The question we're hearing more than any other from Retail Investors is "Should we buy this dip?" In case you’ve been in a cave for the last 3 weeks and just now came out, the S&P 500 and Nasdaq have both officially fallen into "correction" territory. Specifically, the Nasdaq (QQQ) has traded in the red for 4 consecutive weeks. If it stays red one more week, that will be the longest decline since May of 2022 when we were in the throes of a historic bear market. So the question at hand; is this a healthy, much needed pullback from a market that was, as my grandmother used to say, "Getting a little big for its britches?" Or are we in the early innings of a Bear Market?

Let's look at a few of the data points:

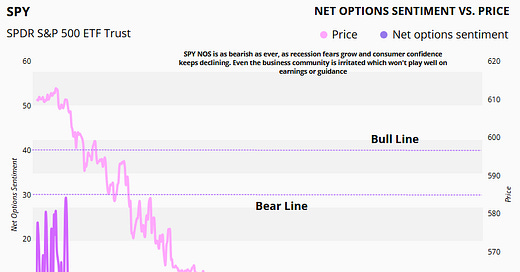

1. On a positive note, Friday experienced a "mean reversion" rally. It's about time! The indexes have gotten grossly oversold and we were way overdue for a bounce. But, does this bounce indicate we’ve hit a longer term bottom and are on the way to another all-time high? There are some pretty good odds it will. Historically, when the Nasdaq gets this oversold, a significant bounce is a very safe bet. BUT…our SPY Net Options Numbers are painting an ominous picture. Let me explain…

2. Despite last Friday's rally, Prospero's SPY Net Options Sentiment (which measures institutions/hedge funds, short-term "put vs call" ratios) is still sitting at ZERO. Historically at Prospero, when our Net Options Sentiment goes to zero and stays there, that has indicated a more substantial correction. Until that number changes dramatically, we remain firmly bearish. Side note, it was the SPY NOS numbers going to 0 that caused us to predict this correction almost a month ago.

3. Hedge Funds are dumping global equities at a historic rate. This point is a bit concerning to us. In an article from IG linked here, data suggest that hedge funds have liquidated global equity positions at the fastest rate on record. The rate in which they’ve liquidated equities surpases the 2018 correction, the 2020 Covid drop and the 2022 Bear Market! That is significant, because the 2022 bear market was the worst bear market since 1973. The article gives some insight into the nature of the selling. It states, "The scale of selling pressure indicates a coordinated response to emerging market conditions, rather than isolated portfolio management decisions" In other words, there's something hedge funds are seeing in this market that is making them ALL respond by selling. When you look at that data, side by side with the fact that gold just surpassed its all-time record last week, that’s about as big of a red flag as you can get. The article concludes by saying, "the unprecedented nature of the liquidation indicates we are entering into uncharted territory". That's a nice way of saying "We don't know what's going to happen, but it looks really bad".

So where do we go from here?

When you put all that data together, the rally on Friday looks like it might be a "dead cat bounce". For you newbies, a dead cat bounce (sorry cat lovers) refers to a bounce that eventually loses its gains and keeps on going down. I say that, because despite the fact that we're historically due for a strong, bullish reversal, we're concerned b/c of how our SPY Net Options Sentiment never got off of 0. QQQ Net Options jumped all the way up to a fairly bullish 38, but then immediately dropped back down to a bearish 15 to end the week. That is telling. In light of how oversold the market is, had Net Options numbers had turned Bullish, we’d be aggressively buying this dip. But our Net Options scores are showing that institutions are still hedging aggressively / extremely bearish.

I hope I'm wrong. I really do. I hope that next Saturday I'm writing this letter explaining how we just experienced a historic short-squeeze kind of rally that gained back most of our losses. But the overarching data suggest we need to be EXTREMELY careful entering into this week. If you are a long term holder of stocks, with no shorting or hedge protection, you need to be aware that we are very close to entering into a longer term bear market. We aren't there yet, but we're getting close to that being a reality and until we know if we're experiencing a sustained rally, now is not the time to be entering into new long positions. If you do want to enter new positions, look for names that look strong in our signals, PLUS have been beaten up over the last 4 weeks and are deeply oversold. A good example would be APP. But even then, have your finger on the trigger ready to get out of those positions in the event of a downturn. Our CEO, George Kailas informed me that he will enter the week light in positions, so he can be prepared to strike based on market direction / updated numbers. For those of you that have paid close attention to our letters and were able to avoid this 4 week correction, congratulations! But for those of you that have taken it on the chin, don't fret, we're going to dig out of this together. Now a word from our CEO:

