THE FUTURE'S SO BRIGHT, I GOTTA WEAR SHADES

04/20/25 Prospero.ai Investing - 213th Edition (Weekend)

From our Prospero Family to yours, Happy Easter everybody! If you celebrate, we hope you all had a great day with your friends and families.

One of the most animated arguments my family and I get into centers around this question: "What decade had the greatest music?" I'm a child of the 80's and to my dying day, I contend it's hard to find catchier tunes than songs like Don Hendly's Boys of Summer or Def Leppard's Pour Some Sugar on Me. And who could forget Timbuk 3's The Future's So Bright, I Gotta Wear Shades. With a quick listen, it seems like a catchy, optimistic anthem of a young man, whose future is so bright that he needs to put on sunglasses. But with a little research into the lyrics, you realize it's anything but optimistic. It was written in 1986. Chernobyl had occurred as well as rising nuclear tensions between the USA and the Soviet Union. Are you old enough to remember the movie Red Dawn? Then you get the point of the song. The song is essentially about a nuclear scientist headed into nuclear weapons research and how the "bright" future he's singing about isn't because of optimism about a great future, but a bleak future that just might be bright because of nuclear fallout. From one perspective, it was a bright, upbeat pop anthem. But when you look under the hood, it was more of a dark, prophetic cultural critique. That song and it's original meaning reminds me of today's market sentiment. Let me explain…

When President Trump was elected the markets rallied. Optimism was high. Tech CEOs rallied around him with the hope that a more business friendly president is just what the country needed. But it was in those days of euphoria, that our CEO Georege Kailas started "looking under the hood" at the market data. And what he saw painted a picture of the future that was anything but bright. It all started a month or so before the bottom fell out of the market. I got a call from George, who had found a fascinating anomaly in the options market. Despite us being in the throes of a strong bull market, there were dozens of companies that banks and institutions had not released their long term options for. George stated that in his extensive career, he had NEVER seen that happen. I asked him why that would be the case and I'll never forget his answer. He said: "That means that Wall Street thinks there's going to be so much craziness and volatility, that they literally have NO IDEA what the future is going to bring." I said "Ok…I don't quite understand…tell me more". He responded "For the first time that I'm aware of, things are so unpredictable, that the options makers' models are simply unable to predict the direction of the market. Things are about to get crazy". In response, we wrote an article waving the red flag, showing how deeply concerned that made us. Turns out that George was right. We've seen an uncertainty-fueled volatility that has rarely happened in the history of the market.

But then, something more ominous happened. BEFORE the market dropped, our SPY Net Options Sentiment turned to Zero. We sounded the alarm even louder. We warned that every time we saw Net Options go to zero and stay there, that it meant a sharp, sustained decline. Once again, that turned out to be darkly prophetic because that's exactly what happened. The market has seen a historic drop over the last couple of months.

Why are we telling you this? Are we trying to brag? No, far from it. We honestly wish we had been wrong with all of it. We're reminding you of these events because it sheds light on where we stand today and how we need to move forward as traders and investors. The reality is that we're still pretty concerned about the future of the market. Why? Because Wall Street is still uncertain; and when you look at their longer term positioning, they're leaning heavily bearish.

To begin, let me show you a picture of our SPY Net Options Sentiment since the beginning of April.

See that purple line that looks like a roller coaster? That's our SPY Net Options line…and that my friends is what's called volatility. If you're new to Prospero, we consider SPY Net Options over 40 as bullish, and anything under 30 as bearish. As you can see, the sentiment is swinging back and forth from very bearish, to bullish, back to bearish again. It ended the week at a bearish 11. That's quite a range to swing from 0 to 45 and back again. QQQ was slightly higher at 25, but still well below our bearish line of 30. What makes this pic fascinating is I've personally never seen this kind of uncertainty in our numbers. I've seen them drop and and I've seen them go higher, but never this constant back and forth within a couple of days. I called George to ask him WHY this back and forth was occurring. He said: "Institutions are Swing Trading with options". That means that they are playing the swings as they happen, but don't really have a strong enough conviction as to the direction of the short term market. In other words, there's so much up and down, that they are playing both sides of the trade. They make money on the upswings and make money as it drops. But what does this tell us about what Wall Street thinks will happen in the long run? Not much. But there's another piece of data that we've referred to that shows us how institutions and hedge funds view the longer term direction of the market…and it's not good. Hedge funds are dumping stocks — just as mom-and-pop investors rush in. Retail is not just buying but making risky levered bets — according to Bloomberg Intelligence, retail investors bought leveraged ETFs at a historic rate. During April, retail investors poured nearly 6.6 Billion into leveraged long, ETFs. This occurred while smart money was running for the hills. The reality is that one of those groups is wrong. Unfortunately, those guys aren't wrong every often. I then asked George why he thought that Institutions were so negative and he sent me an article on the current effects of the tariffs. Let me stop right here and remind everyone that we fight like crazy to remain politically neutral at Prospero. We have no agenda except to help you make money and so we strive everyday to wade through any media bias (on both sides) and get down to the facts. The article argued that the effects of the tariffs, while ultimately could be positive, were currently yielding overwhelmingly negative results. From the decline of oil to the cooling relations with our allies, the future isn't looking very bright. On a positive note, we hear from the Trump administration that deals are coming, but thus far we haven't seen a lot of fruit.

