The Bull Charade

04/06/25 Prospero.ai Investing - 209th Edition (Weekend)

When the market will or will not get back to these levels is unimportant. What is more important, is asking yourself if you can make money on the way down instead of losing money?

Let’s get right into the WHY of that statement. Last week was utterly brutal. The facts are that we're extremely close to officially being in a bear market (if not already there). Thursday and Friday was one of the largest two-day declines in the history of the market. Trillions of dollars of value is gone. So, the question remains: "Have we reached the bottom?" Currently, the answer isn't looking too rosy. As of last Friday's close, QQQ has a Net Options Sentiment of 3, and SPY Net Options Closed at 0. This tells us that Institutions and Hedge Funds are still historically Bearish. Why do I say historically? Because a QQQ and SPY combined Net Options Score of 2 (last week) is as low as we've ever seen in the history of Prospero.

And here's the reality…Our Net Options Sentiment has proven eerily accurate in predicting future market sentiment and direction. This is why we had one of our best weeks ever last week, when many struggled. Around two months ago before the huge drop, we wrote this article: Warning of extremely diminished institutional appetite - That was when SPY (S&P 500 ETF) was at $602. Friday, SPY closed at $505. Almost a 100 point drop.

On Feb 23rd, we wrote an article, We go officially Bearish where we warned that big money on Wall St. has changed its tune and it deeply concerned us. As of the writing of that article, SPY was at $601.

Last week BEFORE the major drop, we wrote this article about making sure you were hedged against a crazy drop: All time lows QQQ/SPY NOS and recommendations for how to hedge. SPY was at 558. Again, since the writing of that letter, SPY is at 505.

We've been saying it for a couple of years now. Our SPY and QQQ Net Options Sentiment is a cheat code.

The S&P 500 Today

We don't mean to be alarmist but when we look around the internet it is still SHOCKING how many people are saying to average down and "buy the dip". It's like they've never seen a bear market before or they've forgotten what it is or how it operates. The other possibility is they're so entrenched in a strategy of buying high growth longs that they’d rather try to convince people it's the bottom, than think about revising their strategy.

Here's the quote we started the letter with…

-When the market will or will not get back to these levels is unimportant. What is more important, is asking yourself if you can make money on the way down instead of losing money?

Could this bloodletting be over soon? Yes absolutely. Countries could cave and this could all deescalate. But countries could also pass reciprocal tariffs, and then who knows where it ends!

And THAT uncertainty is the primary issue with the stock market right now. Wall St. relies on models, and in the absence of hard data they have to run worst case scenarios. If our tariffs are met with higher tariffs abroad, which we then “re-reciprocate” against, it's impossible to know how bad the worst case could get. That unknown spectre of escalation is what's driving the market down so fast and hard. What we don't think is worth our time is to discuss whether Tariffs are good or bad. The reality is that we don't have ANY control over what the current administration does or doesn't do. And the reality is we're all going to eventually find out if they were good or bad. So to spend a ton of time on that seems to be a waste. But what we do think is worth our time is taking a look at WHY the markets are currently reacting NEGATIVELY.

Historically it's highly debatable whether tariffs have been helpful to the US. From a certain perspective, the US's globalized approach has resulted in quite the booming economy. Let’s take a look:

As the chart above demonstrates, the reality is that tariffs were high going into and during the great depression. The growth of our country's GDP seems to really take off the lower the tariffs go. That is why this letter is titled “The Bull Charade.” The idea that NOW is a good price to potentially buy in, has everything to do with whether the tariff situation de-escalates. For example, last Friday we saw a pop in Restoration Hardware which has a lot of manufacturing in Viet Nam. Why? There was discussion that tariffs were going to be dropped. Here's the point. Whether you are a Republican or a Democrat, the fact remains that the market doesn't give a crud about your political leanings. And what the market is doing right now is responding negatively to increased tariffs. If you aren’t preparing yourself for the eventuality that they may not go away, or they might get worse, you very well might look back and regret it.

As we said last week, the best path forward for the less experiencd is to hedge against further downside. All it takes is adding SCC and/or SQQQ to your portfolio to really insulate your losses. Also, depending on how certain you are that more drop is coming, you could even see gains from those two ETFs. An example strategy, would be to have SQQQ and SCC make up 50% of your portfolio and offset that with some of our favorite high risk high reward longs like APP and MSTR and essentially profit off the downside and have APP and MSTR defend against losses if the market flips the other way.