A WORD FROM OUR CEO

Despite being early to call a Bear run and as early as February 9th shared highly concerning options market data we did not get the gains we would have hoped. But in market paradigm shifts, like we are experiencing now, it can be a process to find a the right strategy. We feel we found some good footing last week and the results showed. Our paper trading portfolio is beating the S&P 500 by 67% annualized, with a win rate of 64% against SPY benchmarks. Over a 20% increase on an annualized basis from last week.

Regular streams this week - Monday 3/17 at 11 AM ET and Wednesday 3/19 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Buy the Dip?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Value keeps winning, although winning might be in this case losing less. As valuations compress across the whole market, we see value performing slightly better, as large cap value with durable cash flows seem to be better equipped to ride out this medium-term policy uncertainty. We have adjusted our metrics accordingly to account for this growing factor. Growth can’t stop taking a beating as multiple compress aggressively and uncertainty derails capex and expansion plans, as we’ve already noted. Will be interesting how durable this theme is a couple months out.

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS remains where it has been, as any hope of short-lived uncertainty has died and we seem to be on a more and more irreversible course that only spells more hurt for the broader market, with international markets looking more and more attractive as well.

QQQ NOS remains firmly in bearish territory as even big tech is having problems justifying future capex spend in an uncertain market. We have shifted our portfolio accordingly to reflect this shift in sentiment at least in the short term as tech seems to stumble.

SECTOR ANALYSIS

Energy continues its strong performance, fueled by fresh capital inflows, robust allocation strategies, and persistent geopolitical tensions in Europe and the Middle East. The Utilities sector also had a solid week, demonstrating remarkable resilience against broader market uncertainties and wavering consumer sentiment. On the flip side, the usual underperformers—Tech, Communication Services, and Consumer Discretionary—remain entrenched in losses. Sentiment, as reflected by SPY NOS, remains stagnant with no clear catalysts on the horizon, only a growing sense of apprehension in the market.

PORTFOLIO STRATEGY

Well we’ve been talking a big game on simplification and “shrinking the problem.” And we take another big step towards that this week. While SPY NOS not showing any signs of life we are being cautious not to swing too Bearish with the move up on Friday. QQQ still undecided we have shifted our positioning in our portfolio to reflect the uncertainty in today’s market. 2 Longs, 3 Shorts.

Long / Bull Moves

Long / Bull Moves - SPOT and EME add/ ULTA, IDCC, APP, INTC, BABA and PWR drops

Adds

SPOT was added for its excellent Tech Flow, Net Options and EPS / Sector placing at the top of our screener as a great well rounded pick. EME was added as a mid cap Industrials exposure with good Net Options Sentiment, Momentum and excellent EPS Sector.

Drops

ULTA was dropped as it didn’t have any standout metric to keep it in the portfolio. IDCC and APP were dropped to reduce our Communication Services/Tech long exposure. As well as declining Screener performance. INTC, BABA and PWR were dropped as they didn’t perform well in our screener.

Short / Bear Moves

Short / Bear Moves - INFY, HI and CTSH adds/ FNKO, NTCT, AMRC, NXPI, RY, PFGC, SSNC and DELL drops

Adds

INFY was added as it placed at the top of our screener and we wanted large cap Tech exposure, with good Net Options Sentiment for a short and EPS Sector. HI was added to pair with EME on the long side with well rounded metrics and 0 EPS Sector. CTSH was added as another Tech large cap with good NOS and EPS Sector for a short.

Drops

FNKO was dropped as it was too small of a market cap for us to have in our portfolio, NTCT was dropped as we had better Tech exposure elsewhere. AMRC, NXPI, RY, PFGC, SSNC, and DELL were all dropped because they performed poorly in our screener.

Portfolio Summary

Long / Bull Moves - SPOT and EME add/ ULTA, IDCC, APP, INTC, BABA and PWR drops

Short / Bear Moves - INFY, HI and CTSH adds/ FNKO, NTCT, AMRC, NXPI, RY, PFGC, SSNC and DELL drops

2 Longs: SPOT and EME

3 Shorts: INFY, HI and CTSH

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.