Here's my whole point…and it's not to argue for or against tariffs or to make a case for or against President Trump policies. My point is to show you that as of the writing of this letter, Wall Street is overwhelmingly bearish about the state of the economy and the future impact of these tariffs. That's not opinion, that's a fact.

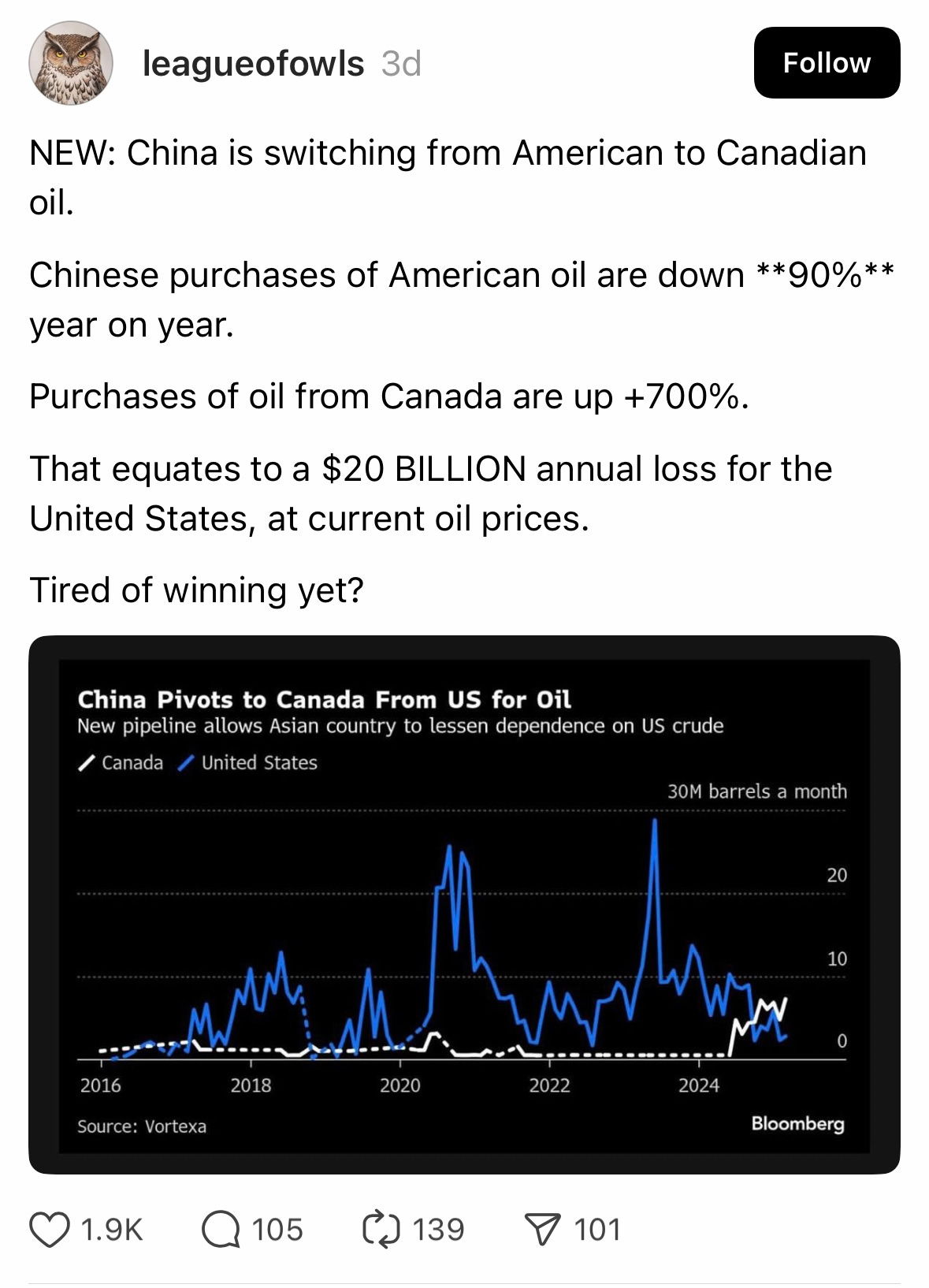

But what is driving that? We talk all the time about how model driven Wall St. is. And while some of this can be reversed by deals other parts may be more permanent. Canadian Prime Minister Mark Carney said that Canada's old relationship with the United States, "based on deepening integration of our economies and tight security and military cooperation, is over". This is beyond talk, see what is happening just with China, Canada and the US with oil.

We are already seeing the potential for the EU to expand trade with China at the expense of our products: EU, China explore minimum prices for Chinese EVs to replace tariffs. If we do not start making new deals where Wall St. can model longer term rewards to match some of these risks, we will continue to see a lot of downward pressure applied to the market.

You see, the stock market is forward looking. It's basing its current prices on where it sees things going in the future. With that in mind, what does the current data tell us? It tells us that Wall Street is bearish about the long term future of the market. Could we see a jump? Absolutely. It might happen this week. The S&P 500 weekly chart just hit 30 on the RSI. Every time that's happened over the last several decades we've seen a bounce. Sometime's BIG ones. But here's what gives me pause. Why the continued bearish stance from institutions and hedge funds? Think about it…if they thought the bottom was in and we were going to rally to all-time highs, wouldn't the data suggest they were