In two days, on December 5th, I have the great honor of speaking at the same conference as Ray Dalio and Jamie Dimon, among others. It is an online event and tickets are free here. Hope many of you can join!

We expect this to bring a lot of visibility, so if you appreciate the work we do, please check out / rate/ review our new app: iOS link and Android link. If you haven’t looked in a while, take a look at all the new changes! We added new onboarding screens to make the app easier to understand. If you already have the app, you can see them if you log out of your account.

At times, you might read some of our letters and think they are repetitive. In some ways, being a good investor is like a lot of things in life…you stick with what’s working. But in some ways, it’s very different. If things are going well in my personal life, I don’t typically worry about what I might be missing. On the other hand, one of the biggest investing lessons I’ve learned- The better you do, the more vigilant you have to be about what you may be missing. I’ll tell you what I figured out below.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Re-thinking everything, Outline:

Portfolio Macro Strategy - New data on Sector momentum

Moving it to the top as there are some vital lessons for every trader/investor!

Market/Macro Update

QQQ and SPY Net Options Sentiment

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> No Keeps —> Drops

Portfolio Summary

Portfolio Macro Strategy

It was a tough week but you’ll see below that we learned some valuable lessons and are still at a 50% beat of the S&P 500 on our 2023 picks, with a 60% win-rate per pick against S&P 500 benchmarks.

We’re placing this section up top today, because we have some interesting insights into what needed to change about our portfolio.

As we saw, META had a tough week. It had weakened Net Options Sentiment (that had been strong for a while). Additionally, we saw some confusing results from stocks low in our signals, so we dug into the data.

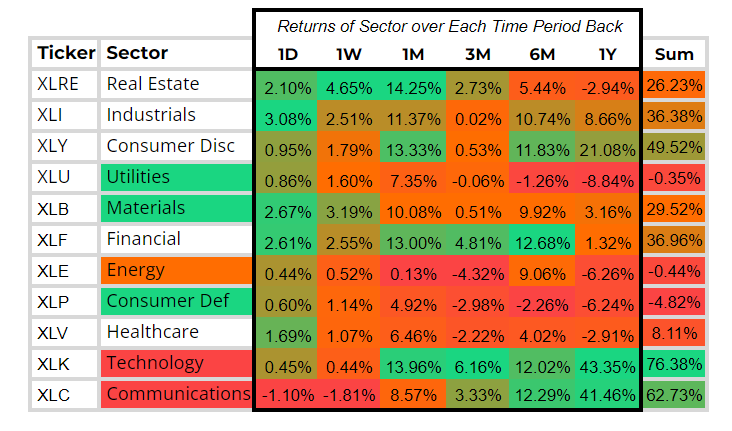

What we found was along the lines of what we expected to find, but this organization helped us form a new strategy. What you can see above, is that a lot of the most beat-up Sectors (an easy way to see which were hit the hardest, is by looking in the sum column) have been coming back strong.

The reason we are targeting greens as Bulls / Longs and Reds as Bears / Shorts, is because it looks like we’re seeing a Bull correction for certain Sectors that were hit the hardest. The green ones have more room to recover, in the near-term especially.

Now, if you look at something like Tech; we’re obviously Bullish (long term), which is why we’re only looking at this as a short term correction. We could easily see it powering through into big gains again in 2024. However, we can’t ignore that it was the 2nd worst performing Sector this past week.

We will monitor this situation to see if we can pick up any helpful patterns. But we will cover this a lot both in our normal YouTube livestream is tomorrow 12/4 at 11 AM EST and our Wednesday 12/6 livestream at a special time 10 AM EST. But our trading letter is the best way to make sure you get our best up to date info on how to handle this rapidly changing market:

Until then, we feel the “correction” has likely taken its course. For now, we are picking up 3 Bulls, 1 Bear and keeping our IWM long position.

Market Update

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish. < 15 = Bearish.

QQQ returned .11% this week vs .83% for SPY. We will also start monitoring IWM which was up 3.11%. This performance is absolutely in line with what we expected when we added IWM to our portfolio. We might have been a tad behind on this Sector shift, but our expectations for smaller cap stocks beginning to rise were right on schedule.

As for the levels, the softer performance for the QQQ, is well reflected in the softening QQQ Net Options Sentiment we see below. For SPY Net Options Sentiment, the charge at the end of the week could mean an even bigger week coming up for non-tech stocks (due for further correction upwards).

SPY Net Options Sentiment going above QQQ has been a Bear signal over the last few months. But we have never seen it with both of them in Bull zones. If both hold in the Bull zone to start the week, we’ll take a more aggressive Bull stance. But for now, we’re waiting on more data.

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish < 15 = Bearish.

Long / Bull Adds - Link to Below Picture

ELF and EXP should offer no surprises, because they’re in the industries we’re targeting and also have strong technicals. EQIX is one of the few exceptions we made, where we looked at the top pick in a Sector that has seen more recovery, but we are not completely sure yet.

Long / Bull Keeps

GWW is a keep, and returned -1.07% vs .83% for the SPY. This one was a tough call as Industrials is not a target Sector of ours but the strong end to the week and good technical signals made us want to hold on one more week. Not to mention it would be ranked 2nd in the above Screener if included.

Long / Bull Drops

LLY is dropped due to it not being in one of our target industries. Covered 11/12-12/01 and it finished -2.29% and a Loss, Losing to the SPY benchmark by 6.48%.

META is dropped due to a shift in technicals and it not being in one of our target industries. Covered 11/19-12/01 and it finished -3.05% and a Loss, Losing to the SPY benchmark by 4.89%.

BABA was added on 11/30 via chat to our paid subscribers. It is now dropped, due to it not being in one of our target industries and a bad Net Options Sentiment trend. Covered 11/30-12/01, and it finished -1.07% and a Loss, Losing to the SPY benchmark by 1.91%.

Short / Bear Adds - Link to Below Picture

You know you are catching a Bull run when you see such strong technicals all around. VNET was an easy choice in our target industry. And just like in the long section we brought in a targeted Consumer Cyclical stock which looked like a great opportunity even with the Sector momentum.

Short / Bear Drops

KW was dropped as a Bear after being added 11/30 via chat to our paid subscriber chat. It was filtered out of the above Screen due to it not being in one of our target industries. Covered 11/30-12/01, it finished +3.61% and a Loss, Losing to the SPY benchmark by 2.77%.

DEI was dropped as a Bear 11/30 via chat to our paid subscribers in a move that prevented a 20% loss on the week. Covered 11/26-11/30 and it finished +8.46% and a Loss, Losing to the SPY benchmark by 8.75%.

FRHC was dropped as a Bear after being added 11/30 via chat to our paid subscriber chat. It was filtered out of the above Screen due to it not being in one of our target industries. Covered 11/30-12/01 and it finished +2.07% and a Loss, Losing to the SPY benchmark by .93%.

LEG was dropped as a Bear, because it was filtered out of the above Screen due to it not being in one of our target industries. Covered 11/26-12/01 and it finished +2.40% and a Loss, Losing to the SPY benchmark by 1.56%.

Portfolio Allocation

5 Longs: GWW, IWM, EQIX, ELF, EXP

2 Shorts: CRMT, VNET

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.