Today we want to talk about a divergence we saw in our QQQ and SPY Net Options Sentiment last week, and what is one of the main reasons for its occurring. Last week we saw QQQ Net Options Sentiment jump into the high 50’s and stay there all week. At the same time, SPY Numbers began to slump below 40. There could be several reasons for divergence, but one of them is becoming clearer and clearer. Tech and specifically A.I., is on the forefront of what many believe is the 4th Industrial Revolution, and this makes AI driven companies stock prices, not a bubble, but justified. For those of you that slept through American History in High School, here is the short version of an Industrial Revolution. It occurs when some technology completely transforms the way, not only business, but entire societies function, live and enact commerce. The first industrial revolution was kicked off with a movement from hand production methods to machines. Steam power, factories, and iron production lead the way. This caused a massive movement from an agrarian society to a more urban one as people sought work in factories. Then the Second Industrial Revolution occurred with the invention of electricity, national railroad systems, mass production of steel and the telegraph. The second industrial revolution was a massive shift in just about every area of society. It impacted everything from travel to long distance communication, which greatly impacted the exchange of ideas across the world. It resulted in the automobile, the airplane, television, and many other inventions that changed the world. The 3rd industrial revolution was implemented with the invention of computers and the internet. This shift was a seismic one and radically changed how everyday people lived, worked and communicated. That brings us to 2024. Scientist and many others are beginning to make the argument that we are in the first days of the 4th industrial revolution and it has everything to do with A.I. The rise of Artificial Intelligence began in earnest when Jensen Huang transitioned Nvidia from a computer graphics company to an A.I. company by the invention of the GPU. GPU’s are like super-powerful brains for computers and they have radically transformed and accelerated “Machine Learning”. In very short order (2010’s until now), Nvidia almost single handedly ushered in the age of the supercomputer. By the mid 2010’s neural networks trained on Nvidia’s GPU’s were identifying images with 96% accuracy (something thought impossible just a decade before). In 2023, in an interview with the New Yorker, Huang was asked the question, “if you’ve figured out how to teach computers to see and react intelligently, what else can you teach them?” Huang responded “Everything”. Huang concluded that these neural networks will completely and utterly transform society. Huang stated that “If it moves, it will move and function autonomously”, driven by these super intelligent computers. It’s hard to put into words the impact this will have on society over the next 20 years. Smart machines (computers, cars, airplanes, robot factory workers and home assistants) run by artificial intelligence will be a reality. Literally every aspect of society from medicine, to electricity usage and more, will be radically transformed by these super intelligent computers. And the reality of all this, is that Nvidia is in the white hot epicenter of this transformation. Whole systems are built around, not only Nvidia’s hardware, but their software systems as well. One example we just learned was Tesla ordering 85,000 of Nvidia’s GPU’s to help kickstart their endeavors in robotics and autonomous driving but they were diverted to X. What does that tell you? Well first, how big of a shift he is planning in a clear application: those chips can be used to speed up model training for more robust autonomous driving capabilities but also someday power a new system that replaces human drivers. So what is so insane about this change? Besides the headline that may have been posturing for his pay package? Well it is simple, X also had an easy use for massive automation without as clear of a use case.

That’s just ONE example. The financial impact of the rise of AI is staggering. Over the last couple of quarters, we’ve seen Nvidia grow revenue by a staggering 200%. That’s never been done before and it might just be the beginning. So if A.I. is driving this bull market, is it a bubble? Not really. This bull market was driven by tech companies making obscene amounts of money. It’s not hype. It’s reality. Will the market see a pullback? Yes, of course. But revolution is upon us. Prospero is here to help each of us “prosper” from it.

A WORD FROM OUR CEO

And we are indeed seeing our signals which tend to have even more clarity on big tech specially - QQQ Net Options Sentiment has been out in front of this and ended the week beating the S&P 500 by 100% annualized, with a win rate of 62% against that benchmark.

For newer readers linking our short intro + learning videos. I am attempting to take a rare vacation this week so no livestreams, hopefully we can all make due :)

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

INDUSTRI(A.I.)L REVOLUTION?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

Last week’s Net Options Sentiment levels from the 6/9 letter:

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

We’re seeing an interesting dichotomy occurring in this market. Tech continues to shine, but SPY is beginning to decline. Market breadth has remained incredibly narrow. For example, the % of S&P stocks outperforming the S&P 500 index over a rolling 21-day period fell to 18%, the second lowest point in history. So the market is absolutely concentrating into a handful of stocks. This can’t go on forever, so one of to things will happen. We’ll eventually see a natural pullback in tech (with no breadth expansion) and that could get ugly. OR, we will see money begin to shift into small caps and other area of the markets and this thing could see some significant upside. Just like the last several weeks, we remain cautiously bullish. Especially in Tech.

CAP/VALUE ANALYSIS

This is a visual picture of everything we just talked about. Something stand out to you? Large Cap Growth. Look at the 1 year mark. The Large Cap Growth sector has growth at a pace of 34% for the year. Significantly higher than any other sector. This is where we’ll camp out until the market shifts.