overwhelmingly bullish? They're not. It's quite the opposite. We wanted to address this so that you will be prepared for the week ahead. If a deal is made with China or some great economic news comes out, we will go long on the market…BUT…we will stay incredibly defensive until we see SPY and QQQ Net Options Sentiment change directions and stay there. Don't be afraid to stay hedged and trim your positions that go green. If you buy, only buy beat up stocks that have value despite the potential storm clouds looming. And as always, we're in the trenches with you. And who knows, it's Easter today. Maybe we'll see a market miracle!

A WORD FROM OUR CEO

This is the last day for our rare offering on monthly AND yearly subscriptions, 33% off! This gets you access to our live portfolio moves during the week which are even more helpful in these volatile times. We continue to be ranked on the Rising Finance list in Substack, help us continue to climb!

It was another volatile week that we found difficult to time this time around but we continue our excellent year with our paper trading portfolio beating the S&P 500 by 80% annualized, with a win rate of 62% against SPY benchmarks.

We updated our short intro + learning videos to include our new full app tour as well as advice on how to use this letter.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

THE FUTURE'S SO BRIGHT, I GOTTA WEAR SHADES

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

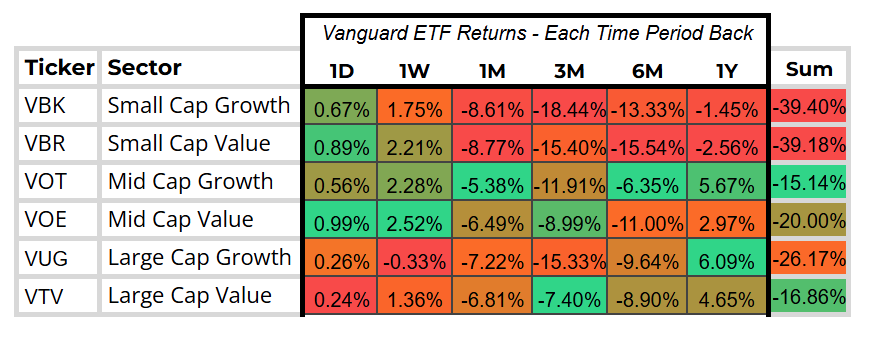

CAP/ ANALYSIS

Value continues to outperform growth, with Mid Cap enjoying a standout month. Growth remains under pressure, particularly in the lower cap ranges. However, there appears to be a growing convergence between value and growth performance compared to previous weeks. This could signal a potential shift into a new market regime where growth may start to regain favor.