Now, let's look at one final, more positive scenario. The reality is that there is a bounce coming at some point. The market won't keep going down forever. There's actually a good amount of data that shows that after a two day decline like we just saw, that a rebound is more likely than not. But again, here are the facts. SPY and QQQ Net Options Sentiment are still historically bearish. And until those numbers change in a dramatically bullish fashion, you might end up wishing you had acted more like the pros who make money off the decline instead of just “zooming out”, averaging down and potentially signing up for extended pain.

A WORD FROM OUR CEO

We are starting to see some traction on there's an AI for that if you have been helped by this letter or our app we’d really appreciate you leaving a review there.

As we always say, sometimes you will hedge and tread water until you see an opportunity. We saw one, loaded up on shorts and had one of our best weeks ever. Our paper trading portfolio is beating the S&P 500 by 101% annualized, with a win rate of 63% against SPY benchmarks.

Regular streams this week - Monday 4/7 at 11 AM ET and Wednesday 4/9 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

The Bull Charade

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/ ANALYSIS

Bad week for everything, as downward pressure forced most over leveraged institutions to sell. Large Cap value will still fair better than most but that isn’t saying a lot. We will keep looking at value opportunities as they have less room to fall.

SECTOR ANALYSIS

Throughout the week, the sell-off left no sector untouched, though Consumer Defensive emerged as the most resilient amidst the turbulence. In stark contrast, Energy, Technology, Financials and Industrials bore the brunt of the downturn, grappling with disrupted capital expenditure plans and a notable decline in consumer demand.

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS paints a grim picture, with institutions maintaining an overwhelmingly bearish stance following Liberation Day. As a result, Monday could see significant market turmoil unless an unexpected, game-changing announcement emerges—but I wouldn’t stake too much on that outcome.

