Welcome to the 19th edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

Don’t have the Prospero.Ai app yet?

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

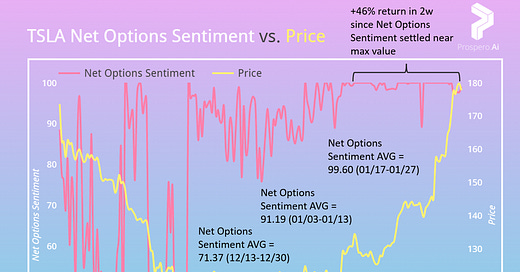

Our signals predicted this breakout from TSLA (Tesla Inc)

From 01/22/23 letter: “Expect an up week if: TSLA Net Options Sentiment > 75 and QQQ Net Options Sentiment > 40. (Risk factor - Rising 1 Year Treasury Yields)”

TSLA was in line with this guidance and had a huge week. Up 39.38% Pre-Market Open 01/23 to After-Market Close 01/27 vs. +2.51% for the benchmark SPY. Since we covered it as a Bull pick in every letter since 01/02 it is up 66%. As seen in the graph below our signals clearly increased Bullishness as we kept talking about TSLA.

Stocks that move like TSLA can turn around fast, so we will be setting a higher threshold for Net Options Sentiment to maintain in order for us to remain Bullish.

Expect an up week if: TSLA Net Options Sentiment > 85 and QQQ Net Options Sentiment > 40. (Risk factor - Rising 1 Year Treasury Yields)

Market is showing signs of a bottom but we are cautiously optimistic until more confirmation from SPY Net Options Sentiment

“For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.”

70% of the values for QQQ Net Options Sentiment were > 40 so it comes as no surprise that it was a big week for the QQQ. Up 4.76% Pre-Market Open 01/23 to After-Market Close 01/27 vs. +2.51% for the SPY.

However, the AVG values for QQQ and SPY Net Options Sentiment are trending down for the 2nd half of the month vs. the 1st.

The downward trend in Net Options Sentiment could be a sign of a Bull trap. But it could just be some conservatism as we wait for further confirmation of a “soft landing” that fed chair Powell mentions. The market is pricing in a 94.3% chance of a .25% increase which is a big sign that the fed is optimistic on inflation. The positive reaction to the 2.9% 4Q increase in GDP could mean the market was previously pricing in worse conditions and institutions see great value to go long now. We did see a breakout from the 2022 downward trendline for SPX as shown in the link, these events often lead excellent price action. If you see SPY or QQQ Net Options Sentiment break upward early this week it could be your last chance to go long before a big run.

“For Tech: QQQ Net Options Sentiment > 45 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.”

Bull Pick - MDB (Mongodb Inc)

We highlighted MDB in our 01/27 Trading Tips newsletter as a big Net Options Sentiment mover (+50 from open 01/26 to close)

We’ve seen in the last month that higher Net Options Sentiment values have excellent price results for MDB.

We like to see higher Growth (71) for a company that has excellent Upside Breakout (90) to Downside Breakout (14) ratio. MDB was trading at $471.96 on 04/01/22, why couldn’t it see explosive price movement if they deliver good revenue growth over the next year?

Expect an up week if: MDB Net Options Sentiment > 50 and QQQ Net Options Sentiment > 40. (Risk factor - Net Social Sentiment < 35)

In Review - Bear Potential - ENR (Energizer Holdings Inc)

From 01/22/23 letter: “Expect a down week if: ENR Net Options Sentiment and ENR Net Social Sentiment BOTH < 50. (Risk factor - SPY Net Options Sentiment > 10)”

SPY Net Options Sentiment spent a lot of time > 10 so it did not meet our Bear guidance, however it still had a bad week, returning -1.96% vs. +2.51% for the SPY.

We reiterate the same guidance as last week, but SPY Net Options Sentiment needs to go down for us to consider a Bear play like this.

Expect a down week if: ENR Net Options Sentiment and ENR Net Social Sentiment BOTH < 50. (Risk factor - SPY Net Options Sentiment > 10)

Long Hold Special - AMZN (Amazon)

We covered our 5 favorite long-term holds in our 01/25 premium letter.

We will discuss some of our favorite longs each week if we see ongoing signs of a bottom. AMZN might seem obvious, but we like it more than stocks like GOOGL or META for reasons discussed below.

Net Institutional Flow (95) shows “smart money” is already loading up. For a company of it’s scale to also have a 59 Growth rating is quite impressive.

We love AMZN for one big reason, process. Google and Apple had founders with harder to replace strengths. Jobs - design/innovation. And Google relies so heavily on a single piece of technology made by the founders. (META too) Expansion efforts have been far less effective vs. AMZN. Plus more AI challengers (like OpenAi / ChatGPT) could threaten various aspects of GOOGL’s business. Bezos’s strengths were in process. Explicit tactics to move into new markets, that will outlive him.

One of my favorite books Built to Last highlights process as the lifeblood of an enduring company. We expect AMZN to make big inroads into Healthcare and shipping among other verticals. The biggest risk for this company is that it is taken on as a monopoly. Regardless, if I had to pick a single stock to hold for the next 10 years it would be AMZN without hesitation.

Our Most Bullish Filter (riskier than other filters we’ve shown but if you think we’ve bottomed these have the largest gain potential for short / long term)

Because these stocks have high Growth predictions and positive institutional bets in the short term options markets (Net Options Sentiment) and long (Upside Breakout) they have a lot of potential. But be careful, especially the BioTech stocks (KRTX, AXSM, CTIC) have low Profitability so a Bearish reversal could mean trouble.