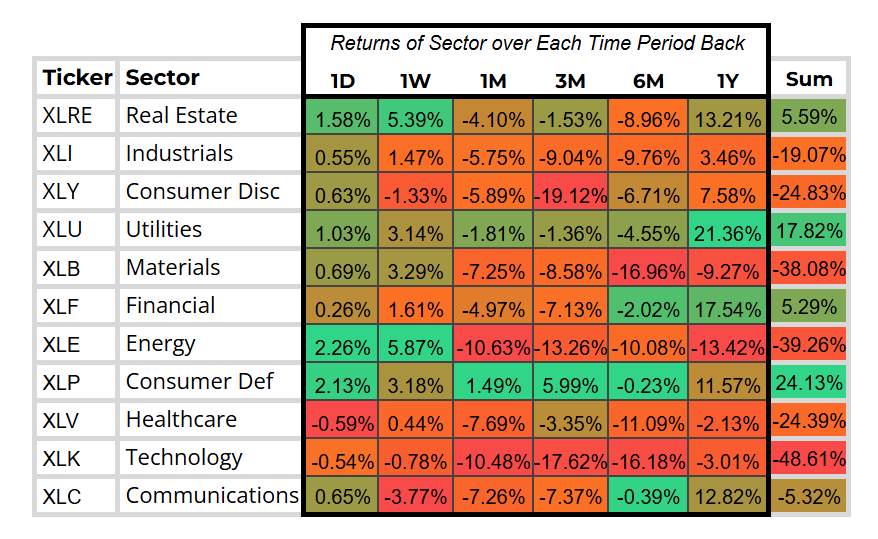

SECTOR ANALYSIS

Energy experienced a solid rebound this week, driven by a favorable swing in commodity prices and a slight contraction in supply. Real Estate also saw movement as long-term interest rates declined, following last week's turmoil in the bond market—this could present an opportunity to express confidence in lower long-term rates. Consumer Defensive continues to deliver consistent returns, solidifying its role as a reliable ballast for long-term-oriented portfolios. Meanwhile, Tech and Communication Services remain in limbo, reliant on policy clarity in Asia—a prospect that appears increasingly distant after the inconclusive discussions with Japan last week.

SPY/QQQ NET OPTIONS SENTIMENT

As we saw above, SPY NOS remains bearish, reflecting economic data that continues to trend toward recession-like territory. We maintain a net short position as volatility and bearish sentiment persist—key indicators that suggest limited upside potential for equities in the current environment.

QQQ NOS continues to maintain a bearish stance, mirroring SPY, as uncertainty in Asia remains a critical concern. Additionally, Asian advertising spend has seen a significant reduction due to tariffs that have made selling Chinese products in the U.S. increasingly challenging, effectively creating a de facto embargo for now.

PORTFOLIO STRATEGY

With the market outlook mirroring last week, both SPY NOS and QQQ NOS remain entrenched in bearish territory. As a result, we maintain our net short positioning while awaiting a market reversal. To mitigate idiosyncratic risk, we continue adhering to our sector and market cap diversification criteria. 5 longs, 7 shorts

