Prospero.Ai 10/30/22 Newsletter

Potential bull flag on the QQQ and a big week for LULU (Lululemon Athletica Inc).

Welcome to the 7th edition of the Prospero newsletter, you are receiving this if you signed up for our Closed Beta or subscribed on substack. If you signed-up for our app on our website but don’t have it yet this link will help you download it. If you are not signed up yet and would like to, click here.

TL;DR

Watch Net Options Sentiment on LULU, NOC, NVDA, ADBE as it could lead price. Same for QQQ, but since we do not have it in the app yet we will post metric updates throughout the week on the @prospero_ai twitter page. If you tag us on twitter, we will respond with the current QQQ Net Options Sentiment ASAP.

Bullish Setup on the QQQ

From our 10/24 letter “Net Options Sentiment on QQQ, a great barometer for tech, is trending positive - averaging 20 on 10/17 and 26 on 10/21. We will continue to monitor, but for now we continue to expect rocky markets.” We did continue to monitor and if the pattern continues, tech in the short term is looking bullish. As you can see in the 3 graphs below: Net Options Sentiment did not move up much last time (10/03-10/07) the QQQ price ran up (vs. ADBE and NVDA where both moved up) and the QQQ price was quick to go back down. We see a longer and more sustained climb in Net Options Sentiment AND price currently. (10/17-10/28)

We’ve seen Net Options Sentiment lead price well in all 3 of these graphs, definitely more on the individual stocks though. You can track these stocks in the app to monitor if this trend may continue. You cannot yet see QQQ in the app and since Net Options Sentiment is tracking so well against QQQ price, we will be posting this number frequently on the @prospero_ai twitter this week. If you tag us on twitter we will respond with the current QQQ Net Options Sentiment ASAP.

Explainer on Net Options Sentiment

We’ve gotten some questions on how to use Net Options Sentiment. You do not need to trade options to make use of Net Options Sentiment. This metric was invented when our CEO was trying to teach retail investors how to read options chains and after many difficult sessions finally said “what if I told you the short term options markets liked this stock or didn’t like this stock”. We created it to help even novice investors use information from the options markets without needing to understand or trade options. From our help file:

“Net Options Sentiment takes the Positive Options Sentiment and subtracts the Negative Options Sentiment. Positive Options Sentiment indicates a higher quantity / price of open call options. Negative Options Sentiment indicates a higher quantity / price of open put options. A call option is the right to buy the stock at a predetermined price. Buying a call is a bet the stock will go up. A put option is the right to sell the stock at a predetermined price. Buying a put is a bet the stock will go down. Price skew is an important input to this score as well. It subtracts the average price of call options above the current price from the average price of put options below the current price.”

NVDA (NVIDIA Corp)

Unless we get a reversal in QQQ, we could see stocks like NVDA and ADBE continue to outpace the index. In addition to the positive trend in Net Options Sentiment, NVDA has a great Upside to Downside breakout ratio and excellent Net Institutional Flow. We have seen Net Social Sentiment on NVDA bounce around a bit on this price rise (10/17-10/28) so the low Net Social Sentiment alone should not be reason for concern but it is certainly worth caution if it remains low and Net Options Sentiment falls.

ADBE (Adobe Inc)

ADBE, much like NVDA, has excellent Net Institutional Flow and is markedly better in Profitability which has been a vital signal in the newsletter the last 1+ months. These are stocks that could be a few of the biggest beneficiaries of a continued rally in the tech sector.

Reviewing Last Week - LULU (Lululemon Athletica Inc)

