*Note these numbers are as of close 4/7. As of close 4/8 we are up to 98% above the market!

After beating “the market” (S&P 500) by 77% in 2024 and ~50% in 2022 and 2023, 2025 has been the hardest year we can remember but our results are still stellar!

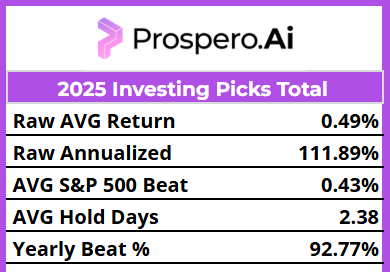

What makes the beginning of 2025 so amazing is that our paper trading portfolio beat the S&P by an incredible 92.77% annualized in the middle of one of the S&P's greatest drops in history. We've made 512 picks so far, many of which have been shorts. As the old saying goes, "Defense wins championships." And that certainly seems to be the case here. This pick pace would double our 916 picks last year. We are proud to make so many and yet still win at a 61.91% rate vs S&P 500 comps.

Here are some of the themes we want to highlight for this quarter:

1. The state of the market and how our ability to adjust strategy helped us to have a 92.7% return in one of the worst downturns in Stock Market history. The reality is that the Stock Market had one of the worst quarters in its history. Years from now, this latest decline will be listed with market events like the 2008 Financial Crisis and the 2020 Covid Crash. Yet despite the craziness, Prospero's results stand up to any institution at a small fraction of the budget/headcount. A testemant to our technology!

2. How our Net Options Sentiment allowed us to predict this drop BEFORE it occurred. It's a subject we've talked about at length in our weekly newsletters, but the reality is that we saw this huge drop coming when SPY was still around 605. It's since dropped around 100 points.

3. How ASTS and APP were our top Long Bull picks of the Quarter and how we found it. Two stocks in the Technology sector made up a huge portion of our positive return for our Bull Longs. These were two of our biggest winners in 2024 as well. It shows what we always say, if you get to know how the signals relate to a stock and the market you will have a much better read on what is ahead. Check out our full history with Applovin’ to get a good feel for how to do that.

4. How the Technology Sector ended up being an area of targeting both in the Long and Short categories. By far and away, the sector with the highest number of our picks was Technology. Being able to pick winners and losers in the same sector at such a high rate can make a year, it certainly helped us in a big way this quarter. However, holding some of our favorite Tech/Growth stocks too long was one of our bigger drags on return. So we will keep an eye out to improve on that.

Considering the situation, it's been a great quarter. We've all been in this together and we hope that you have learned with us along the way. The learning curve has been a bit steep at times, but the end result was success and those lessons are going to be crucial in the quarter to come.

Disclaimer: Any signals presented are for illustrative purposes only and are not intended to portray recommendations to purchase or sell and security. Past performance is not necessarily indicative of future results. The results presented here relate solely to signals generated by our models and systems and are not actual trading results. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. The performance of accounts using actual trading will likely differ from the results presented here due to various factors including slippage, commissions and other costs. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown here.

How we beat the S&P 500 by 92.77% in the 1st Quarter

If you've ever heard an old grisled Football veteran talk about the glory days of their career, at some point you'll hear them say "Defense wins Championships". Why do they say that? Because the reality is that it's harder to STOP someone from scoring, than it is to score yourself. The offense already knows the plays. The defense is responding, so the offense has the edge. For a team to win it all, they have to have a dominant defense. That statement has proven true in this quarter. Why? There are a lot of talking heads on X and other social media outlets that made a killing over the last two years in a bull market, but have grown spuriously silent? Why? It's one thing to make money in a bull market, it's something entirely different to make money when the stock market is volatile and then has one of the greatest three day drops in history.

NET OPTIONS SAVES THE DAY

In our letter last Sunday, we laid out all the times we warned of this coming collapse. One of our first warnings was two months BEFORE it happened when the S&P was still in the 600's. Our Net Options Sentiment dropped to 0 and stayed there. We started waving the red flag to our readers that something was brewing. Historically, when SPY Net Options had gone to 0 and stayed there, that signaled a larger decline. History repeated itself. If our subscribers were reading our letters consistently, they would have avoided and even profited during this historic collapse. The brilliance of Prospero is that our numbers are data driven. We were seeing "behind the curtain" of Hedge Funds and Institutions as they were selling in mass. One of the primary reasons we were able to have such a great quarter is that we were prepared. And we were prepared because Propsero's numbers showed us well in advance what was about to happen.

One thing we see online a lot is the idea that you shouldn’t “panic” sell. We wanted to address this as we were never panicked about this situation and you don’t have to be if you manage risk actively. Being Bearish doesn’t mean you are panicked and vice versa.