NET OPTIONS SENTIMENT

See the graph below. QQQ continues on a strong upward trend and finished the week with no sign of slowing down. On Friday, QQQ Numbers ended the week at 58 which are near historic highs for us at Prospero. We’ll be watching these numbers closely for a sign of reversal. If one comes, we will react accordingly.

***Note these are from our Thursday letter but what we’ve essentially seen is this continuation of QQQ Net Options Sentiment continuing up to 58 and SPY down to 37 to end the week.

SPY Net Option Sentiment Numbers continue to concern us. On Wednesday of last week, they were at a very strong 48, then fell off a cliff to 36 that Wednesday. They recovered slightly, but then ended the week under 40. This reminds us of 23 when SPY ran behind QQQ. It will be interesting to watch if this means we’re going to see a further leg up, driven by tech, or the beginning of a greater decline in the market. As we shared in the beginning of the letter. We’re kind of in unprecedented territory, so it’s hard to guess with any degree of accuracy. But that’s the beauty of Prospero. We’re not really guessing are we? We’ll follow the numbers.

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

SECTOR ANALYSIS

Similar to the Cap Analysis, there was one very obvious winner and that was technology. Not only for the week, but for the month as well. Interestingly, Energy has seen a major pullback and isn't showing signs yet of a turnaround. Even during the peak travel months of summer. Materials, Financial and Utilities continue to underperform. We’ll be looking for short opportunities there. Until we find otherwise, Tech seems to be the safest play.

PORTFOLIO STRATEGY

Similarly to our strategy last week, QQQ Net Options Sentiment looks stronger than SPY but that has gone even further this week so our tech exposure relative to our total portfolio will be dictated by this. However, we are hedging our portfolio with tech short again with less of a balance in our long / short ratio but maintaining diversified short picks to mitigate downside risk in the broader market.

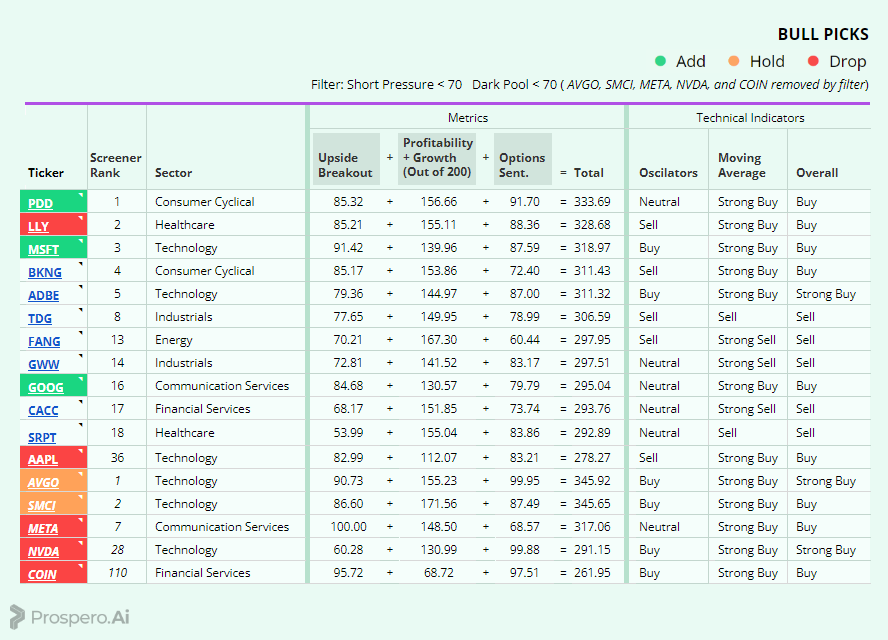

Long / Bull Moves - Link to Below Picture

Long / Bull Moves - PDD, MSFT, GOOG adds / AVGO, SMCI holds / LLY, AAPL, META, COIN drops

Adds

PDD was at the top of our screener this week, and presented with good technicals. In addition, we found its net options sentiment trend more attractive than BKNG making PDD an obvious pick. Speaking of leaning into Tech, MSFT was a no-brainer considering both technicals, ranking, and Tech’s strong performance which motivated our overall Tech hedge. GOOG beat META due to a much stronger net option sentiment trend.

Holds

SMCI was chosen over ADBE due to its greater upside potential. SMCI also has a stronger net option sentiment trend compared to ADBE’s.

Drops

APPL ranked low in our screener and its technicals were not as strong as the other Tech stocks. As previously mentioned, META was dropped due to poor recent net options sentiment trend. NVDA was our lowest ranking Tech stock in the screener, despite strong technicals. Lastly, COIN was dropped both because of its low ranking and the Financial Services underperformance. LLY turned in the technicals.

Short / Bear Moves - Link to Below Picture

Short / Bear Moves - DEI, KSS, AVT adds / PBR hold / BXMT, LPL, CALM, WEN, POR drops

Adds

DEI won over BXMT due to stronger technicals with a more Bearish net options sentiment trend. AVT was chosen over LPL for similar reasoning.

Holds

PBR is in a bad Sector trend and at the top of our list.

Drops

CALM, WEN, and POR do not have strong Bear positions due to their respective sectors’ performance and their screener numbers.

Portfolio Allocation

5 Longs: PDD, MSFT, GOOG, AVGO, SMCI

4 Shorts: PBR, DEI, KSS, AVT

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.