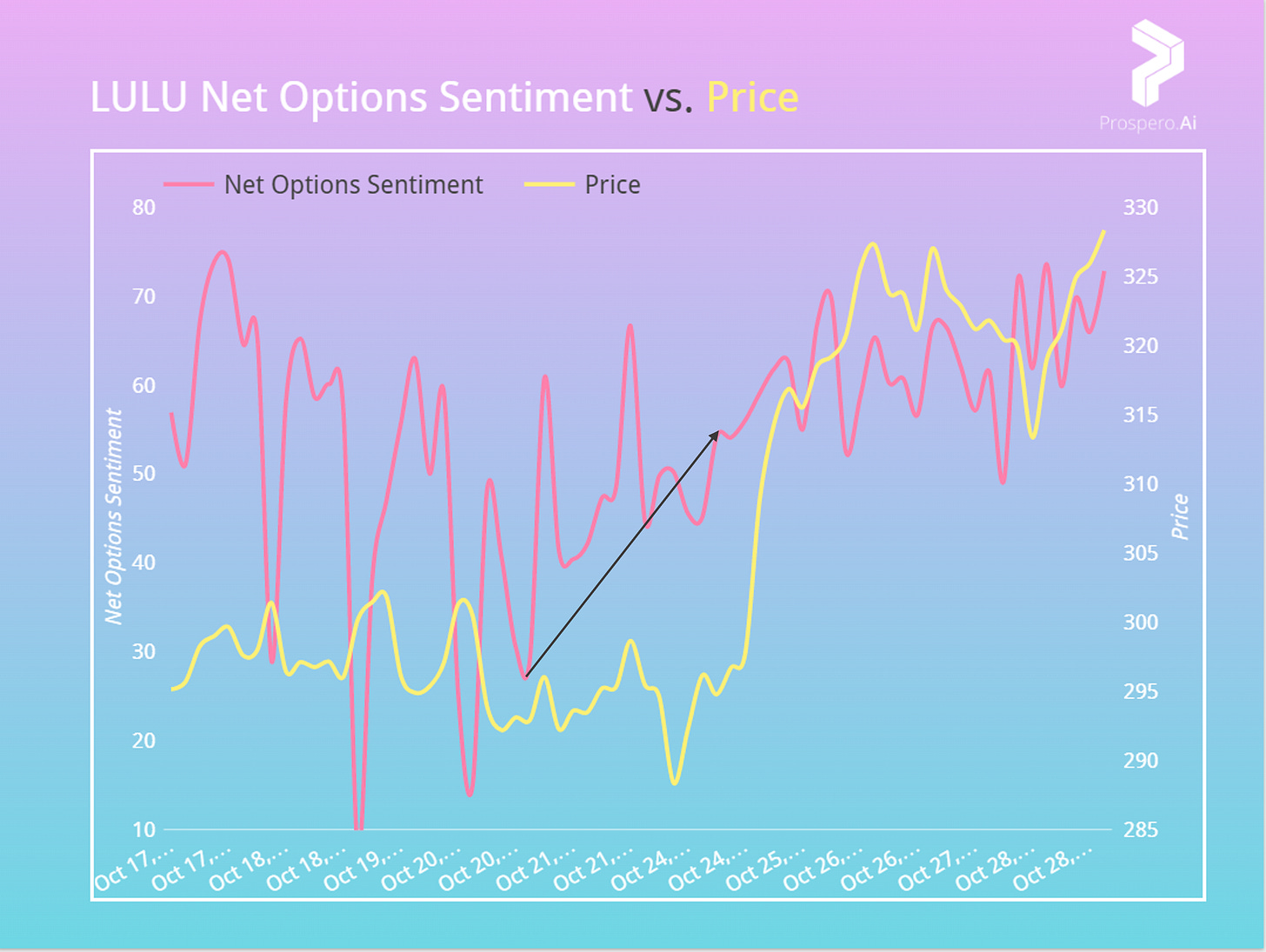

From our 10/24 letter we indicated Net Options Sentiment could lead the stock either way. We saw a clear pattern of decreased volatility in Net Options Sentiment lead to a steady climb from 10/21 to 10/24. This was a leading signal for a jump in price and a 9.55% weekly return for LULU vs. 3.70% for the S&P 500. (open Monday 10/24 to close Friday 10/28)

Retail traders might be catching up with this trade as Net Social Sentiment is sitting at 81 this week vs. 48 in the 10/24 letter. If Net Options Sentiment and Net Social Sentiment stay strong we could see another big week for LULU. But watch out for these signals reversing or a return to larger volatility in Net Options Sentiment because that could be a sign the price is going to go in the other direction.

NOC (Northrop Grumman Corp)

NOC Net Options Sentiment has stabilized on the high end, which was the behavior we wanted in the 10/24 letter for the bull case. It saw a 3.88% return vs. 3.70% for the S&P 500. It could have been a bigger week but NOC missed earnings on 10/27. This is the benefit of investing in stocks with a high profitability rating, despite the miss and opening 10/27 at 512.58 it closed at 535.51, about 5 points higher than the previous close.

If we see Net Options Sentiment stay high it could be a better week. Net Social Sentiment is a little lower than last week (72 vs. 78) but not nearly a big enough drop to be concerned about. If these numbers drop price could as well, so be sure to track if you are invested.

The Last Word - VAL (Valaris Ltd)

As of Friday 10/28 VAL popped into our recommendations for short term in addition to already being in our long term recs.

For the “we’d tell our families to invest” long term stocks we rank them by Upside Breakout - Downside Breakout and filter for Profitability above 50. Maximizing the chance of Upside, minimizing the chance of Downside and ensuring the company has enough financial footing to brave a tough market.

Not only does VAL rank among the best stocks, a month ago the Upside Breakout was 68 and Downside Breakout was 14, so both are trending in the right direction.

Our short term “biggest potential gains” take the stocks with the highest combined Net Options Sentiment and Net Social Sentiment while also requiring Upside Breakout be greater than Downside Breakout. Much like Net Options Sentiment is gauging the bets in the short term options markets, Upside Breakout and Downside Breakout heavily weigh the ratio and price discrepancies of long term options contracts. We prioritize this relationship even for our short term recs because it provides an added layer of risk mitigation.

VAL looks great in both Net Options Sentiment and Net Social Sentiment but make sure to watch them as VAL reports earnings this Tuesday Nov, 1. They have beat estimates the last 4 Q’s, including a huge beat of $1.57 ($1.48 vs. $-.09) last quarter. The market could be expecting another big beat. As the saying goes “buy on the rumor sell on the news” it could drop even after a big beat. Monitor the short term signals around this event to help see if people are starting to exit.

Thanks for reading and a very happy Halloween to everyone!

If you signed-up for our app on our website but don’t have it yet this link will help you download it. If you are not signed up yet and would like to, click here. Information on how we calculate our signals and how best to leverage them can be found here.