Long / Bull Moves

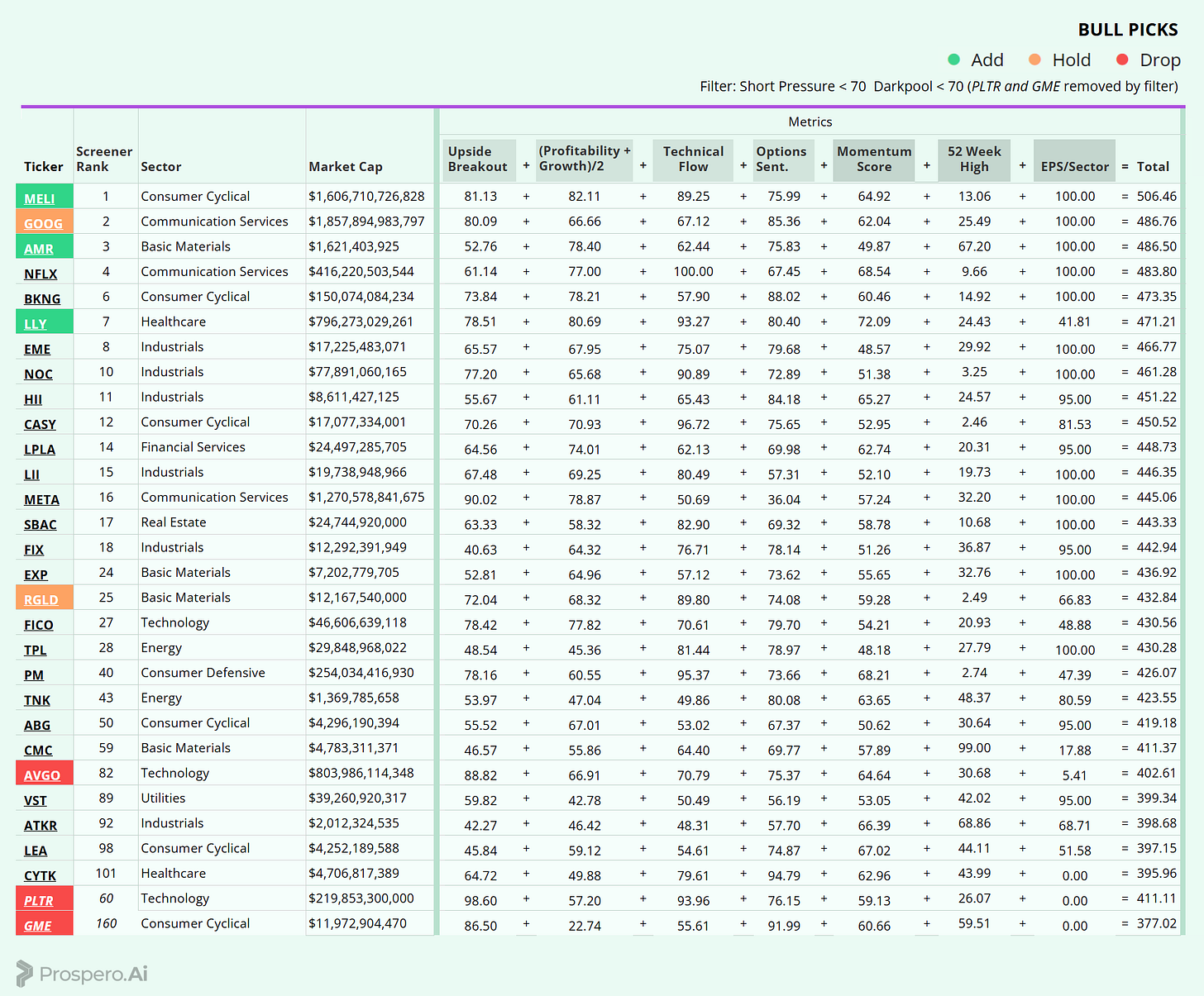

Long / Bull Moves - MELI, AMR and LLY adds / GOOG and RGLD holds / AVGO, PLTR, GME drops

Adds

MELI was added as it placed at the top of our screener with a well rounded profile, with great earnings power. AMR seems like a promising small cap with excellent earnings power, and decent Net Options and that’s why we added it. LLY was a good addition with high Tech Flow and excellent Momentum.

Holds

GOOG again remains in our portfolio this week, placing second in our screener with good Upside Breakout and Net Options. RGLD was kept as a gold play with great Tech Flow.

Drops

AVGO, PLTR and GME were dropped because they performed poorly in our screener.

Short / Bear Moves

Short / Bear Moves - RHI, ZG, ARES, SNY and PRDO adds / SSNC and LSCC holds / CHON, JACK, ASML and TGT drops

Adds

RHI looked like a solid Industrials pick with low Tech Flow and Net Options, as well as poor Momentum. ZG seemed like a great Communications Services mid cap with poor earnings power and low Net Options. ARES was added for large cap Financial Services exposure with <10 Net Options and good Downside Breakout. SNY was also added for large cap exposure but in Healthcare Services. PRDO seemed like a good add to play the slowing momentum in Consumer Defensive and weakness in small cap style category.

Holds

SSNC was kept for large cap Tech exposure. Same thing with LSCC, but wanted to get some Mid Cap growth exposure in our portfolio,

Drops

CHON, JACK, ASML and TGT were all dropped because they performed poorly in our screener.

Portfolio Summary

Long / Bull Moves - MELI, AMR and LLY adds / GOOG and RGLD holds / AVGO, PLTR, GME drops

Short / Bear Moves - RHI, ZG, ARES, SNY and PRDO adds / SSNC and LSCC holds / CHON, JACK, ASML and TGT drops

5 Longs: MELI, AMR, LLY, GOOG and RGLD

7 Shorts: RHI, ZG, ARES, SNY, PRDO, SSNC and LSCC

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.