Bull / Long Picks

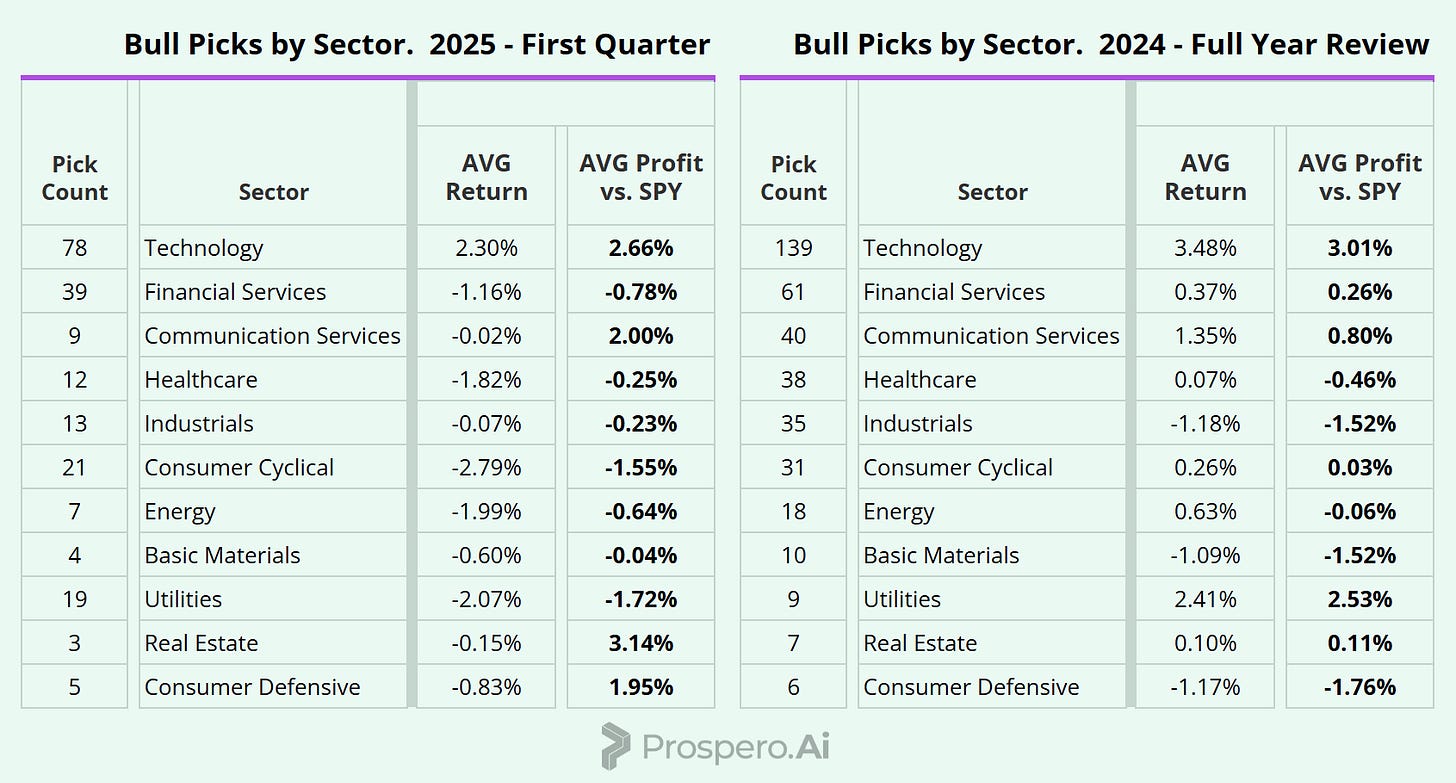

If you simply looked at top of this chart without having ANY idea of what was going on in the world, you would think to yourself, "Wow, Prospero didn't do as well in their longs as they typically do". But it again, speaks to how we've had to adapt in an ever changing market. In the beginning of the quarter, we were experiencing unprecedented volatility. The market felt like a roller coaster. So we adapted our strategy and started being more defensive. We wrote to our subscribers about how this market was difficult to simply "Buy and Hold" because sectors were coming in and out of relevance like 2010 Boy Bands. It is also worth noting that our average beat of SPY was MORE on our longs than shorts, despite the negative raw return.

Sector Analysis

For help in understanding both the Bull and Bear Picks by Sector/Cap:

Pick Count: The number of stocks Prospero chose to go long in that sector.

Avg Return: Prospero's Return from the stocks we went long on in that sector.

Avg Profit vs. Spy: How those same picks performed vs the spy benchmark.

