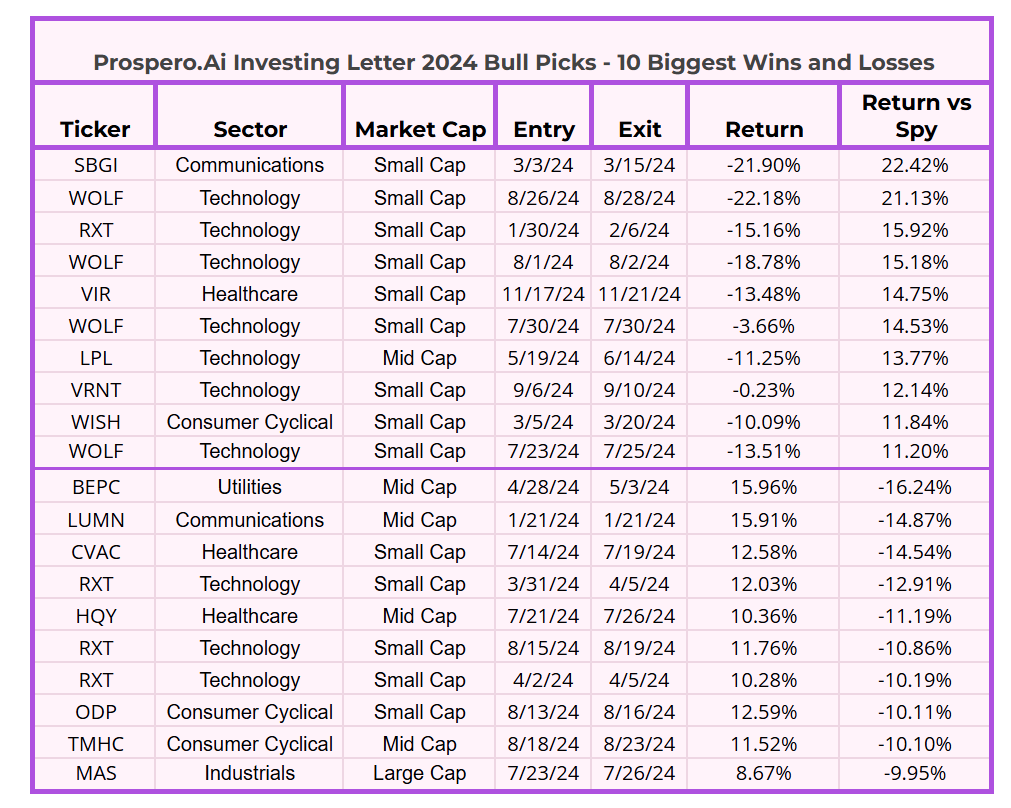

Best and Worst Picks

The first thing that jumps out here is the fact that some of our biggest wins are also our biggest losses. (ASTS, SMCI) If people wonder why we are in and out of stocks that we ultimatley love long term, this is why. These big winners can swing in the other direction quickly and getting out and back in at the right time, can be the difference between a good year and an excellent year. We built these signals to help people out perform the old addage “time in the market is better than timing the market.” While it isn’t the right strategy for everyone, we prove time and time again that every day people can wield these signals to time the market well.

Another important lesson we’ve been preaching this year is picking your spots. 9/10 of these winners were picked in 5 months during January, June, July, August and November. We were more "risk on" at those times and were simply treading water at others. It had everything to do with what our overall signals were showing. If the overall signals were weak, we made less choices.

40% of our biggest losses were Small Cap Industrials or Financial Services. We will definitely keep an eye on these segments and put in some extra research before adding this year.

Finally, notice how the smallest number for our biggest win is about the inverse of the largest biggest Bull loss. This is one of the ways our risk management manifests. We will cut losses when they reach a certain point but are more patient with gains.

Bear / Short Picks

*See a chronological view of our Bear by letter picks at this link

We have explained the setup here pretty well. Our strategy with shorts has been largely to hedge/protect for our high conviction longs. A lot of the time heavily shorted stocks can “bottom out” so you have to be quick with the exit. That is where our new Momentum score has been particularly helpful to our ability to monitor more shorts. If you look at our shorts in 2024, a lot of them work on longer horizons too. That is because most shorts have good short and long term profiles, regardless of how we re-prioritize the positions. But when looking at Momentum score we often see better candidates within a Sector or we see that we want to shift from being overexposed to Smaller Caps to target Larger Cap shorts. Regardless, our shorts can have a short shelf life because when you play defense it is good to have a fresh strategy at all times. The market changes fast!

Sector Analysis

The standout on the Bear picks is the remarkable consistency we have through 9 months. We only lost to the market on 1 of 11 Sectors. Much like for the Bull Picks, the Tech Sector is our most frequent as well as the best performing Sector. This is a big reason this is our best year, it has been a great year for Tech with a lot of winners for us. But we have been very successful sniping losers in an otherwise great Tech market as well. This demonstrates the point we made with our Bull picks again. We are open to finding Bear picks in any Sector, so it enables us to pick our spots well and find winners across the board. This also speaks to our ability to hedge, even when playing good defense on the Tech Sector we turn it into offense!

Cap Analysis

It is always a theme with us but it cannot be said enough. Take what the defense gives you! After leaning on Large Caps for our short profits in 2023, 2024 we went the opposite direction. Our biggest profits were in Small Caps! Small Caps had a good year in 2024 as Large Caps did in 2023 so we did another important thing - we picked losers in a group with a lot of winners.

Best and Worst Picks

Continuing with our Bull winners the theme of being “risk on” at the right time emerges again. The same months that had 9/10 of our biggest Bull wins also had 6/10 of our biggest Bear wins - January, June, July, August and November. So it wasn’t simply a matter of riding a Bull or Bear run to the victories. But this is not just a coincidence. It is our philosophy. At times when we are more confident and seeing bigger wins on either side we are comfortable picking within a bigger risk band and holding for longer.

We don’t mind going back to the same watering hole. WOLF made up 40% of our biggest Bear wins. We use some stocks as risk managers and WOLF was one of them. Whenever we were heavy into the Chip vertical this was one of the tools we used to manage risk. But as always beware of picking up bad patterns. We did not realize the extent of this but we had a nice win with RXT in Jan/Feb but we went back to it unsuccessfully 3 times later in the year. We made a classic mistake of winning with a stock and trying the same playbook too many times while getting bad results. This part of the analysis is new so we are eager to see how looking at the wins and losses as we go will prevent more errors in 2025!