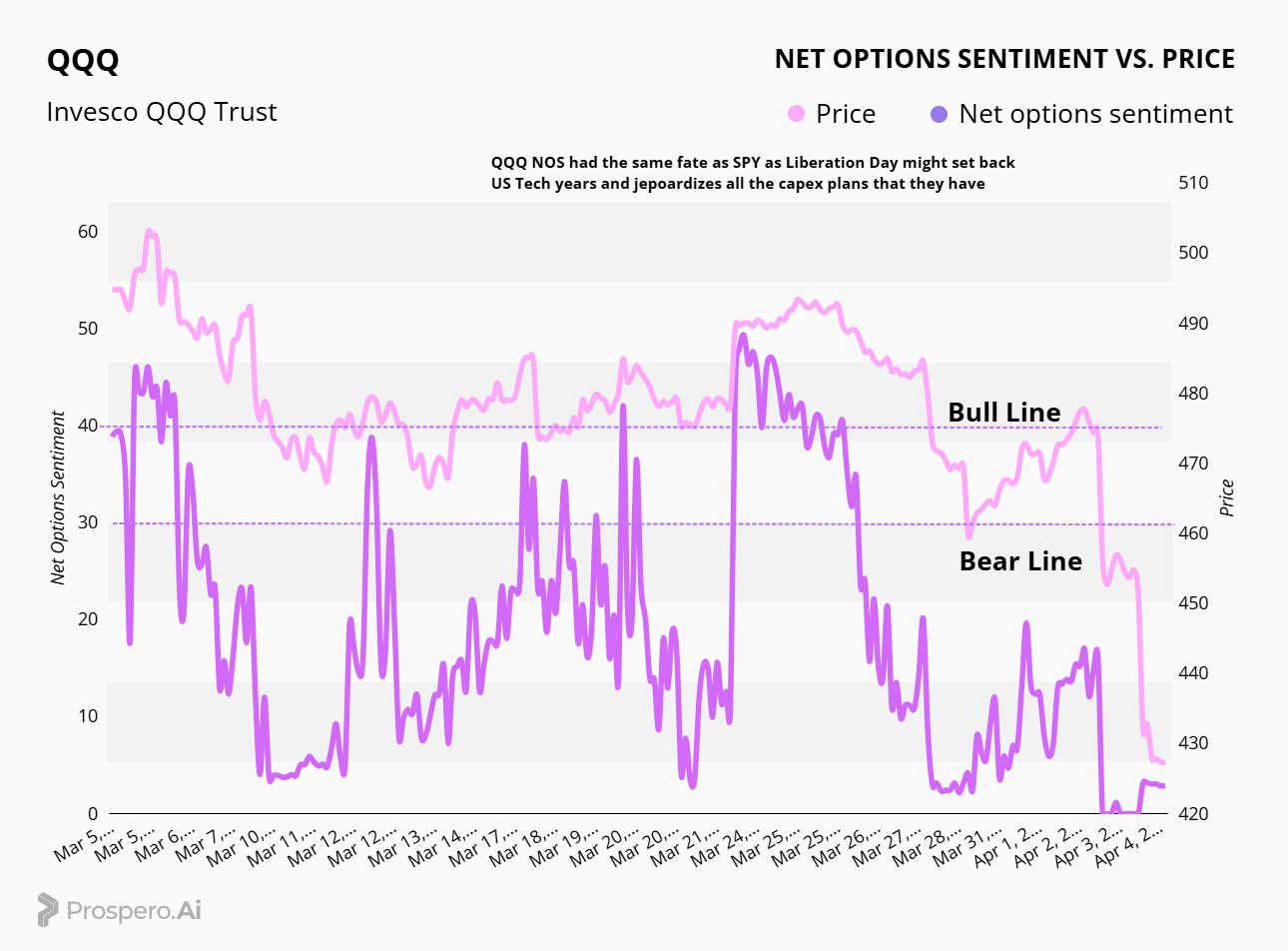

Now Check out the QQQ Net Options Sentiment Chart. If anything, Tech is could have decades long impacts from this policy/uncertainty and the market sell off doesn’t reflect it enough. You can see QQQ Net Options Sentiment was not fooled last week and stayed well in the Bear zone even with good price action on Monday/Tuesday.

The fact that the overall trends in QQQ/SPY have been historically bad means we would have to see sustained Bullish activity from QQQ and SPY Net Options Sentiemnt at the same time to be Bullish.

PORTFOLIO STRATEGY

We keep our net short positioning from a week ago, but remain flexible if any last minute deals are announced. We’ll run a slightly larger book to make sure we get better downside protection. 4 longs, 7 shorts.

Long / Bull Moves

Long / Bull Moves - GOOG, AZO, NOC and DG adds / UTHR, LNG, PM, BJ and AVGO drops

Adds

GOOG and NOC were a good adds with decent Tech Flow, Net Options and great earnings quality. AZO was also a no brainer with amazing Tech Flow. DG is always a great counter cyclical value play with great Tech Flow.

Drops

UTHR was cut because it didn’t have any decent signals to keep it in the portfolio. LNG was cut because we fear the weakness in energy will be prolonged. PM, BJ and AVGO were all removed due to their poor performance in our screener.

Short / Bear Moves

*52 Week Mid is done differently. We realized we did not want to add shorts too close to the 52 Week High or Low. So the lower the number the closer to the midpoint it is.

Short / Bear Moves - LUV, ARM, SU and MS adds / DAN, TRMB and ALB holds / DELL, SWKS, ALKS, KMT, PSX and RH drops

Adds

LUV was added as we wanted to keep playing the weakness in Industrials with a larger cap company with poor earnings power. ARM was chosen for its favorable NOS and large cap Tech exposure. We are breaking a trend with ARM at 79 Upside that is by far the highest for a bear pick ever. But this tells you exactly where we are at on the market. SU is there for Energy exposure with favorable Momentum. Lastly, MS was a good large cap Financial services pick with low Momentum and Net Options.

Holds

DAN was kept for its low EPS/Sector. TRMB was kept for its large cap Tech exposure. ALB stays in our portfolio to play the weakness in Basic Materials with favorable Tech Flow.

Drops

DELL, SWKS, ALKS, KMT, PSX and RH were all dropped because they performed poorly in our screener.

Portfolio Summary

Long / Bull Moves - GOOG, AZO, NOC and DG adds / UTHR, LNG, PM, BJ and AVGO drops

Short / Bear Moves - LUV, ARM, SU and MS adds / DAN, TRMB and ALB holds / DELL, SWKS, ALKS, KMT, PSX and RH drops

4 Longs: GOOG, AZO, NOC and DG

7 Shorts: LUV, ARM, SU, MS, DAN, TRMB and ALB

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.