The largest category by far for Long Picks was Technology and it was also our 2nd best performing sector. So we're proud of those picks and feel like we performed well considering we're in a market where Tech is getting hammered. As you'll see in our Best Picks Section, our Net Options Numbers helped us identify and score big on those Tech Longs. Also of note, check out Real Estate and Consumer Defensive. In Real Estate, we only had 3 picks (and our return was -.15%) but as you can see, it was +3.14% better than the S&P in the same sector. That means our picks were few, but we picked well. The same was true for Consumer Defensive. We went long only 5 times, but our return was better than the S&P benchmark. and -.83% which beat SPY by 1.95% on average.

Cap Analysis

As we look at our picks based on Market Cap, a couple of points of interest. One, the overwhelming majority of our picks came from Large Caps. We were highly selective when dipping our toes in the Small Cap Market and when we did, those returns were great. This is a stark contrast from 2024 where Small Caps where by far our worst segment. And while we only had 23 picks in the Mid Cap Range, we performed well and had a good profit against the S&P Mid Cap Benchmark.

Best and Worst Picks

For our Best Picks, ASTS was our top performer for the Quarter. It's a company based out of Midland, Tx that provides satellite based 5G coverage to unmodified cell phones. Their technology exceeds that of Starlink and they have definitive commercial agreements with AT&T and Verizon. Full commercial service will begin in the US in late 2025, early 2026. We were able to see spikes in their net options sentiment and capture significant upswings in this disruptive company. APP was also a bright spot for us. APP, like ASTS, were some of our biggest wins in 2024. It goes to show you that we practice what we preach. We advocate getting to know the Prospero signal patterns of a stock to more easily see where there is opportunity. And we certainly did a good job of that with these stocks in back to back years.

For our Worst Picks, volatility was our enemy and we got caught on the wrong end of some of our favorite names like COIN, VST and SMCI. COIN especially took us off guard at times. Its down swings were the result of Bitcoin collapsing from around $100,000 to the mid $70,000. Political unrest, tariffs and uncertainty regarding the current administration's policy toward a strategic reserve led to that collapse. But all of our MSTR, COIN longs averaged -2.02% vs SPY so we had our fair share of wins too. SMCI was two of our biggest losses and our 2nd biggest win. It shows that you can really make money on swings with this stock but be careful! It has been a portfolio staple of ours since 2023 and we still have challenges timing it.

Bear / Short Picks

It was our ability to see the potential downside in the market and go net short in our picks that was the bread and butter of what made this quarter so successful, with a yearly beat % of a whopping 116.97%. A few letters ago we ran some numbers on some different scenarios that took into consideration different levels of hedging with instruments like SQQQ. The data shows that in markets like the one we're in, hedging makes all the difference in the world. BUT, when our Net Options Sentiment became obviously Bearish, we adapted and became more aggressive with our shorts. After Thursday and Friday of last week, it was clearly the right call.

Sector Analysis

Our two highest shorted sectors were Technology and Consumer Cyclical. In a market downturn that is driven by Macro Economic events, it is often those two areas that get hit the hardest. When our Net Options Sentiment started showing that we were likely headed for a downturn, we looked for Tech stocks that were overvalued. When we combined that with a lowering Net Options Sentiment we jumped in. Overall, we did really well in our shorts and they're a huge reason we achieved the return we did.

Cap Analysis

One of our primary strategies as we looked for shorts was to look in our Large Cap Sector. Why? Because many of the Large Caps had valuations that were getting high, and when you combine that with how so many of our long picks were in the Tech sector, we wanted to offset that. While we had less success on Mid Cap shorts so far this year it is good to see we haven’t lost our best skill from 2024. Finding Small Cap shorts. Important to note that while IWM was up 11.39% last year it is down 20.95% YTD so it is clear we can leverage this skill in vastly different markets.

Best and Worst Picks

For our best Bear picks, a lot of it was timing selection of Small Caps. In a declining, bearish market, Small Caps often get hit the hardest. SFIX (Stitch Fix) was our biggest winner on the short side. It was showing horrible Net Options Scores, and at the end of the day, as a clothing distribution company, it's likely to be hit hard by tariffs.

For the Biggest Losses on the short side, 4 of our 10 came from Large Cap Tech. Many times we were holding those Large Cap Tech shorts as a hedge against our longs. So while they may be losses here in many cases we had multiple bigger wins on the Bull side. (IE for that Dell 12.91% loss 3/10-3/14 we had a INTC 13.51% win and a APP 22.74% win over that same period in the big wins column)

Thanks and good luck to all of our readers. We hope this letter has helped you navigate this difficult market better.

Your strategy to adapt and thrive in such a volatile market is truly impressive. It’s all about playing smart defense, and it looks like you’re doing just that. Can't wait to see where you take it next!